HP Inc. (NYSE: HPQ)

beat revenue and earnings expectations for the fourth quarter of 2019. Shares

were up 2% in aftermarket hours on Tuesday.

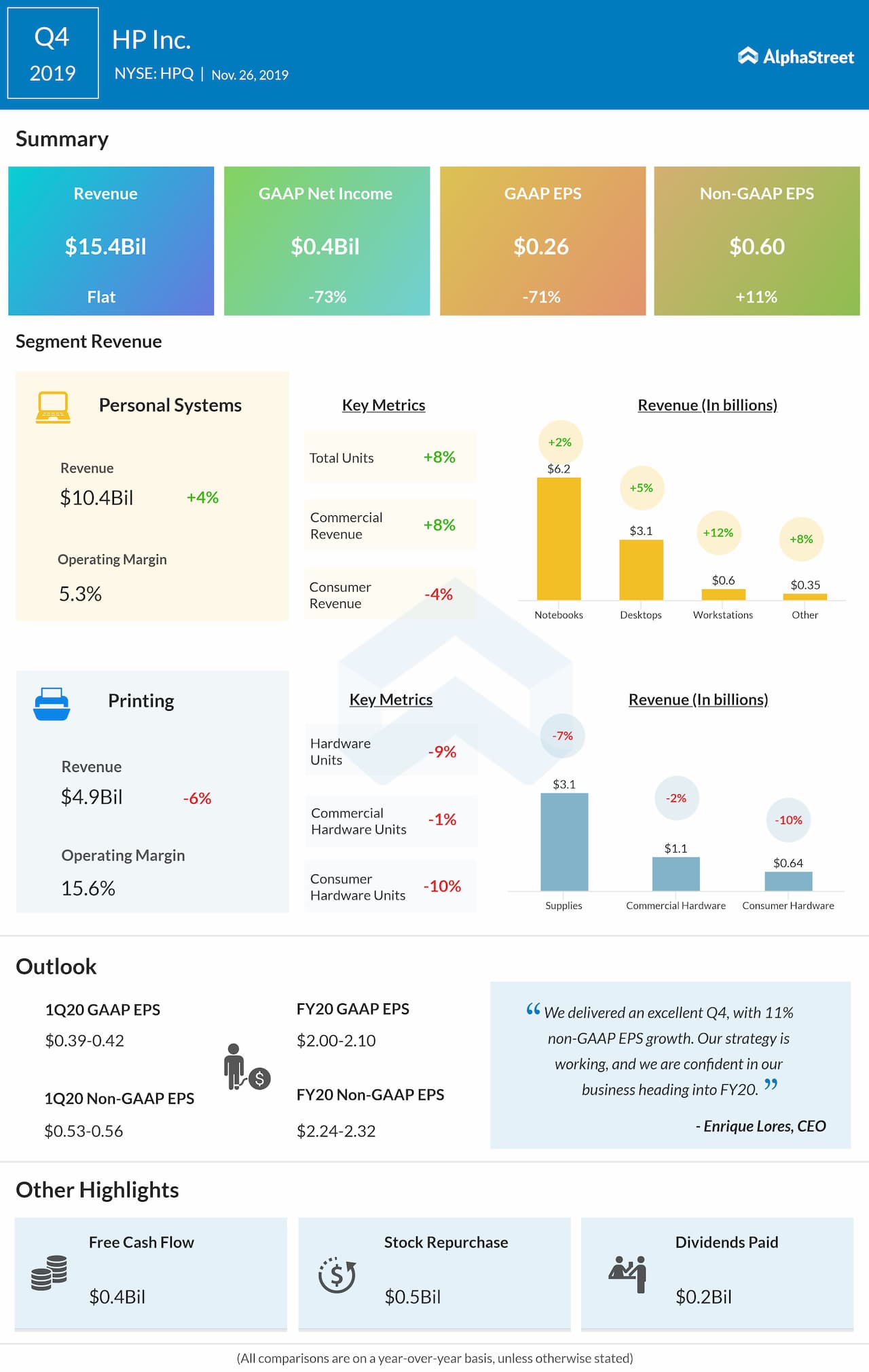

Total revenue of $15.4 billion was up 0.3% from the same period last year and above the estimates of $15.2 billion.

On a GAAP basis, net income fell more than 70% to $0.4

billion, or $0.26 per share. The results came below the company’s outlook of

$0.51-0.55. Adjusted net income rose 4% year-over-year to $0.9 billion while adjusted

EPS increased 11% to $0.60. Adjusted EPS came above the company’s outlook range

of $0.55-0.59 as well as analysts’ projections of $0.58 per share.

Personal Systems net revenue was up 4% year-over-year. Commercial net revenue increased 8% while consumer net revenue fell 4%. Printing net revenue declined 6% year-over-year, with a 7% drop in supplies net revenue.

Also read: Analog Devices Q4 2019 Earnings Report

For the first quarter of 2020, HP estimates GAAP EPS to be

in the range of $0.39 to $0.42 and adjusted EPS to be in the range of $0.53 to

$0.56.

For fiscal 2020, HP estimates GAAP EPS to be in the range of

$2.00 to $2.10 and adjusted EPS to be in the range of $2.24 to $2.32.

HP’s dividend payment of $0.1602 per share in the fourth

quarter resulted in cash usage of $0.2 billion. HP also spent $0.5 billion of cash

to repurchase approx. 25 million shares of common stock.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions