Home Depot provided a preliminary fiscal year 2020 outlook

which outlines total sales growth of approx. 3.5-4%. Based on data

from CNBC, analysts were expecting sales growth of 4.3%. Comparable sales

growth is expected to be approx. 3.5-4%.

The retailer also touched upon its One Home Depot strategy which

includes investments in store enhancements, new e-commerce solutions, and

delivery options. The company said it was building on its distinct competitive

advantages to capitalize on a large and fragmented market opportunity and

expand its leadership position for years to come.

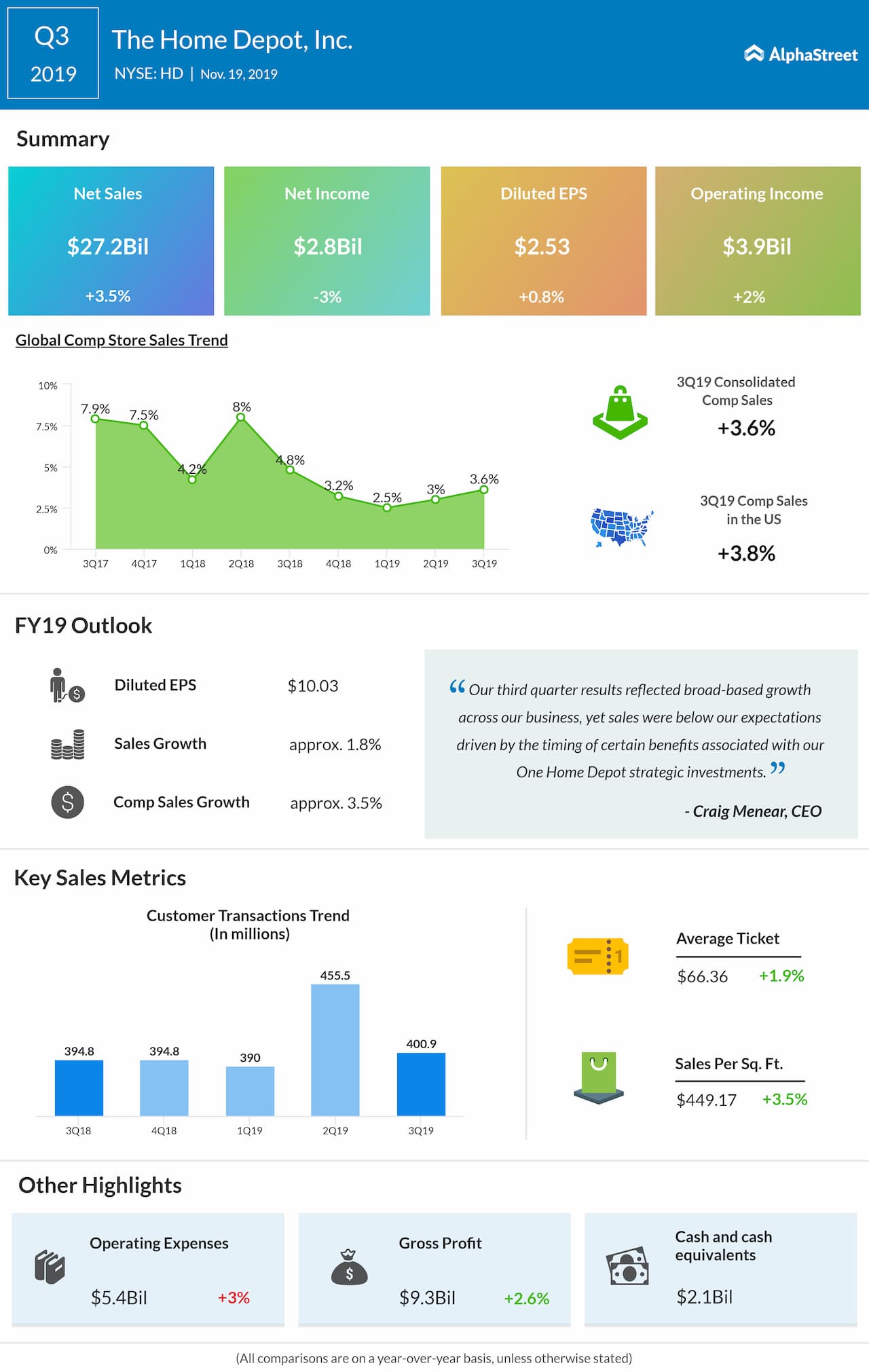

For its most recent quarter, Home Depot reported better-than-expected earnings but missed revenue estimates. Net sales rose 3.5% to $27.2 billion while EPS grew 0.8% to $2.53. Comparable sales rose 3.6%.