Revenue

Earnings

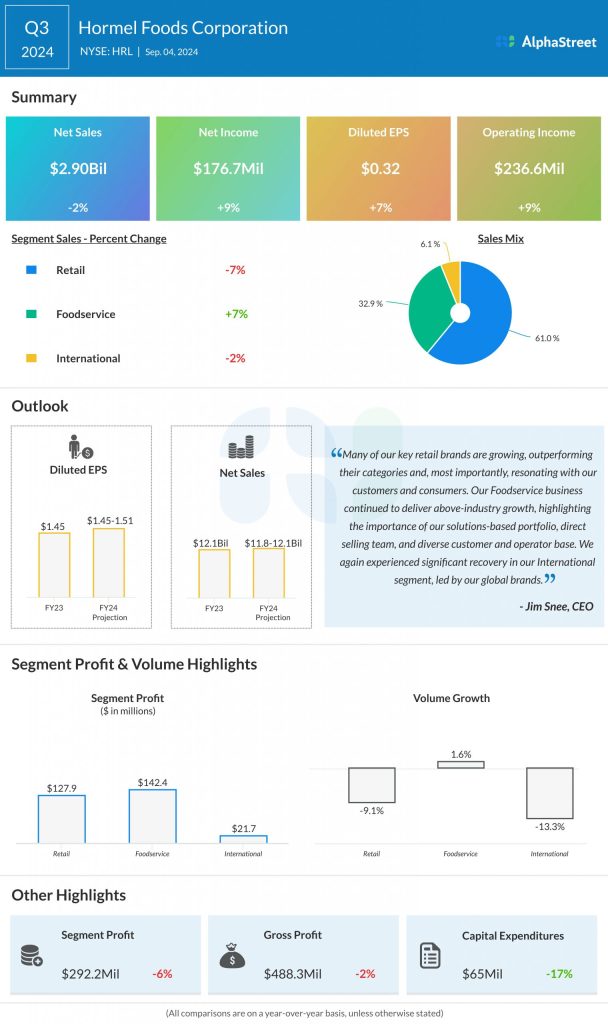

The consensus estimate for earnings per share in Q4 2024 is $0.42. This compares to adjusted EPS of $0.42 reported in the fourth quarter of 2023 and $0.37 reported in the third quarter of 2024.

Points to note

In the fourth quarter, Hormel is expected to benefit from continued demand for many of its key retail brands such as Hormel Black Label bacon, Applegate meats, Jennie-O ground turkey, and Skippy peanut butter. The company has been doing well in categories like bacon, canned meats, turkey and peanut butter. It has also been seeing a stabilization in its convenient meals and proteins business.

In Q3, the Retail segment results were negatively impacted by volume and price declines for whole bird turkeys, lower sales of Planters snack nuts caused by production disruptions at the Suffolk facility, and lower contract manufacturing volumes.

The company expects to see improved service levels for the Planters snack nuts business in the fourth quarter but the contract manufacturing business is anticipated to see continued softness due to low demand for certain items.

The Foodservice business is expected to deliver growth in Q4. Last quarter, sales and volume in this segment benefited from strong performance across the turkey, premium prepared proteins, bacon and pepperoni categories. Products such as Old Smokehouse Bacon, Café H proteins, and Jennie-O turkey delivered double-digit sales growth. Hormel’s portfolio and the diverse channels it operates in continued to provide its Foodservice business a cushion against several macro headwinds.

Hormel expects to see growth in its International business during the fourth quarter. Despite a drop in sales and volume last quarter, the company saw improvement in its performance versus the previous year. This segment benefited from gains in SPAM luncheon meat, Skippy peanut butter, and refrigerated foodservice exports. Its China business appears to be on a positive trajectory and its investments in the Philippines and Indonesia are beginning to pay off.

Hormel continues to make progress on its transform and modernize initiative, which has enabled it to unlock additional production capacity and realize cost savings across its network. These initiatives are expected to help drive growth going forward.