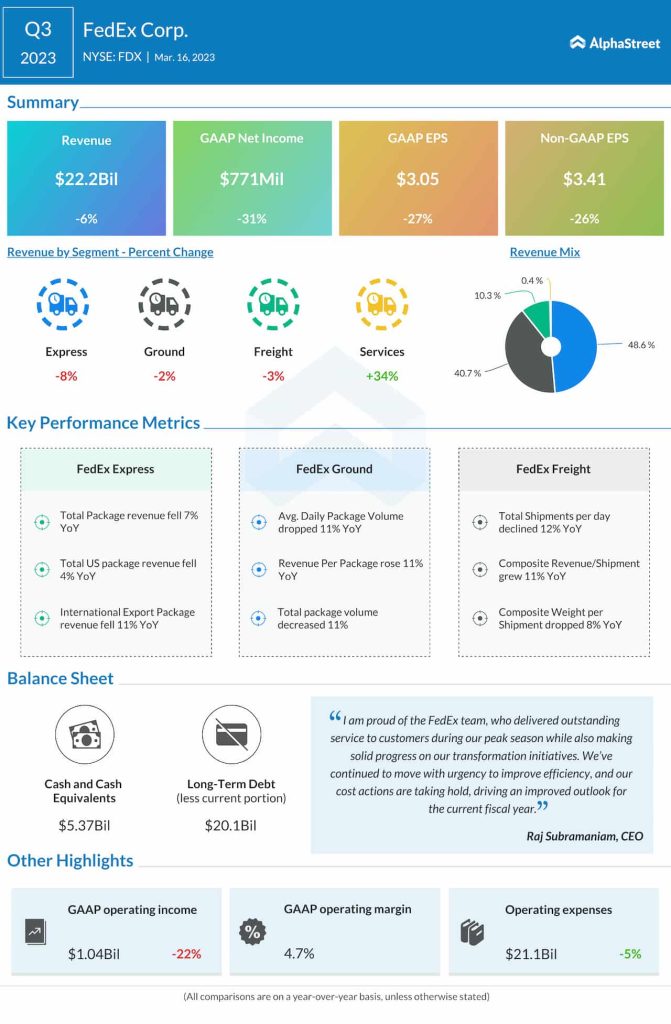

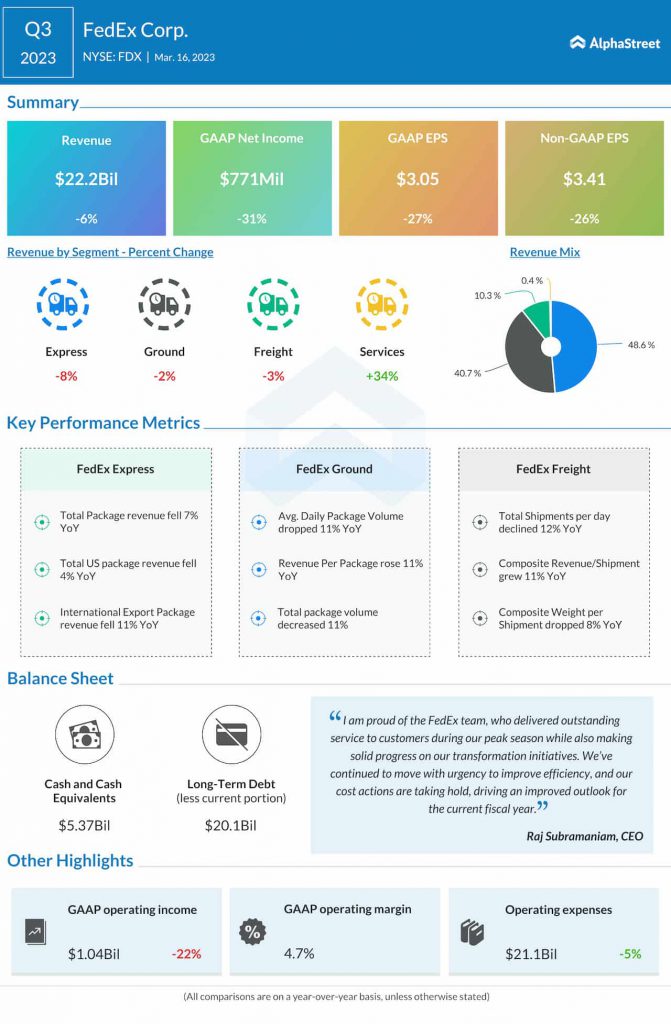

Quarterly performance

Cost saving efforts

FedEx faced a challenging demand environment in the third quarter along with headwinds caused by adverse weather across the US. The company continued with its strategy to reduce its costs to mitigate the pressures on its business. These efforts supported margin expansion at the Ground and Freight segments but could not offset the pressures in Express.

In the Ground segment, the management of staffing levels and related expenses led to a reduction in salaries, benefits and purchased transportation costs. Altogether, the company managed to bring these expenses down by 8% compared to last year. Total operating expenses for this segment were down 4% in Q3. Although volumes declined 11%, operating income rose 32% YoY and operating margin improved 240 basis points to 9.7%.

Within Freight, the company is temporarily parking and selling equipment to right-size the fleet and reduce future maintenance costs. It is also managing its staffing levels to match volumes. The Freight segment saw total Opex drop by 6% during the quarter while operating income grew by 15% and operating margin expanded by 270 basis points.

On its quarterly conference call, FedEx mentioned that the cost base for its Express segment is constrained in the short-term, and therefore it is taking extra steps to address its fixed expense structure. In Q3, the company reduced flight hours by 8% and salary and benefit expenses by 4%. It also parked nine additional aircraft. These, coupled with certain other actions, helped in mitigating 45% of total revenue declines on an adjusted basis.

FedEx achieved $1.2 billion in total enterprise year-over-year cost savings during Q3 2023 and it remains on track to generate $1 billion in permanent savings in FY2023.

Outlook

In the fourth quarter of 2023, FedEx expects market conditions to have a negative impact on its revenue and operating profit. The company plans to continue its cost reduction efforts as well as identify opportunities to lower costs further in order to alleviate the effect of volume declines on its operating results. For the full year of 2023, FedEx expects adjusted EPS of $14.60-15.20.