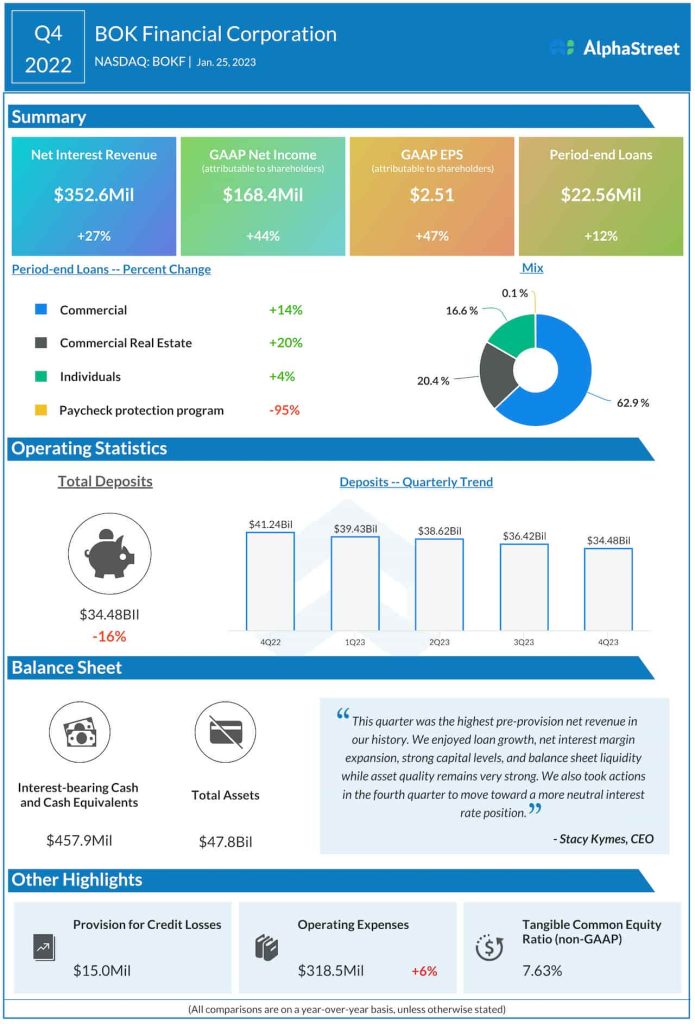

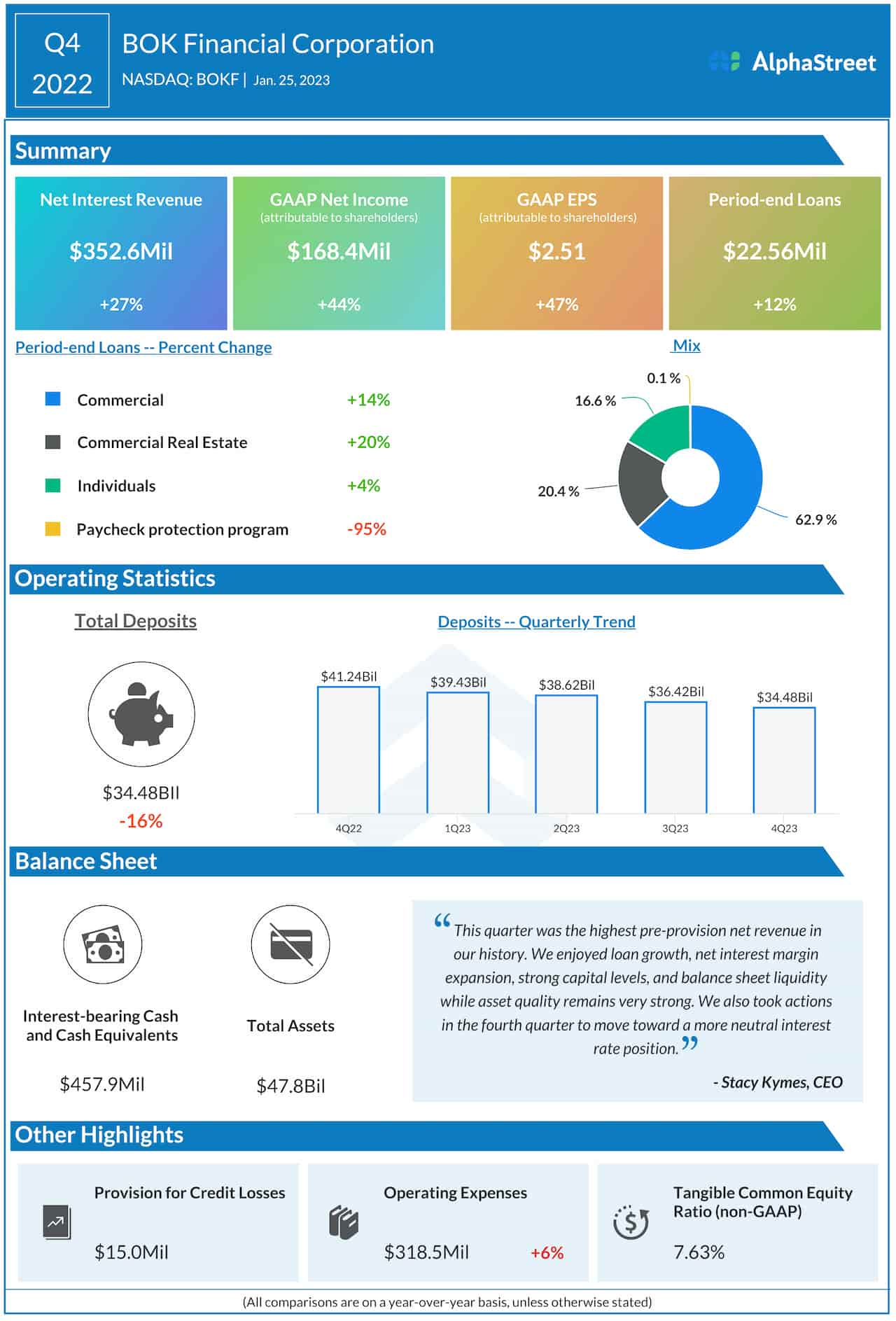

At $352.6 million, net interest revenue was up 27% year-over-year. Net interest margin moved up to 3.54% from 2.52%, mainly reflecting the recent increase in interest rates. At the end of the quarter, the company had total loans of $22.6 billion, up from $20.2 billion recorded a year earlier.

Net income increased sharply to $168.4 million or $2.51 per share in the fourth quarter from $117.2 million or $1.71 per share in the same period of 2021. During the quarter, BOK Financial repurchased 314,406 shares at an average price of $103.14 per share.

Commenting on the results, the company’s CEO Stacy Kymes said, “This quarter was the highest pre-provision net revenue in our history. We enjoyed loan growth, net interest margin expansion, strong capital levels, and balance sheet liquidity while asset quality remains very strong. We also took actions in the fourth quarter to move toward a more neutral interest rate position.”