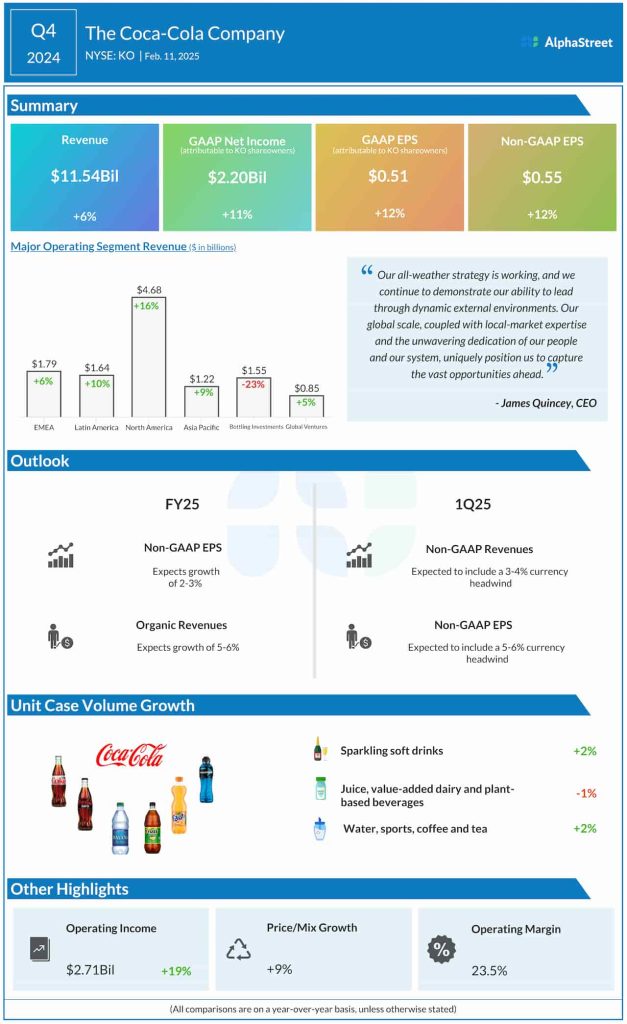

In the December quarter, the beverage giant’s revenue grew 6% to $11.54 billion from $10.85 billion last year. The latest number topped expectations. Organic revenue, excluding mergers & acquisitions and foreign currency, rose 14% during the three months. Coca-Cola’s highly diverse portfolio, ranging from sparkling soft drinks to plant-based beverages, enables it to effectively navigate through challenges like inflation and economic downturn.

Price Hike

The strong demand for Coca-Cola’s products indicates that customers haven’t stopped purchasing them despite recent price hikes, at a time when consumer-focused businesses are generally witnessing a demand slowdown. While margins benefit from the favorable pricing, elevated operating costs could be a drag on profitability this year.

Adjusted earnings rose to $0.55 per share in Q4 from $0.49 per share a year earlier, exceeding estimates. Net income attributable to shareowners, on an unadjusted basis, was $2.20 billion or $0.51 per share in the fourth quarter, compared to $1.97 billion or $0.46 per share in the year-ago period. Last week, PepsiCo reported flat revenues for its latest quarter amid weak sales in the Americas. Meanwhile, the rival beverage company’s Q4 profit grew by double-digits, aided by stable demand in other markets.

Guidance

For the first quarter, Coca-Cola’s management expects that comparable net revenues will include a 3-4% currency headwind and comparable earnings growth will include a 5-6% currency headwind. For the whole of fiscal 2025, it anticipates a 5-6% organic revenue growth and a 2-3% increase in comparable earnings, on a per-share basis.

Commenting on the Q4 results, Coca-Cola’s CEO James Quincey said, “We are pleased with our 2024 results, which include volume growth, robust organic revenue growth, and comparable gross and operating margin expansion. This led to a 7% comparable earnings-per-share growth despite nearly double-digit currency headwinds and the impact of bottler re-franchising. These results reflect the continuation of delivering on our long-term commitments. Through our all-weather strategy, we’ve demonstrated we have agility to navigate what comes at us and continue to grow comparable earnings per share.”

After a long time, shares of Coca-Cola traded above their 52-week average price this week. On Tuesday afternoon, the stock traded up 3%, maintaining the post-earnings upswing.