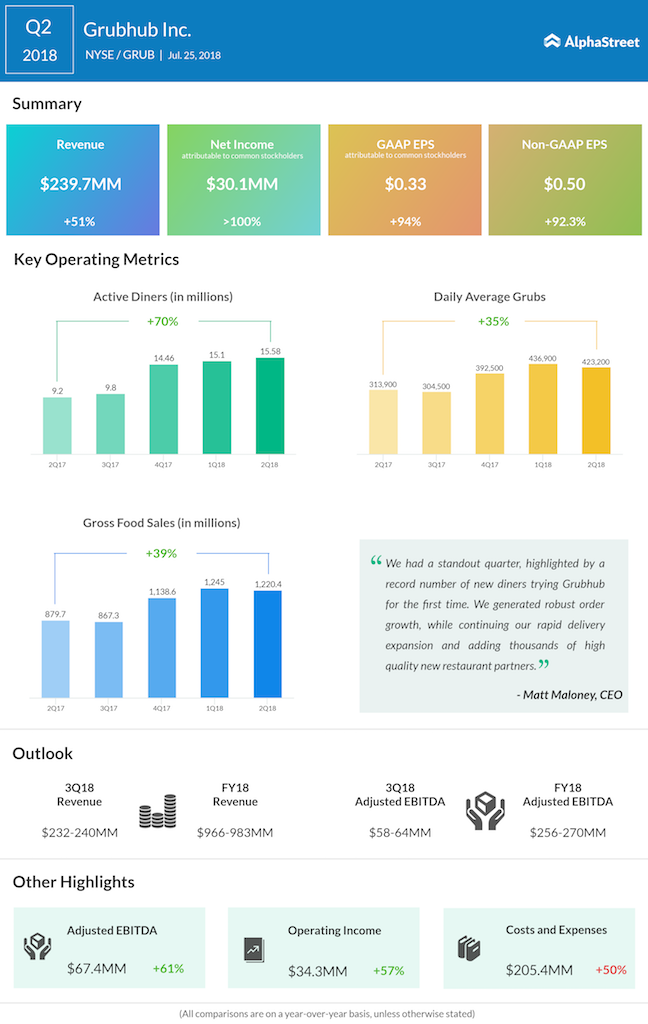

Looking ahead, revenue is expected to be in the range of $232-240 million for the quarter ending September 30, 2018, and $966-983 million for fiscal 2018.

Grubhub also reported that it would acquire the seven-year old start-up firm LevelUp for $390 million. This deal will help Grubhub provide more channels to attract and engage diners and increase volume from existing diners.

“By becoming a part of Grubhub, we take our biggest and most exciting step in achieving that mission. Together, we will provide restaurants with everything they need to grow profitably as more and more diners opt for the convenience, transparency and control of ordering online,” said Seth Priestbatsch, LevelUp’s CEO.

In early May, Grubhub announced a partnership with Jack in the Box (JACK) to provide delivery at hundreds of locations in over 20 markets across the US. The company plans to further expand its partnership with Jack in the Box in 2018.

Related: Jack in the Box reports disappointing Q2 results

Shares of Grubhub jumped over 25% today in the morning trading session and achieved a new all-time. The stock ended in red during yesterday’s trading session and closed at $109.06. The company had a dream run both in the year-to-date period as well as in the past one year period surging 87% and 195%, respectively.