New strategy

NewCo will have a revenue base of $19 billion along with $60 billion in services backlog. It has 4,600 clients which include over 75% of the Fortune 100.

This move is part of IBM’s plan to increase its focus on the hybrid cloud platform, which represents a $1 trillion market opportunity. It will allow IBM to generate the majority of its revenues from high-value cloud software and solutions instead of services.

Cloud opportunity

The open hybrid cloud platform architecture, based on RedHat’s OpenShift, helps drive up to 2.5 times more value for clients than a public cloud-only solution. The $1 trillion addressable opportunity in hybrid cloud includes $300 billion in cloud transformational services, $450 billion in cloud software and platforms, and $230 billion in cloud infrastructure.

More than 90% of enterprises have a hybrid environment and around 75% of workloads are not in the public cloud. In addition, around 60% of the hybrid cloud opportunity is in highly-regulated industries.

Cloud computing has gained prominence significantly during the COVID-19 pandemic with several companies investing heavily in cloud-related software and solutions to enable remote work.

Performance

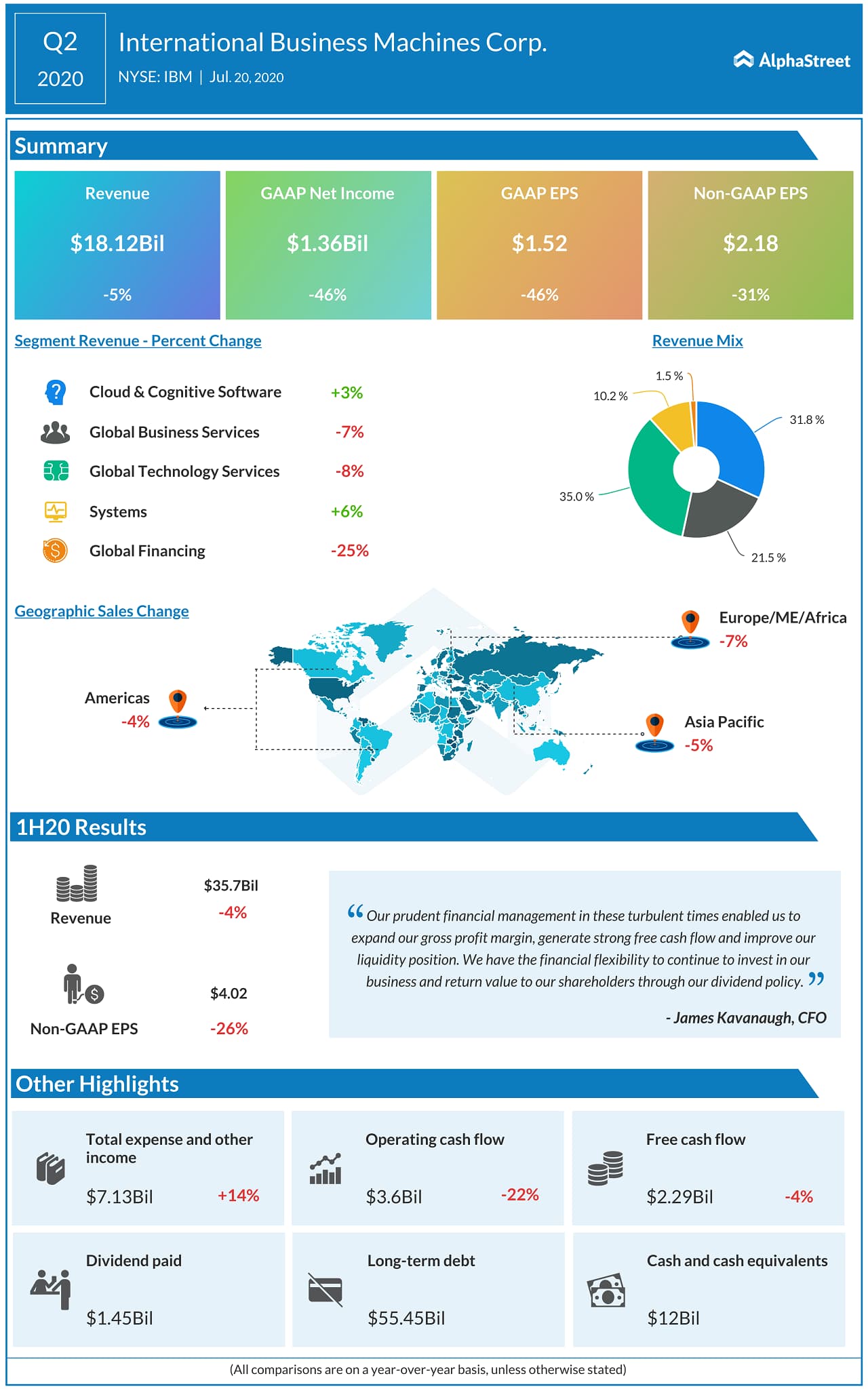

IBM has been seeing strength in the cloud segment over the past few years while everything else has been lagging behind. In 2019, within the Cloud & Cognitive Software segment, total cloud revenue grew 78%, reflecting the acquisition of Red Hat.

Looking at the periods from 2017 to 2019, Cloud & Cognitive Software has seen revenues increase consistently year-over-year. In both 2017 and 2018, the segment recorded a 2% increase in revenue which then rose to 2.5% in 2019.

All the other segments have witnessed fluctuations. Of this, the Global Technology Services division saw revenues drop 3.6% in 2017, with only a slight increase of 0.5% in 2018, followed by a bigger drop of 5% in 2019. Another segment which has been witnessing heavy declines is Global Financing which posted a 17.8% drop in revenue in 2019.

In the first half of 2020, Cloud & Cognitive Software recorded a growth of nearly 4% in revenue while Global Technology Services posted a 7% decline. Total revenues were down 5% in 1H 2020.

During the second quarter of 2020, total revenues fell 5.4%, dragged down by decreases in many segments. However Cloud & Cognitive Software revenues rose 3%. Total cloud revenue jumped 30% to $6.3 billion. Total cloud revenue over the last 12 months was up 20% to $23.5 billion. Revenue from Red Hat grew 17% in Q2.

Outlook

For the third quarter of 2020, IBM expects to report revenues of $17.6 billion, GAAP EPS from continuing operations of $1.89 and adjusted EPS of $2.58.

In short, it makes sense for IBM to shed some weight and focus more on the portion of the business that has the highest revenue and growth potential. Cloud computing is set to grow by leaps and bounds in the coming years and this strategy will position the company well to take advantage of this trend.

Click here to read the full transcript of IBM Q2 2020 earnings conference call