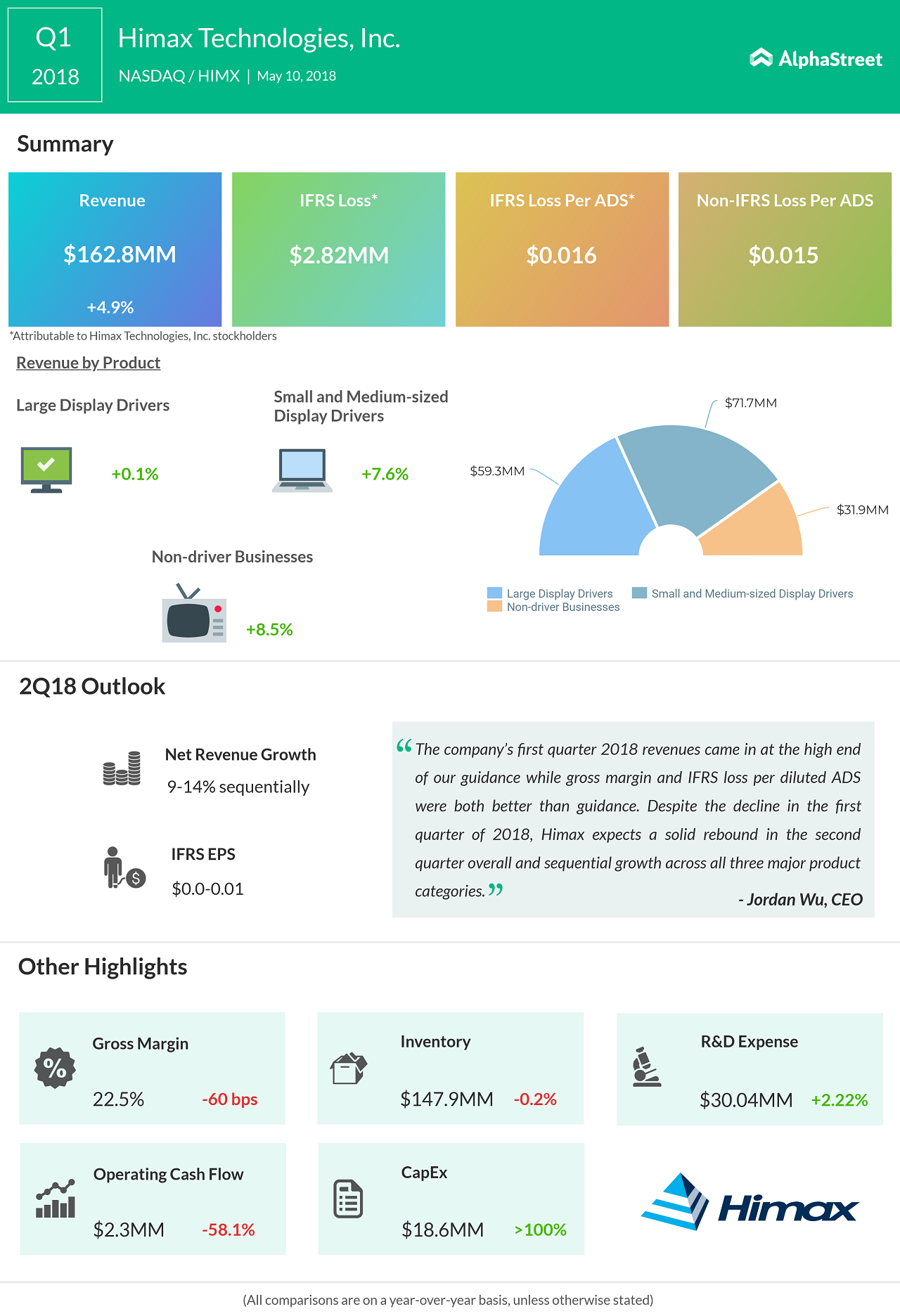

Semiconductor company Himax Technologies (HIMX) witnessed a surge of 4.27% in its share price during the pre-market trading, after the company beat estimates on both top and bottom lines. Himax posted revenues of $162.9 million in the period, up 5% from $155.2 million, easily topping analyst estimates of $157.9 million.

This topline surge was mainly due to the contribution from the small and medium-sized display drivers that posted revenues of $71.7 million during the quarter, jumping 7.6%.

During the quarter, the small and medium-sized display drivers accounted for 44% of total sales. The driver IC sales for automotive application grew 40%. However, the driver IC sales for tablets went up by only 2.4%. This was mainly due to weak overall market demand in this product segment.

Revenue from large display drivers was $59.3 million, inching 0.1% up. Large panel driver ICs accounted for 36.4% of the total revenues. This increase was driven by increasing 4K TV penetration and Chinese customers using up more LCD fabs.

The Taiwan-based company reported a quarterly loss of $2.8 million or $1.6 loss per share, compared to a profit of $1.2 million or $0.7 per share in the prior year period. The results were negatively impacted due to higher expenses.

For the second quarter of 2018, the company expects its net revenues to increase 9% to 14% sequentially, representing a double-digit year-over-year growth. The company anticipates EPS of flat to 1.0 cent per share.

“Going into the second quarter, while our large display driver IC business will continue benefiting from Chinese panel customers’ ongoing capacity expansion and in-cell TDDI shipment for smartphone in the small and medium display driver IC business will benefit from the new model launches, the growth in both segments would be somewhat offset by the foundry capacity shortage issue,” said Jordan Wu, CEO.