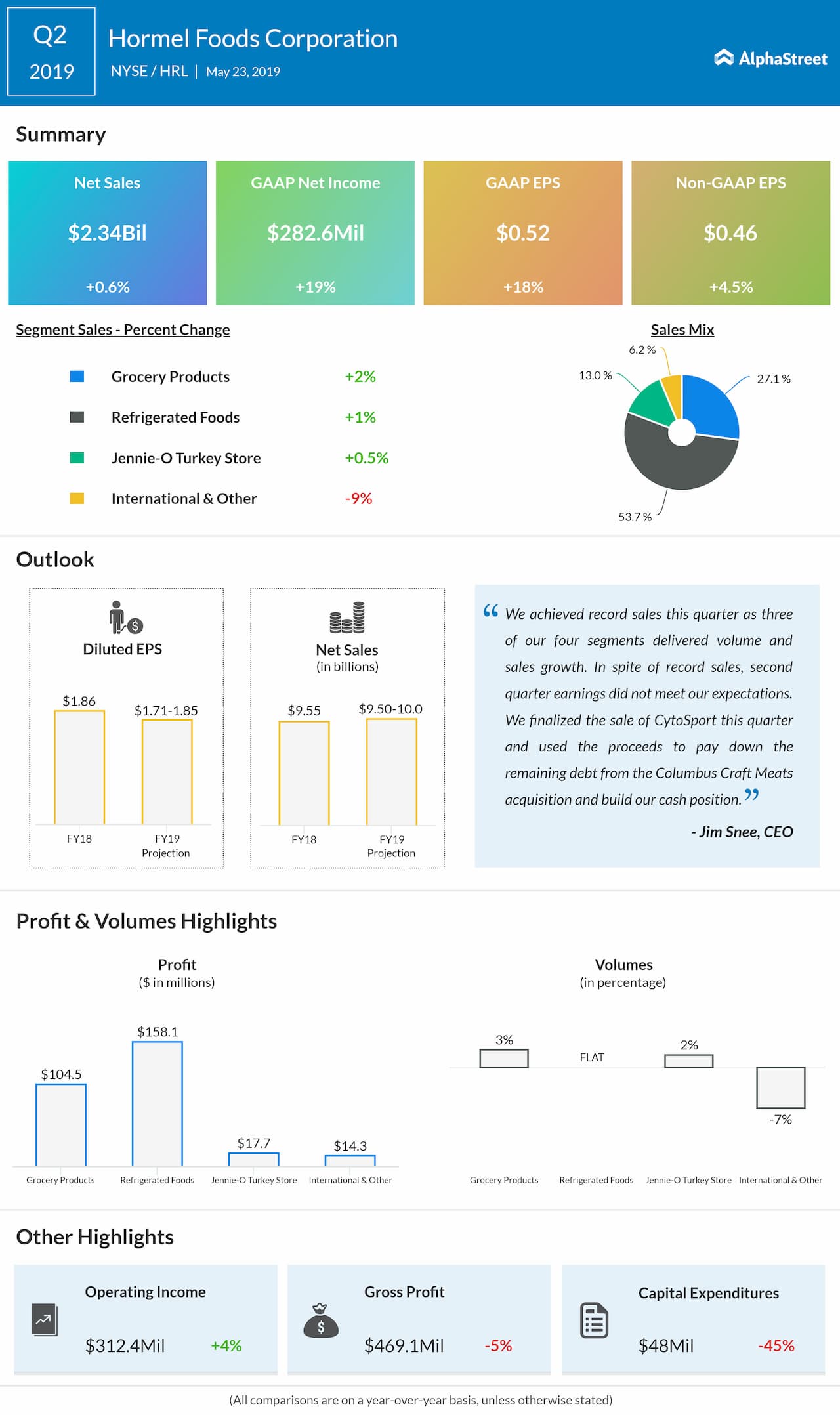

Net sales inched up 0.6% to $2.34 billion. The company’s three of its four segments delivered volume and sales growth.

Looking forward, the company is currently experiencing with African swine fever. For fiscal 2019, the company lowered its net sales outlook to the range of $9.50 billion to $10 billion from the prior range of $9.70 billion to $10.20 billion, and its earnings guidance to the range of $1.71 to $1.85 per share from the previous range of $1.77 to $1.91 per share. The revised earnings guidance range is based on the input cost increases and a forecast for volatile domestic pork prices in the second half of fiscal 2019.

For the second quarter, the company experienced a rapid increase in input costs as the global hog and pork markets were impacted by the African swine fever in China. In response, pricing action was taken across the company’s branded value-added portfolio in the Grocery Products, Refrigerated Foods, and International segments.

A combination of plant startup costs and lower retail sales dragged Jennie-O Turkey Store profits down. However, the company is reactivating promotional activity and advertising in order to regain distribution as it is now on track to deliver the production efficiencies. Hormel Foods has made a large investment to automate its whole-bird facility in Melrose, Minn.

Also read: Del Frisco’s Restaurant stock drops to 7-year low

Hormel Foods has used the proceeds from the sale of CytoSport to pay down the balance debt from the Columbus Craft Meats acquisition and build its cash position. The company is expected to use the balance sheet for growing through disciplined and strategic investments, including acquisitions and capacity expansion projects.

In the Refrigerated Foods segment, volume remained flat while net sales inched up 1%. This was led by foodservice products such as Hormel Bacon 1 cooked bacon, Hormel Fire Braised products, and Austin Blues authentic barbeque products. Retail products such as Hormel Black Label bacon, Hormel Natural Choice products, Hormel pepperoni, and Hormel prepared foods products for the deli also showed excellent growth.

In Grocery Products segment, volume increased by 3% and net sales rose by 2%, which was led by Herdez salsas and sauces, Wholly guacamole dips and Skippy peanut butter. In the Jennie-O Turkey Store, sales were flat as improved results in foodservice and whole-bird sales were offset by declines in retail sales due to the lingering impact of two voluntary product recalls.

International volume decreased by 7% and net sales fell by 9%, primarily due to the continued impact of tariffs on fresh pork exports along with higher freight costs. Growth in the company’s China business was driven by increased sales of branded value-added products such as SPAM luncheon meat and Skippy peanut butter.

Shares of Hormel Foods closed Wednesday’s regular session down 0.83% at $39.49 on the NYSE. Following the earnings release, the stock inched down over 2% in the premarket session.