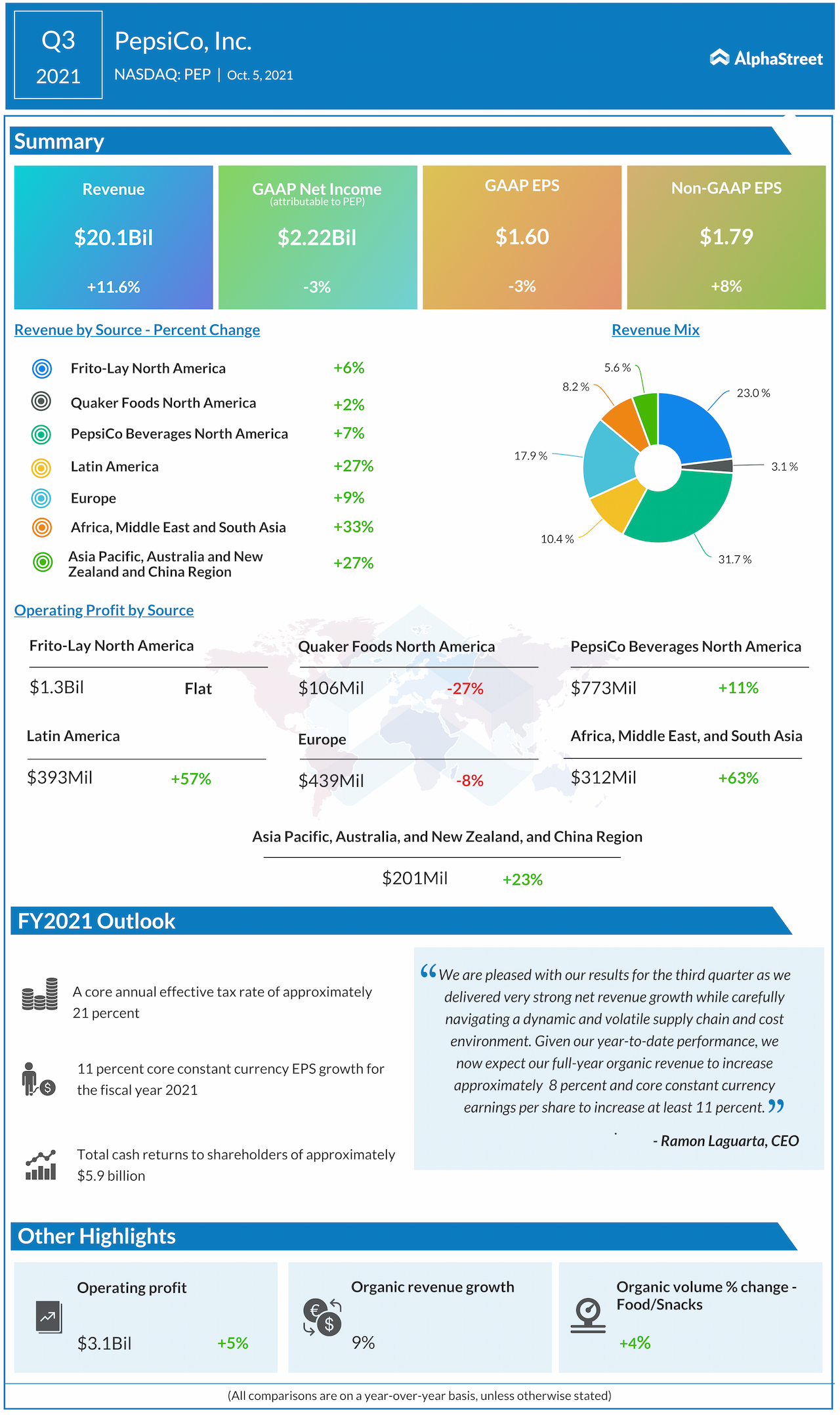

Shares of PepsiCo Inc. (NASDAQ: PEP) stayed in green territory on Tuesday after the company delivered a strong earnings report for the third quarter of 2021 and raised its guidance for the full year. Revenue rose 11.6% year-over-year to $20.1 billion while core EPS amounted to $1.79. Both numbers beat estimates. The company also raised its revenue outlook for the full year based on this strong performance.

Strong product portfolio

PepsiCo’s product portfolio has always been one of its greatest strengths. During the third quarter, the company’s global snacks and food business delivered organic revenue growth of 8% while its beverage business posted revenue growth of 10%.

PepsiCo gained market share in key categories like salty and savory snacks, and carbonated soft drinks in North America in Q3. Frito-Lay North America posted organic revenue growth of 5% for the quarter helped by momentum in brands such as Ruffles, Doritos and Cheetos. PepsiCo Beverages North America recorded organic revenue growth of 7% driven by the strong performances of brands like Mountain Dew, Pepsi, bubly, and Aquafina.

PepsiCo posted organic revenue growth of 14% in its international markets in Q3. Revenues grew both in snacks and beverages and the company witnessed strong growth in regions such as Mexico, Brazil, and Russia among others.

Product innovation

PepsiCo continues to roll out new varieties and flavors within its products to appeal to the different tastes of customers. Within the Frito-Lay segment, the company is offering new products such as the Lays Flavor Swap lineup, Doritos 3D Crunch, Cheetos Crunch Pop Mix and a lineup of Flamin’ Hot varieties.

Products like Cheetos Mac’ n Cheese and Quaker Protein Instant Oatmeal helped the snack giant gain market share in meals and instant oatmeal within the Quaker Foods North America segment. PepsiCo is also working on incorporating wholesome ingredients such as plant-based proteins, nuts, seeds and whole grains into its products.

Healthy choices

As health and fitness gain prevalence and consumers shift to healthier snack options, PepsiCo is adding more nutritious products to its portfolio to gain a competitive edge. These include oven baked, multigrain and wholegrain snacks within its Lay’s, Cheetos, and Tostitos brands as well as oatmeal, rice crisps and rice cakes within the Quaker portfolio.

The company is also offering veggie crisps and snacks made from baked fruits. Within beverages, PepsiCo is offering zero-sugar options for its Pepsi, Mountain Dew and Gatorade brands. It is also offering beverages with proteins and dairy alternatives.

Based on its strong performance in the third quarter, PepsiCo now expects organic revenue growth of 8% in fiscal year 2021 versus its previous outlook of 6%. Core EPS is estimated to grow 12% for the full year.

Click here to read the full transcript of PepsiCo Q3 2021 earnings conference call