Weak Q2

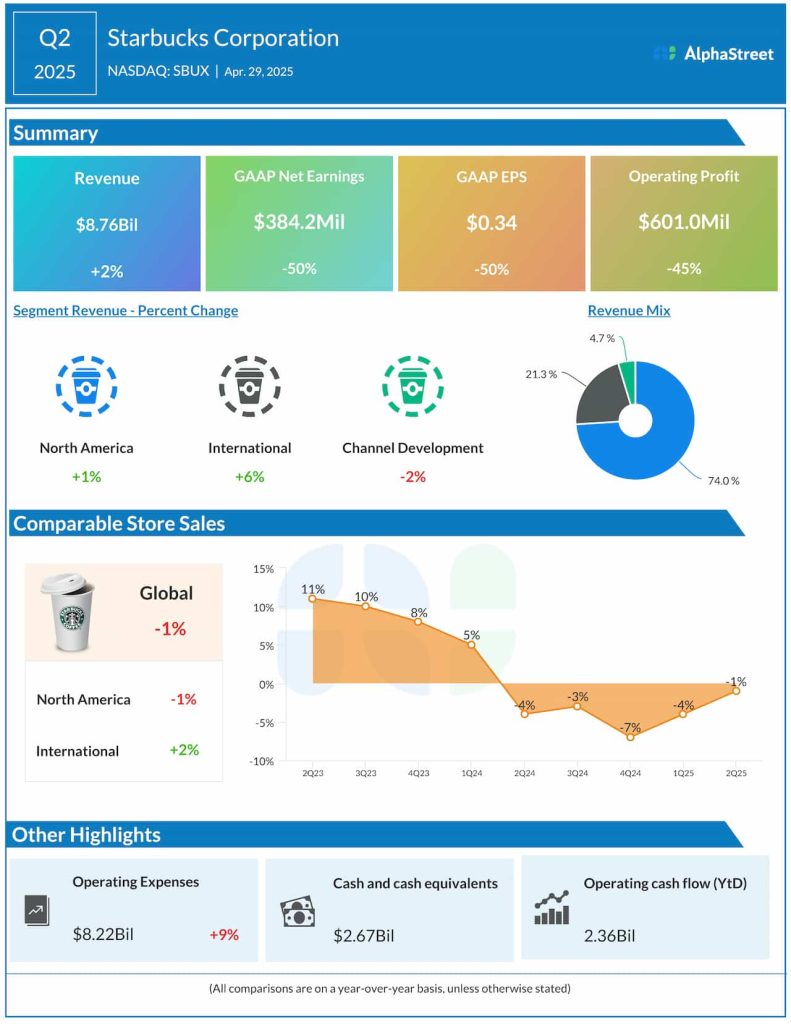

In the second quarter, net income was $384.2 million or $034 per share, compared to $772.4 million or $0.68 per share in the same period last year. Second-quarter revenue increased to $8.76 billion from $8.56 billion in the year-ago quarter. Global comparable store sales declined 1%, hurt by a 2% decline in comparable transactions, partially offset by a 1% increase in the average ticket. Revenue and net income both missed analysts’ estimates, after beating in the prior quarter.

“In the near term, we’re making the most out of our beverage pipeline. This summer, we’re bringing back the best-selling Summer-Berry Refreshers with Pearls, launching the new limited-time Iced Horchata Oatmilk Shaken Espresso. and bringing new innovation to our Frappuccino platform. In the longer term, we’re using an agile test-and-learn approach to build a culturally relevant innovation pipeline across beverage and food. To do this, we’re developing enduring platforms that reshape the business and create long-term potential for the brand,” Starbucks’ CEO Brian Niccol said in the Q2 earnings call.

Turnaround

The company said that under the Back to Starbucks strategy, its turnaround remains on track, with better-than-expected opportunities ahead. The focus is on navigating the challenging business environment and transforming Starbucks to align with changing market dynamics. The company is making disciplined investments in its partners and coffeehouses, as well as in improving the menu and customer experience.

In the post-earnings sell-off, Starbucks’ shares slipped below their 12-month average value of $91.60. The stock declined around 6% early in Wednesday’s session, trading just below $80.