Shares of eBay Inc. (NASDAQ: EBAY) were up 2% on Thursday, a day after the company delivered better-than-expected results for the third quarter of 2022 and provided an encouraging outlook for the remainder of the year. Despite the upbeat results, concerns still remain over softness in gross merchandise volume and macroeconomic headwinds. Here are a few noteworthy points from the Q3 earnings report:

Better-than-expected results

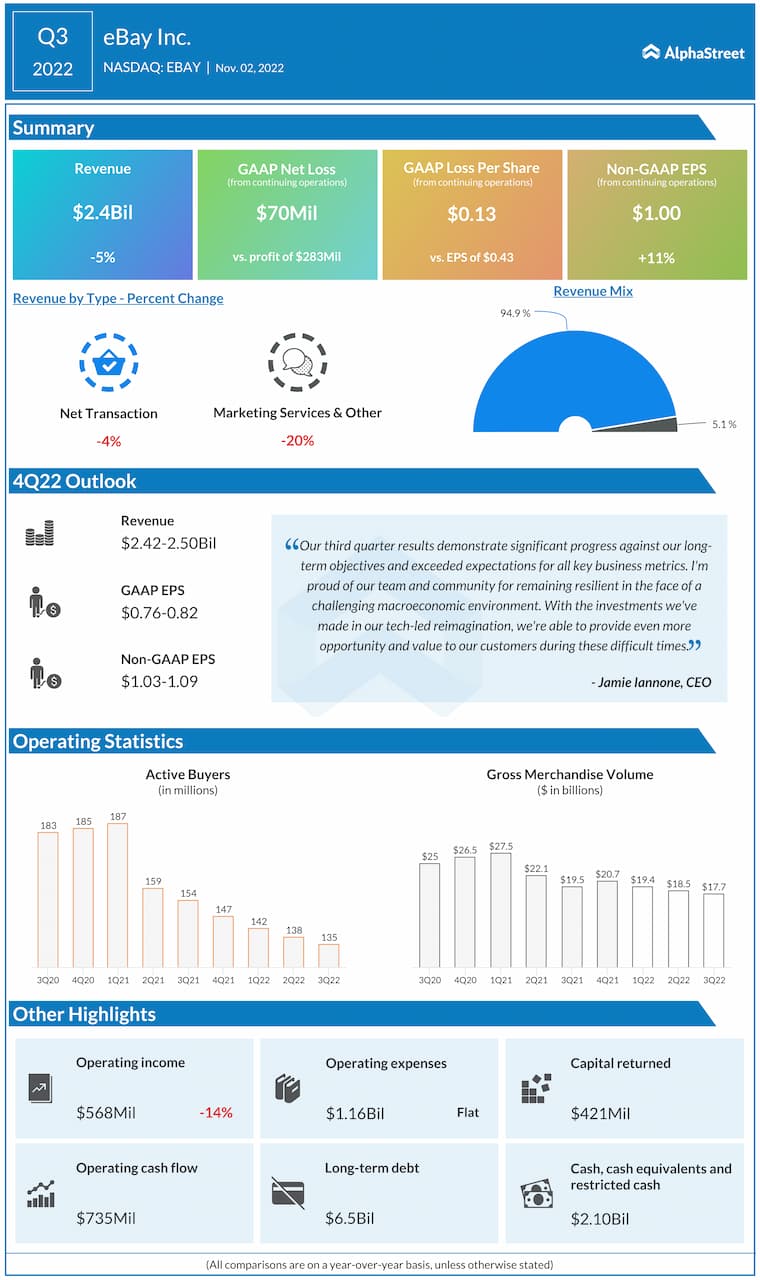

eBay reported revenues of $2.4 billion for the third quarter of 2022, which was down 5% year-over-year on a reported basis and 2% on an FX-neutral basis but managed to beat estimates. The top line was impacted by a double-digit drop in gross merchandise volume (GMV) during the quarter. Adjusted EPS increased 11% YoY to $1.00 and surpassed expectations.

Ecommerce resilience

The macro environment remains challenging with inflation, higher energy costs and rising interest rates impacting consumer discretionary income. Against this backdrop, eBay has been focusing on non-new in-season categories which has helped it stay resilient. The company is seeing growth in GMV of used and refurbished goods.

On its quarterly conference call, eBay stated that according to a recent survey, a vast majority of sellers used eBay to sell pre-owned goods. Focusing on non-new in-season goods will help the platform stay durable during times of economic uncertainty as people tend to opt for pre-owned, refurbished and vintage goods instead of going for brand new purchases.

Pre-owned and refurbished goods make up over one-third of eBay’s GMV and have been growing significantly faster than brand new goods in recent years. The company has been seeing double-digit growth in GMV from used and refurbished goods since the start of the pandemic compared to pre-pandemic levels. In Q3, total GMV was down 5% year-over-year but accelerated nearly 9 points sequentially.

Outlook

eBay’s outlook for the fourth quarter and full year of 2022 were in line with analysts’ projections. For the fourth quarter of 2022, the company expects revenue to range between $2.42-2.50 billion and adjusted EPS to range between $1.03-1.09. Analysts are estimating revenue of $2.49 billion and adjusted EPS of $1.06 for Q4.

For FY2022, eBay expects revenues to range between $9.71-9.79 billion and adjusted EPS to range between $4.07-4.13. The consensus estimate for the year is for revenues of $9.72 billion and EPS of $4.04.

Click here to read the full transcript of eBay’s Q3 2022 earnings conference call