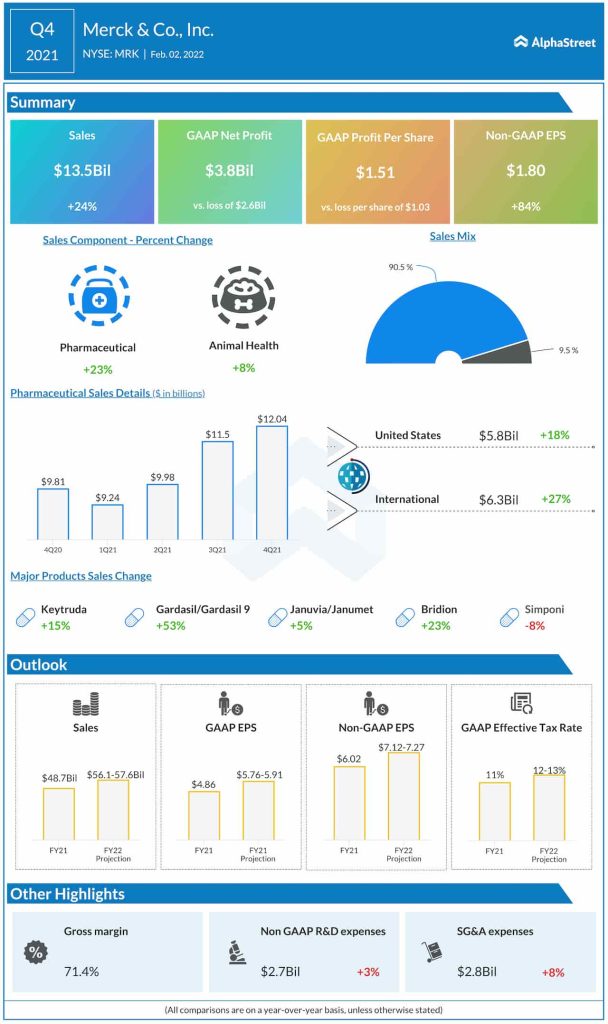

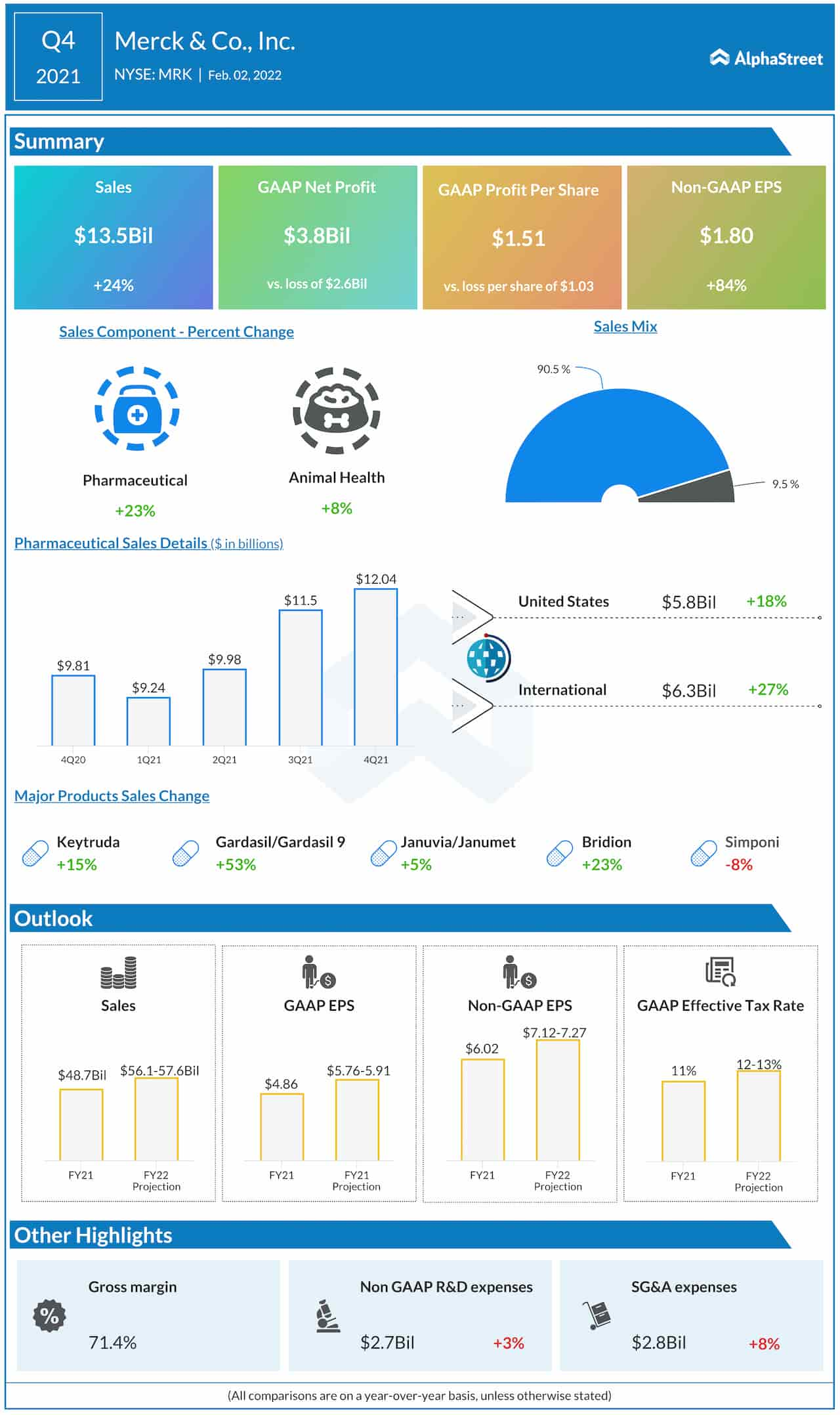

Worldwide sales rose 24% year-over-year to $13.5 billion in the final three months fiscal 2021, which is well above the market’s projection. Excluding foreign exchange impacts, sales grew 23%. The top-line benefitted from strong sales of oncology and human health vaccines.

Net earnings, on an adjusted basis, nearly doubled to $1.80 per share from $0.98 per share in the fourth quarter of 2020, and exceeded the consensus estimates. Unadjusted net income was $3.82 billion or $1.51 per share in the fourth quarter, compared to a loss of $2.62 billion or $1.03 per share in the corresponding period of the previous year.

“We enter 2022 with strong momentum and are moving with speed to bring forward innovations that address critical unmet needs and contribute to global health. This remains at the core of our strategy, and why we are focused on benefitting the patients we serve, and in turn creating long-term value for our shareholders,” said Robert Davis, chief executive officer of Merck.

Read management/analysts’ comments on Merck’s Q4 2021 earnings

Merck’s stock traded lower during Thursday’s premarket session, after closing the previous session higher. It has gained about 7% since the beginning of the year.