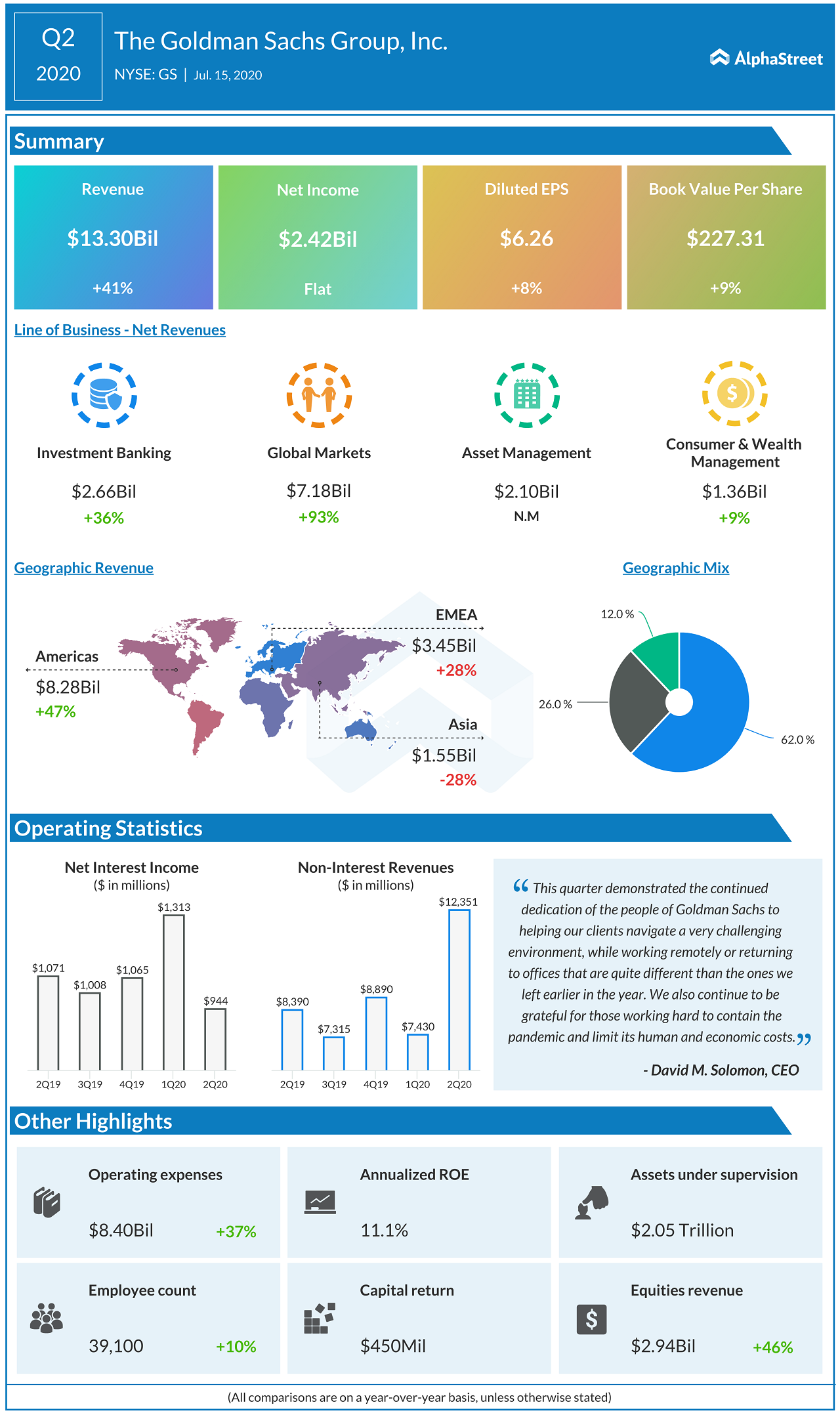

Goldman Sachs (NYSE: GS) today announced its second quarter financial results for the period ended June 30, 2020.

Net earnings for the second quarter was $2.42 million, or $6.26 per share, compared to net earnings of $2.42 billion, or $5.81 per share in the second quarter of 2019.

Net revenues increased 41% to $13.30 billion.

Provision for credit losses was $1.59 billion, compared to $214 million in the second quarter of 2019.

Our strong financial performance across our client franchises demonstrates the inherent benefits of our diversified business model. The turbulence we have seen in recent months only reinforces our commitment to the strategy we outlined earlier this year to investors. While the economic outlook remains uncertain, I am confident that we will continue to be the firm of choice for clients around the world who are looking to reshape their businesses and rebuild a more resilient economy.

David Solomon, CEO