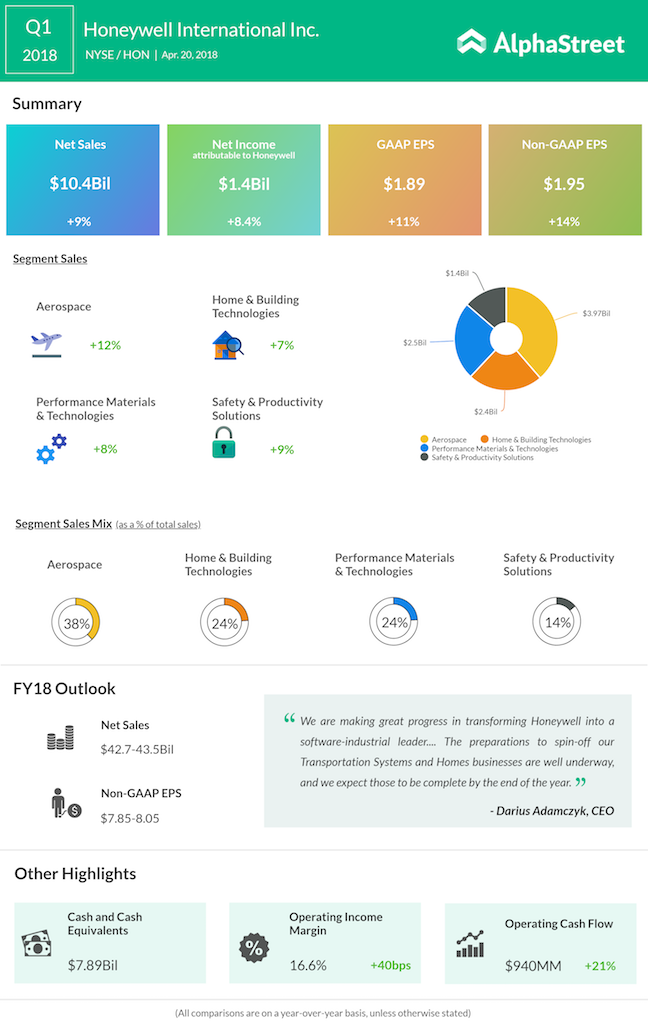

With sales climbing by 9% to $10.4 billion, the diversified technology and manufacturing company saw its earnings for the quarter climb 8.4% higher to $1.44 billion or $1.89 per share. Higher demand for residential thermal solutions and thermostats, orders growth, and higher volumes in Sensing helped in the sales outburst. Adjusted EPS grew 14% to $1.95.

Revenue benefited greatly from the higher demand for industrial safety products, Movilizer software, as well as short-cycle demand in process automation. As expected earlier, Aerospace, Performance Materials and Technologies revenues have weighed on the overall top line. Meanwhile, Home and Building Technologies organic sales rose 2% on the back of an improving global economy, which led to increased construction activity.

Looking ahead into fiscal 2018, Honeywell raised its sales outlook to a range of $42.7 billion to $43.5 billion from previous estimate range of $41.8 billion to $42.5 billion, and its EPS guidance to $7.85 – $8.05 from the prior range of $7.75 – $8.00. The company narrowed its free cash flow forecast to $5.3 billion to $5.9 billion from $5.2 billion to $5.9 billion projected earlier.

Aerospace sales rose 8% on an organic basis helped by growth in the commercial original equipment and US defense, and demand strength for light vehicle gas and commercial vehicle turbochargers in Transportation Systems.

The company liquidated stocks and bonds fairly quickly as seen from a 36% drop in short-term investments as on March 31, 2018. These short-term investments were converted into cash, which rose by 12%. Despite the current portion of long-term debt, which was due within one year’s time, falling by 89% from December 31, 2017, long-term debt had risen by 1.3%. Other liabilities and shareowners’ equity too had risen for the period.

In the pre-market session, the stock is trading up 0.28% to $148.80. In the past 52 weeks, Honeywell has risen 16.56%, while the S&P 500 has increased 14.67%.