Mixed results

Trends

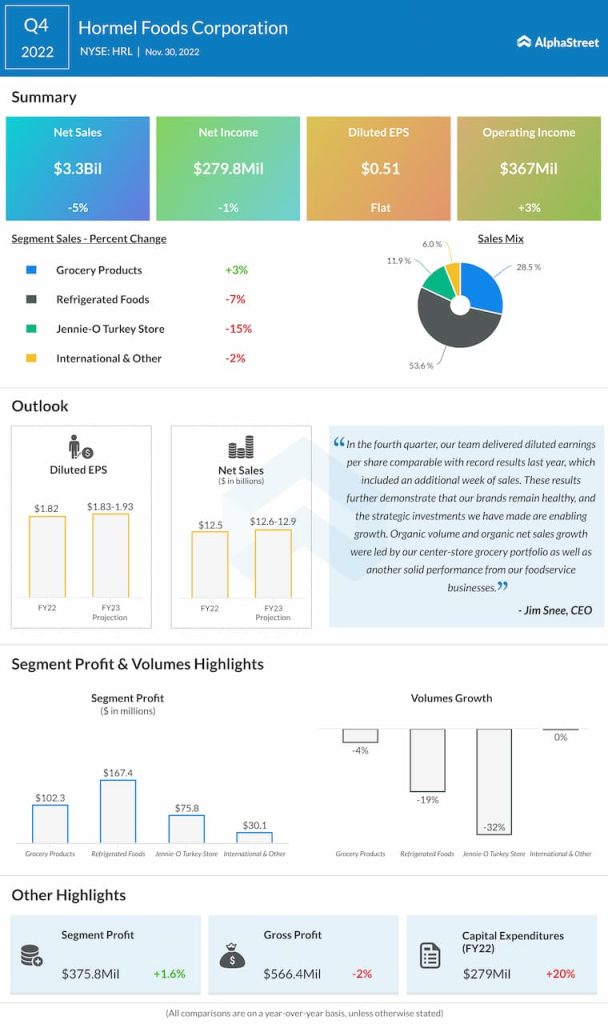

In Q4, Hormel witnessed volume declines across all its segments except for International & Other where volume remained comparable to last year. Volume in Refrigerated Foods was impacted by lower commodity sales resulting from the company’s new pork supply agreement. In the Jennie-O Turkey Store segment, volume declined due to impacts on the supply chain from highly pathogenic avian influenza.

Net sales decreased across all segments in Q4, barring Grocery Products. In Grocery Products, net sales rose 3% driven by strong demand for SKIPPY peanut butter and price increases across the Mexican and simple meals portfolios.

Net sales in Refrigerated Foods declined 7% due to the impact from an additional week in Q4 2021 and lower commodity sales. In International & Other, sales growth from the SPAM and SKIPPY brands and the multinational businesses were offset by lower fresh pork and refrigerated export sales.

Hormel realigned its business into three operating segments – Retail, Foodservice and International and will begin reporting earnings under this new structure from the first quarter of 2023.

Outlook

Looking into fiscal year 2023, Hormel said it is well-positioned in the retail, foodservice and international channels and expects to drive top line growth. Earnings growth is expected to be driven by the Foodservice and International segments as well as improvements across the supply chain. The company said it expects to operate in a volatile, complex and high-cost environment again in fiscal 2023.

Hormel forecasts net sales to grow 1-3% YoY to $12.6-12.9 billion in FY2023. EPS is expected to increase 1-6% to $1.83-1.93. Analysts, however, were estimating sales of $13.01 billion and EPS of $2.00 for FY2023.

Click here to read more on food and beverage companies’ stocks