Q4 performance

During the quarter, Estee Lauder witnessed weakness in the mainland China and North America markets due to softness in overall prestige beauty, which may have been fueled by inflationary pressures in North America and a cautious consumer sentiment in China.

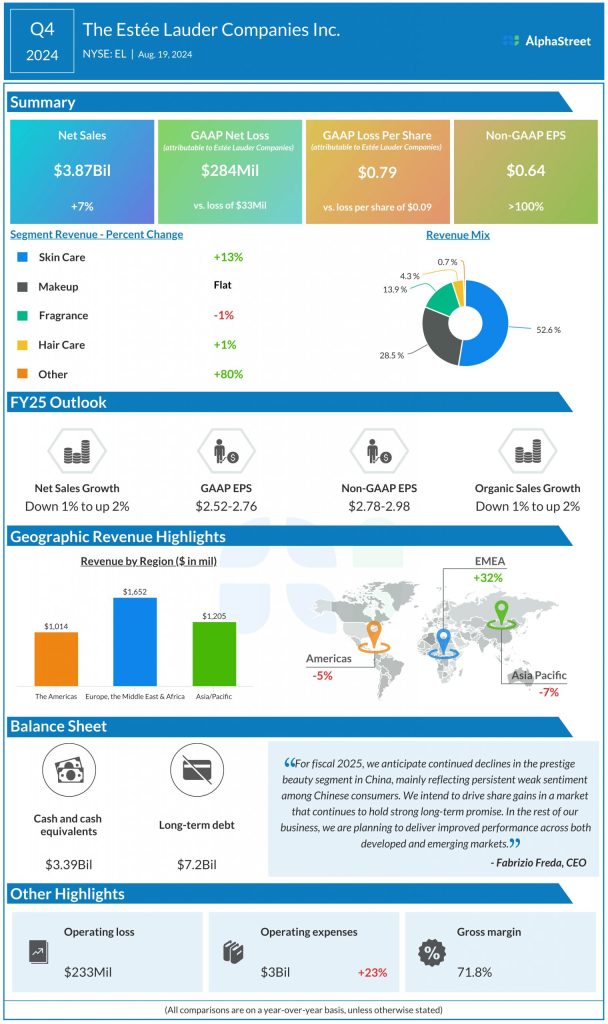

Organic sales increased 32% in the Europe, Middle East & Africa (EMEA) region, driven by growth in the Asia travel retail business and the developed European and priority emerging markets. Organic sales in Asia Pacific fell 4%, mainly due to the softness in overall prestige beauty in mainland China. Organic sales in the Americas dropped 5% due to the decline in North America, caused by heavy competition and the slowdown in prestige beauty.

FY2025 outlook

Estee Lauder expects global prestige beauty to grow 2-3% in fiscal year 2025, reflecting strength in many developed and emerging markets globally. Markets like North America are expected to see tempered growth while weak consumer sentiment is likely to cause continued declines in mainland China and Asia travel retail.

The company expects its performance in FY2025 to be more muted than the industry, primarily due to its significant business in mainland China and Asia travel retail. The challenges in mainland China and Asia travel retail are expected to pressure its results in the first quarter of 2025, as it continues to see weak consumer sentiment and more experiential spending.

For the first quarter of 2025, Estee Lauder expects net sales to decrease 3-5% year-over-year on both a reported and organic basis. Adjusted EPS is expected to range between $0.01-0.09 on a constant currency basis.

For FY2025, reported and organic net sales are forecasted to range between down 1% to up 2% versus the prior year. Adjusted EPS is expected to be $2.78-2.98 on a constant currency basis.