For the China-based company, the key growth strategy has been to expand globally while strengthening its foothold in the domestic market. The esports market, which is still at a nascent stage, is expanding rapidly in China and across the world due to the mass adoption of online sports. Huya’s diversification into professionally generated content continues to complement the core business.

Swelling User Base

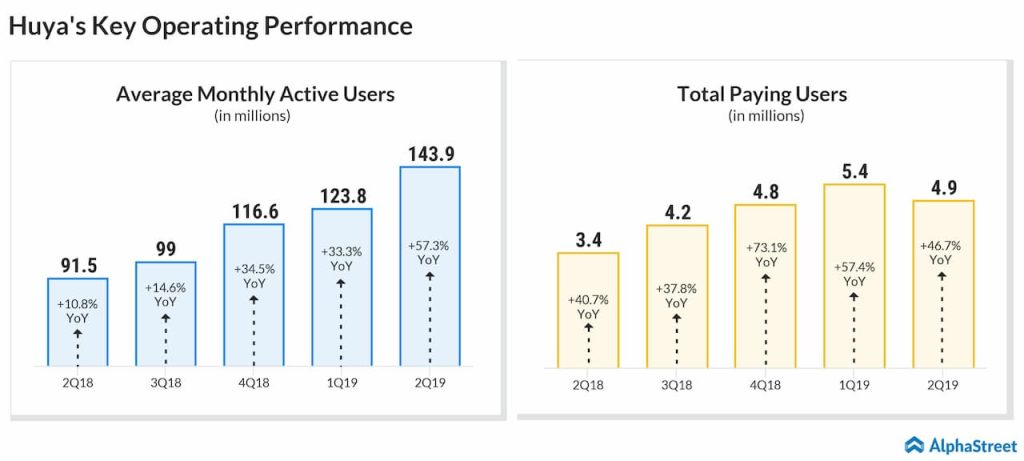

Initial estimates indicate that the tech firm added more paying users in the to-be-reported quarter, driving up revenues from last year’s levels. The positive momentum, marked by bulk conversion of non-paying users into paying users, reflects the management’s aggressive efforts to innovate the product portfolio to effectively monetize customer growth.

Meanwhile, the bottom-line will likely be affected by the squeeze on margins due to heavy investment in expansion initiatives, especially outside China, and high spending on broadcasting and the conduct of esports tournaments.

Future Perfect

Going ahead, the explosive growth of esports in China, combined with Huya’s focus on hosting tournaments and its leadership in mobile game streaming, puts the company at an advantageous position compared to its international counterparts. On the flip side, margin growth could be affected by competition. Among rivals, Tencent-backed Douyu (DOYU) debuted on NASDAQ in July, raising about $775 million in the IPO.

Going by the current trend, live streaming will continue to be Huya’s primary revenue source in the foreseeable future, while advertising keeps gaining strength.

Looking Back

The tech firm further expanded its user base in the June-quarter, but there was a sequential decline in the number of paying users to about 4.9 million due to a higher churn rate and expansion of the timeframe required for monetization. Revenues nearly doubled to $293 million, driving up the profit to $0.11 per share. The results also topped the Street view.

Also read: Tencent Music reports Q2 earnings beat

Ever since they debuted on the New York Stock Exchange last year, the performance of Huya shares has been mixed. The stock gained 25% so far this year while staying volatile all along.