Estimates

As the company gears up to publish its numbers for the first quarter of 2025, Wall Street forecasts earnings of $0.74 per share for the period, on an adjusted basis. That is slightly higher than the management’s earnings guidance of $0.70-$0.76 per share for Q1, at the mid-point. In the comparable quarter of 2024, the company’s adjusted profit was $0.81 per share. First-quarter revenue is expected to increase 1.25% YoY to $13.35 billion. The report is scheduled for release on Thursday, February 27, at 4:15 pm ET.

From HP’s Q4 2024 earnings call:

“We know our plans are working and we are well-positioned to capitalize on new opportunities that drive sustained growth. We are looking ahead with a clear focus on leading the future of work. With the proliferation of AI and flexible work, customer expectations have continued to evolve. Employers want to drive growth, while employees are seeking professional fulfillment. At this intersection, it’s an attractive opportunity for HP. With our powerful portfolio of solutions and the right team in place, we believe we have what it takes to lead the next era.”

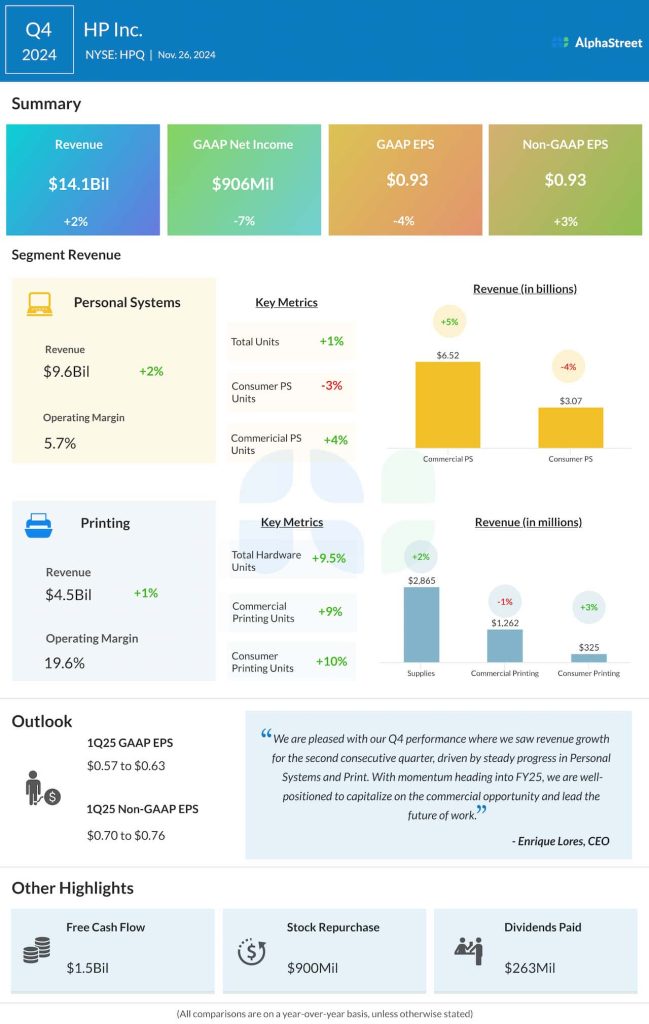

In the final three months of fiscal 2024, net revenues increased 2% year-over-year to $14.1 billion and came in slightly above estimates, mainly reflecting strong performance by the core Personal Systems segment. Q4 earnings, excluding special items, came in at $0.93 per share, compared to $0.90 per share in the year-ago quarter. It is in line with analysts’ expectations. On a reported basis, net income was $906 million or $0.93 per share, vs. $974 million or $0.97 per share in Q4 2023.

AI Power

After a surge in the demand for laptops and other personal computing devices during the pandemic a few years ago, there has been a slowdown in sales. To deal with the situation, HP has implemented a strategy focused on product innovation and cost reduction. It has launched several AI-enabled computers, including the OmniBook series designed to enhance productivity using advanced artificial intelligence technology. While the company is busy collaborating with other tech platforms to optimize the performance of its AI-integrated systems, their adoption will likely be gradual.

HP’s stock traded slightly lower on Friday afternoon, remaining just above its 52-week average value. the shares have gained about 6% in the past 30 days.