Q2 Report on Tap

The computing behemoth will be reporting second-quarter results after the close of markets on July 19. Analysts are a bit cautious in their earnings guidance for the June quarter, but the actual number is likely to exceed the consensus — quarterly profit beat estimates regularly in recent years. The market sees a 13% year-over-year dip in adjusted profit to $2.01 per share on flat revenues of about $15.6 billion.

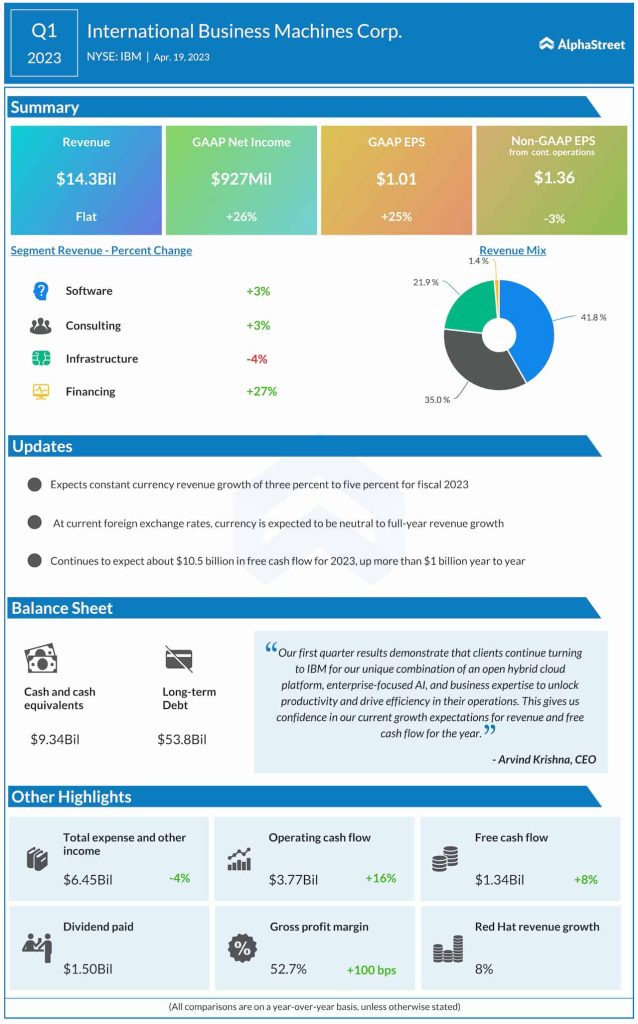

The IBM leadership is looking to end the fiscal year with a healthy free cash flow of $10.5 billion, which is up by $1 billion compared to last year. It also predicts a 3-5% growth in full-year revenues. CFO James Kavanaugh said at the last earnings call, “Looking at the second quarter, we expect first to second-quarter revenue seasonality to be fairly consistent with last year. That’s up about $1.3 billion, though the underlying dynamics are different due primarily to Z Systems’ product cycle and currency. I’ll remind you, we had a successful launch of our z16 in the second quarter of last year, and that creates a year-to-year headwind to growth of about 3 points. In terms of profit, we now expect a little over one-third of our operating net income in the first half and just under two-thirds in the second half.”

Q1 Outcome

In mid-April, IBM reported first-quarter revenues of $14.3 billion, which is broadly in line with the market’s estimates. Earlier, revenues had topped expectations for five consecutive quarters. The latest number also remained unchanged from the prior-year period as a contraction in the Infrastructure business offset revenue growth in the other three operating segments. Meanwhile, earnings from continuing operations, excluding one-off items, declined 3% annually to $1.36 per share.

The company is banking on the unique combination of its open hybrid cloud platform, industry-leading expertise, and enterprise-focused AI to achieve long-term revenue and free cash flow goals.