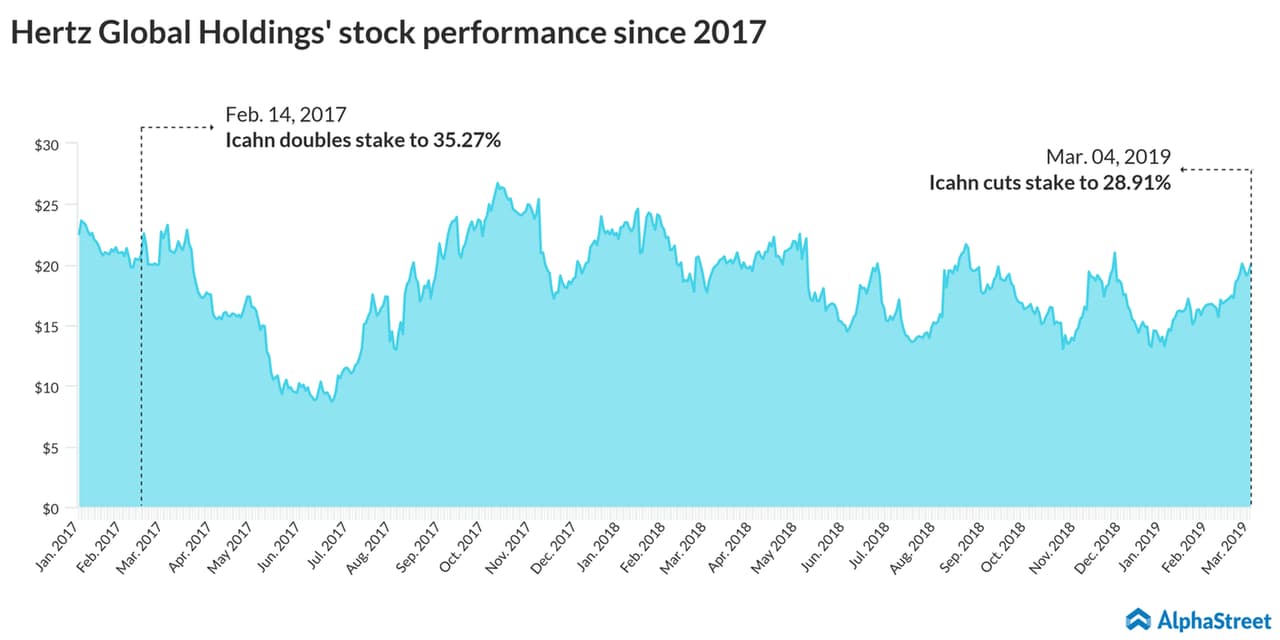

Icahn currently holds over 24.2 million shares of HTZ.

The 83-year-old businessman had more-than-doubled his stake in Hertz Global two years back when the rental company was facing a slew of skeptic remarks from analysts and market watchers due to its poor performance as well as an accounting scandal. A month before this, Icahn had installed Kathryn Marinello as the CEO of the company to steady the ship.

HTZ stock is up 42% since the start of this year.

Hertz has not responded to a request for management comment on the stock sale. The story would be updated once we get a response.

READ: Will the new EVs lift Nio in Q4?

Hertz Global had last week posted narrower-than-expected fourth quarter results and higher revenues. The company posted a loss of 55 cents per share, compared to 90 cents expected by analysts. The results had sent the stock up 15% during pre-market trading that day.

CEO Marinallo said, following the results, “We finished 2018 strong, delivering improvements in rental price, volume, utilization and fleet costs for the full year as a result of targeted strategies, disciplined execution and well-placed investments.”

“We have tremendous momentum as we move into 2019 and will focus on continued revenue growth as well as productivity to drive margin expansion,” she had added.