With sector leader Schlumberger (SLB) not exuding confidence, Halliburton is also not expected to beat earnings consensus for the quarter.

Oil service providers usually see a surge in their sales and profitability after strong commodity prices, as they typically point to robust upstream activities.

But West Texas Intermediate (WTI) crude oil prices crashed in the past quarter. This could lead to stakeholders treading a more careful line regarding further investment.

A general industry slowdown would hurt the overall demand for services and equipment — something that is not looking good for Halliburton.

REVISITING THE THIRD QUARTER

In the previously reported quarter, robust international activity beat the slowdown in North American drilling fluids demand and pricing pressures leading to an earnings beat of 2%.

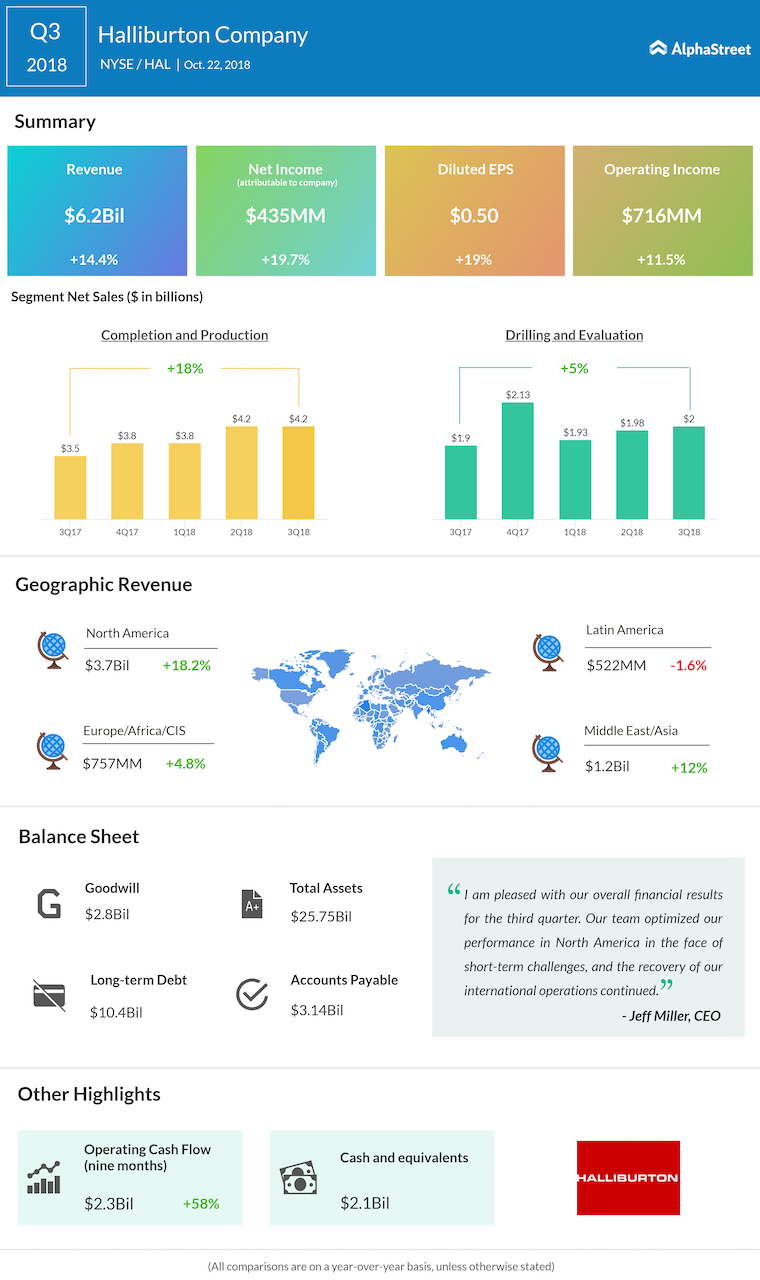

Net income rose to $435 million or $0.50 per share in the September quarter from $365 million or $0.42 per share.

ALL IS NOT WELL

Despite reservations on slowing demand for Halliburton services, the fourth quarter saw US rig count rise by 29 to 1,083 from 1,054 — despite the oil price crash.

Halliburton is expected to gain favorably on this.

However, pipeline takeaway capacity constraints in the Permian Basin might still come to bite Halliburton’s prospects.

The company has already warned about a slowdown in the Permian Basin affecting fourth-quarter earnings. This could also push Halliburton’s adjusted operating income estimate for completion and production close to $460 million, much lower than third quarter’s $613 million. This is troublesome, since it is the lion’s share of the company’s total operating income.