“

Hormel Foods Corporation (NYSE: HRL) reported a 19% dip in earnings for the second quarter of 2020 due to higher costs and expenses. The top-line increased by 3.3% year-over-year backed by double-digit growth in sales from Jennie-O Turkey Store and single-digit growth in sales from Grocery Products and International & Other. Even though the COVID-19 […]

· May 21, 2020

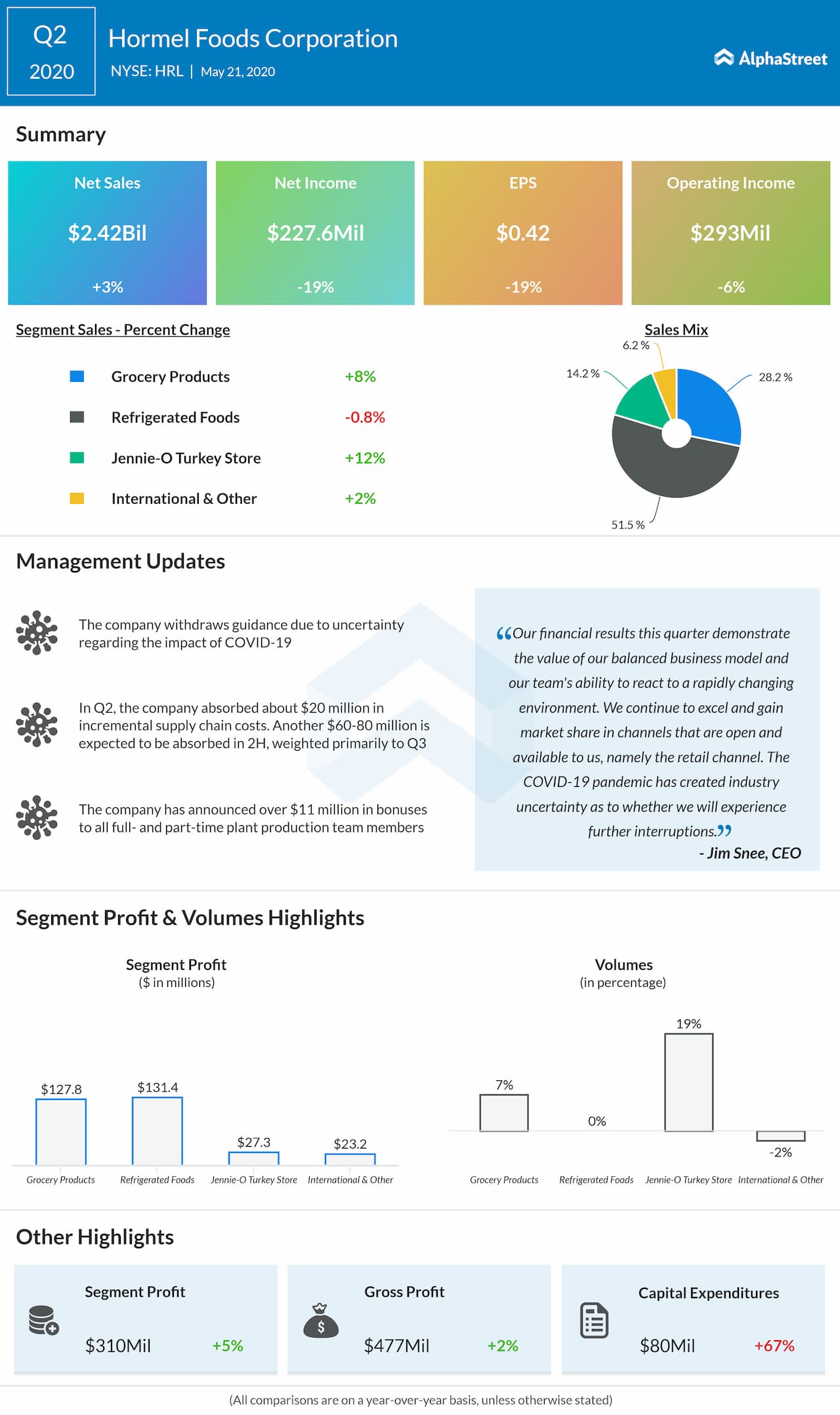

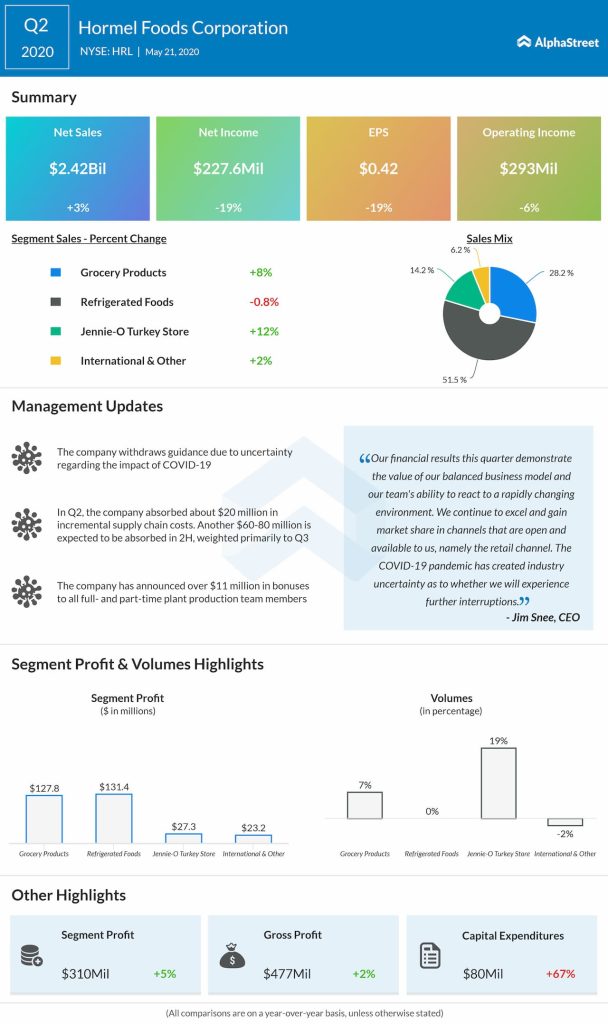

Hormel Foods Corporation (NYSE: HRL) reported a 19% dip in earnings for the second quarter of 2020 due to higher costs and expenses. The top-line increased by 3.3% year-over-year backed by double-digit growth in sales from Jennie-O Turkey Store and single-digit growth in sales from Grocery Products and International & Other.

Even though the COVID-19 pandemic has caused a dramatic shift in consumer behavior, operational disruptions, and extreme volatility in raw material markets, the company remains financially strong and well-positioned to weather the pandemic. The company withdraws its guidance due to uncertainty regarding the impact of COVID-19.