Healthcare service provider Humana, Inc. (NYSE: HUM) Wednesday reported better than expected earnings and revenues for the first quarter, helped by an increase in the sales of health insurance plans amid strong membership growth and improved premium rates. The company also raised its full-year 2019 earnings guidance. The stock gained about 2% in Wednesday’s pre-market session.

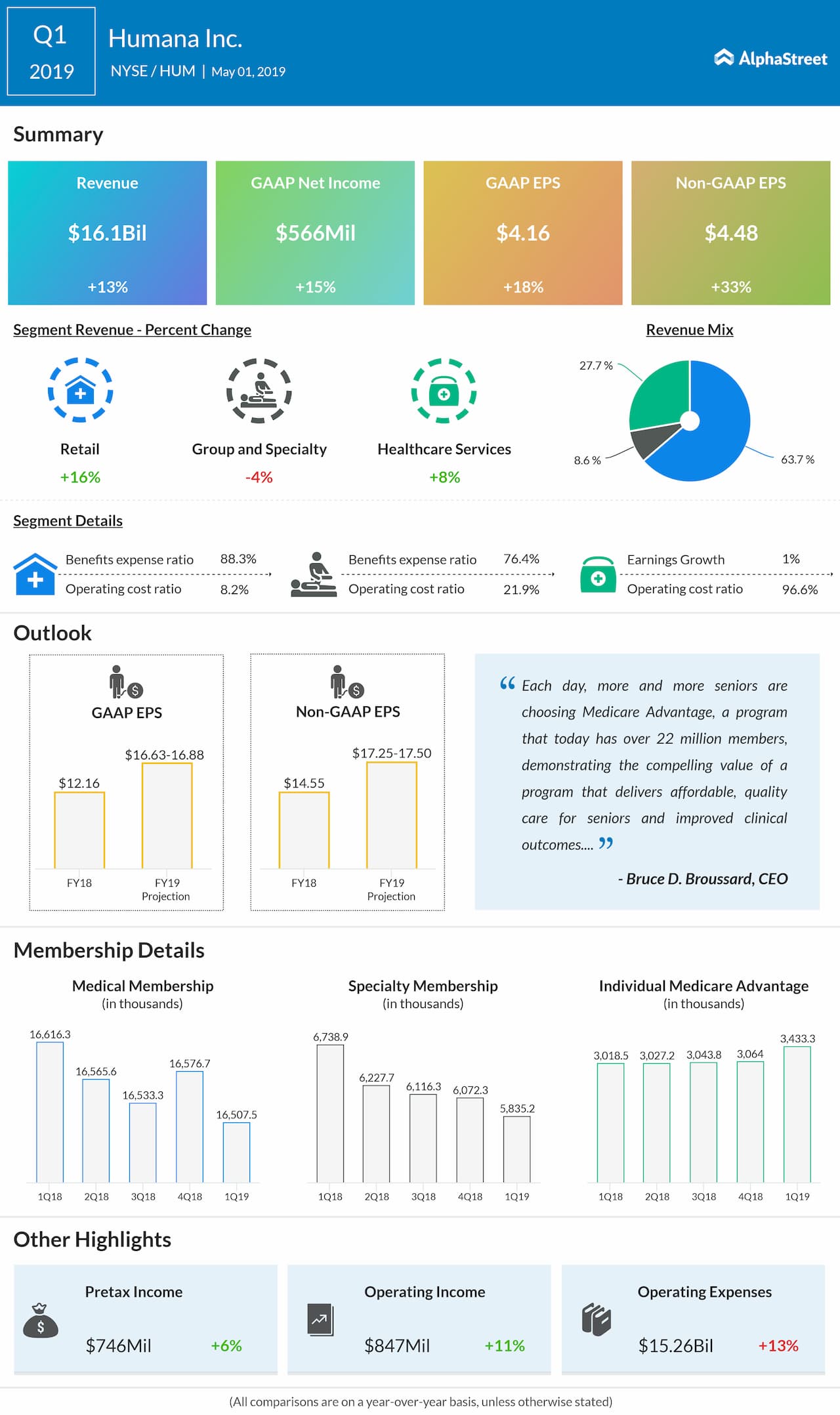

Adjusted earnings climbed to $4.48 per share in the first quarter from $3.36 per share a year earlier. Earnings also topped Wall Street’s expectations. Net income, on an unadjusted basis, rose to $566 million or $4.16 per share from $491 million or $3.53 per share in the first quarter of 2018. The bottom line was boosted by cost efficiencies achieved under the ongoing productivity initiatives.

On a reported basis, total revenues grew 13% to $16.1 billion and came in above analysts’ forecast. The robust top-line performance is attributable to better than expected utilization in the individual Medicare Advantage business. The retail division, which includes the Medicare service, registered double-digit growth. Sales of premiums, the main contributor to revenues, grew 13.3%, while services revenue moved up 8.6%.

The bottom line was boosted by cost efficiencies achieved under the ongoing productivity initiatives

“In a year of strong Medicare Advantage membership growth for the industry, driven in no small part by the health insurance industry fee suspension and the resulting increased benefits offered to seniors nationwide, we are pleased to be able to deliver industry-leading individual Medicare Advantage membership growth of 415,000 to 440,000 members together with above target earnings growth for 2019,” said CEO Bruce Broussard.

Related: Humana Q4 2018 Earnings Conference Call Transcript

The management, meanwhile, revised up its full-year 2019 guidance for adjusted earnings to the range of $17.25 per share to $17.50 per share, to reflect an estimated growth in the Medicare Advantage business. The forecast for unadjusted earnings is between $16.63 per share and $16.88 per share, compared to $12.16 per share last year.

Individual Medicare Advantage membership is currently expected to grow in the range of 415,000 to 440,000 in fiscal 2019, which is higher than the initial estimate.

CVS Health Corp. (CVS) Wednesday reported a 43% growth in first-quarter earnings to $1.09 per share, aided by a 35% increase in revenues to $62 billion. The results also surpassed the Street view.

After closing Tuesday’s trading session lower, Humana shares gained 2% early Wednesday. The stock has lost 11% over the past twelve months and 9% since the beginning of 2019.