Sales and profits

Mattel’s net sales in Q3 2022 remained flat at $1.75 billion compared to the prior-year period as it faced a challenging macro-economic environment. On a constant currency basis, sales grew 3%. Adjusted EPS dropped to $0.82 from $0.84 last year.

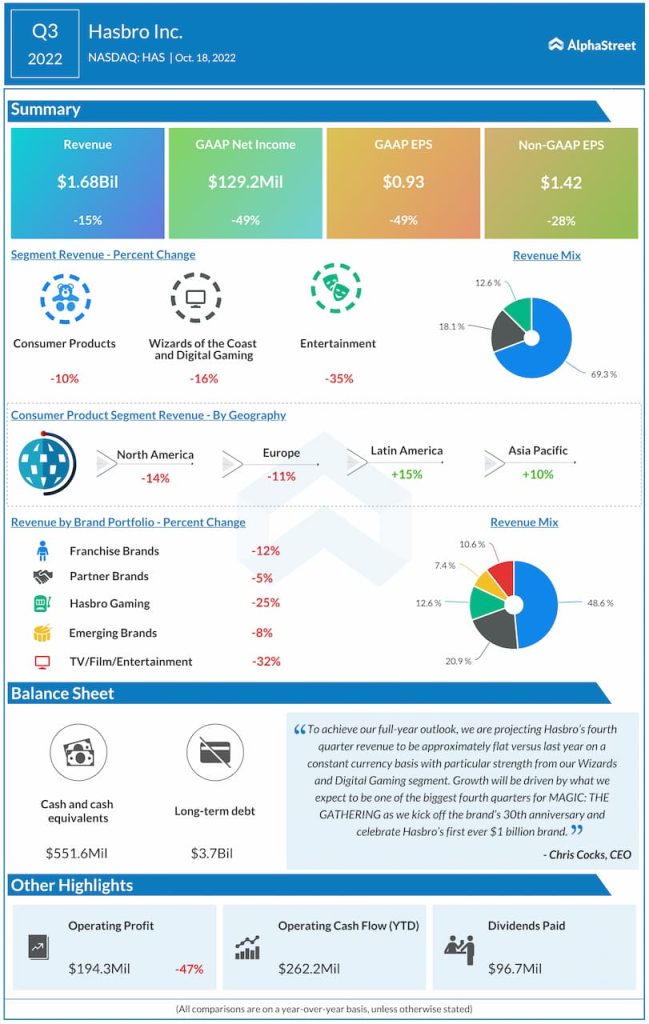

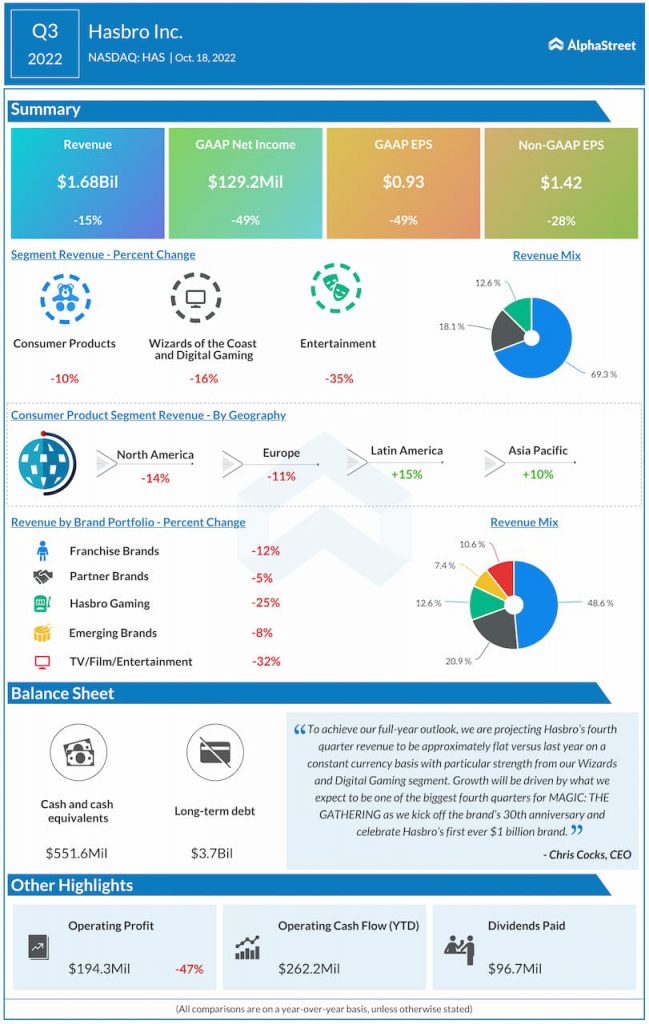

Hasbro saw double-digit sales declines across all its segments during the third quarter. Mattel witnessed single-digit sales declines in its North America and American Girl segments in Q3 while its International segment recorded a 5% growth in sales.

Strategies and plans

Hasbro is undertaking a new strategy that will help in driving growth through a focus on gaming, digital and direct-to-consumer. The company plans to focus on a fewer number of its bigger brands that have the potential to generate over $1 billion. It will also work on growing its high-profit games and licensing businesses while driving significant cost savings. The toymaker aims to grow its adjusted operating profit by 50% as well as drive $250-300 million in annualized run-rate cost savings by year-end 2025.

Hasbro expects to see growth in its high-margin games business during the fourth quarter of 2022, helped by its MAGIC line-up and the addition of Wordle to its portfolio. The company is innovating in key brands like NERF and it is strengthening its position in high-margin, high-potential categories like preschool with brands like PEPPA PIG and PLAY-DOH.

As part of these strategic efforts, Hasbro is planning the sale of a part of its eOne TV and film business that is not core to its Branded Entertainment strategy. The company’s entertainment line-up includes six films and 20 scripted and unscripted shows for 2023.

Mattel is working on growing its IP-driven toy business and expanding its entertainment offering. In 2023, the company plans to roll out Monster High, bring back the Disney Princess and Frozen franchises and broaden its portfolio with the addition of Universal’s Trolls.

Outlook

For the fourth quarter of 2022, Hasbro expects its revenue to be approx. flat on a constant currency basis, buoyed by growth in My Little Pony, Peppa Pig, Marvel, and key gaming brands. For the full year of 2022, revenue is expected to be flat to slightly down in constant currency. Mattel expects net sales for FY2022 to increase 8-10% in constant currency.