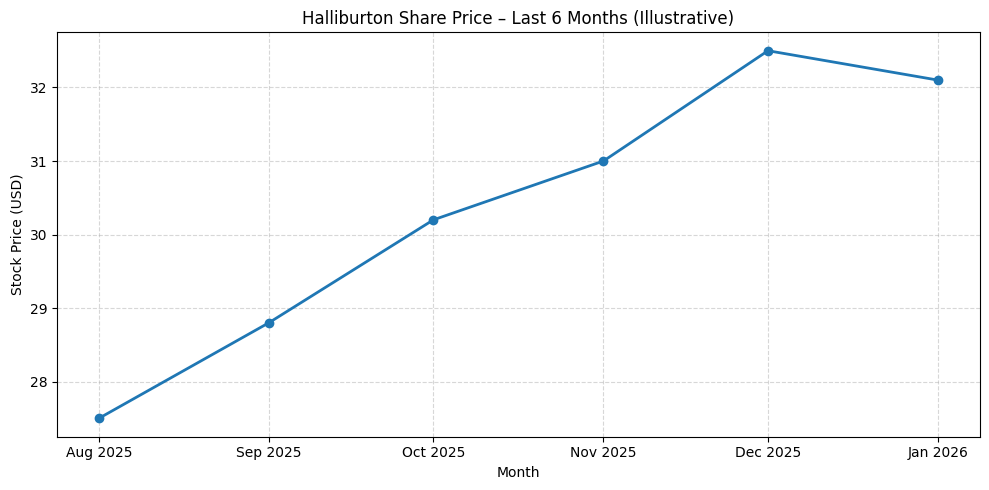

Market Reaction and Share Performance

Quarterly Results Overview

Halliburton reported fourth-quarter revenue of about $5.7 billion, broadly in line with market expectations. Adjusted earnings were $0.69 per share, compared with analyst estimates near $0.55 per share.

Net income for the quarter was $589 million, or $0.70 per diluted share. That compared with $18 million, or $0.02 per share, in the prior quarter, reflecting improved operating performance and lower charges.

Revenue, Margins and Cash Flow

Adjusted operating income rose to approximately $829 million from $748 million in the previous quarter. Adjusted operating margin was about 15%, improving sequentially as cost controls and higher-margin work offset pricing pressure in some markets.

Free cash flow for the quarter was about $875 million. The company said working capital efficiency and disciplined capital spending supported cash generation during the period.

Full-Year Performance

For the full year, Halliburton reported revenue of about $22.2 billion, down from $22.9 billion in the prior year. Full-year adjusted operating income also declined year on year, reflecting softer activity in North America and lower completion intensity.

Despite the decline, management said the company maintained solid margins and cash flow through cost discipline and technology differentiation.

Regional and Segment Performance

International markets continued to be the main source of strength. Halliburton reported higher activity and improved margins in several international regions, supported by drilling, completions, and well intervention work.

North America remained softer, with lower stimulation activity and pricing pressure weighing on results. The company remains focused on its “Maximize Value” strategy in the region, prioritizing returns over volume growth.

Technology and Product Developments

Halliburton highlighted several technology initiatives during the quarter. These included the rollout of the StreamStar wired drill pipe interface system, designed to provide high-speed data transmission and continuous downhole power.

The company also cited the LOGIX unit vitality monitoring system, which enables real-time equipment performance tracking. Management said demand for digital and automation solutions continues to grow, particularly in international markets.

Capital Allocation and Balance Sheet Actions

During the quarter, Halliburton repurchased about $250 million of its common stock. The company also retired roughly $382 million of senior notes and paid a quarterly dividend of $0.17 per share.

Halliburton said its balance sheet remains strong and that it will continue to prioritize shareholder returns alongside investment in technology.

Outlook and Management Commentary

Management reiterated confidence in international growth trends while noting ongoing uncertainty in North America. The company said customer spending remains sensitive to commodity prices and capital discipline.

Executives said activity levels could improve if broader energy investment trends strengthen, but provided no specific quantitative guidance.

Analyst Activity

There were no widely reported analyst upgrades or downgrades directly linked to the earnings release on Wednesday. Recent analyst notes have generally cited international strength while remaining cautious on North American market conditions.

Sector and Macro Environment

Halliburton’s results come as oilfield services companies face mixed demand conditions. Energy investment remains influenced by crude price volatility, cost inflation, and capital discipline among producers. Digital and software-enabled services within the sector face similar scrutiny as other technology spending, with customers prioritizing efficiency and measurable returns.