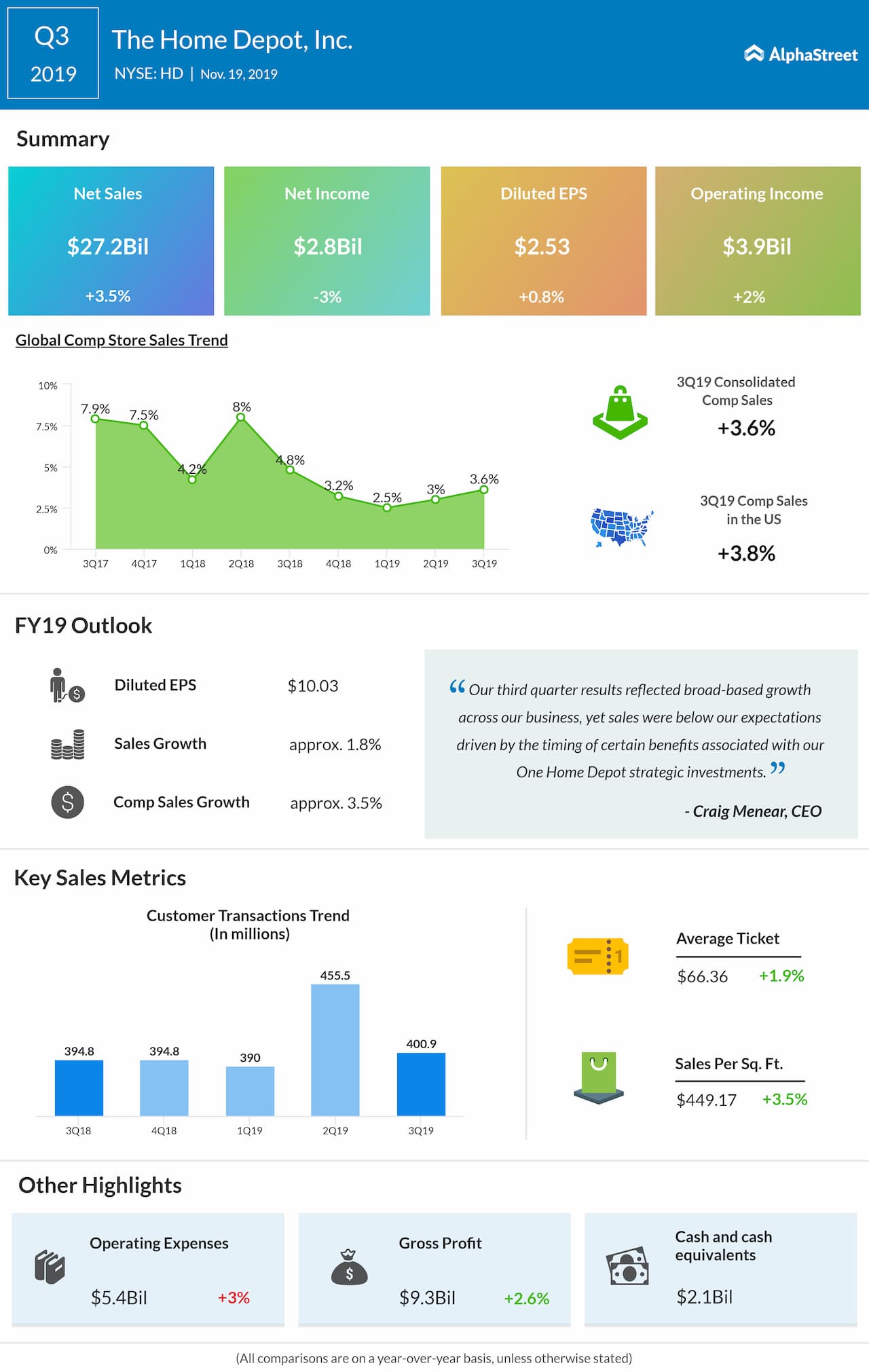

Net earnings were $2.8 billion, or $2.53 per share, compared to $2.9 billion, or $2.51 per share, in the year-ago quarter, reflecting EPS growth of 0.8%.

Craig Menear, Chairman, CEO and President, stated, “Our third quarter results reflected broad-based growth across our business, yet sales were below our expectations driven by the timing of certain benefits associated with our One Home Depot strategic investments. We are largely on track with these investments and have seen positive results, but some of the benefits anticipated for fiscal 2019 will take longer to realize than our initial assumptions. As a result, today we are updating our fiscal 2019 sales guidance, and we are reaffirming our fiscal 2019 earnings-per-share guidance.”

During the quarter, the company recorded a 1.5% growth in customer transactions. Average ticket rose 1.9% while sales per square foot increased 3.5%.

The Home Depot updated its sales and comp sales guidance for fiscal 2019, a 52-week year compared to fiscal 2018, which was a 53-week year. The company now expects fiscal 2019 sales to grow approx. 1.8% and comp sales for the comparable 52-week period to increase approx. 3.5%, compared to the previous sales growth guidance of 2.3% and comp sales growth of 4%. Diluted EPS is expected to grow approx. 3.1% to $10.03 from 2018.

At the end of the third quarter, the company operated a total of 2,290 retail stores in all 50 states, the District of Columbia, Puerto Rico, US Virgin Islands, Guam, 10 Canadian provinces and Mexico.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions