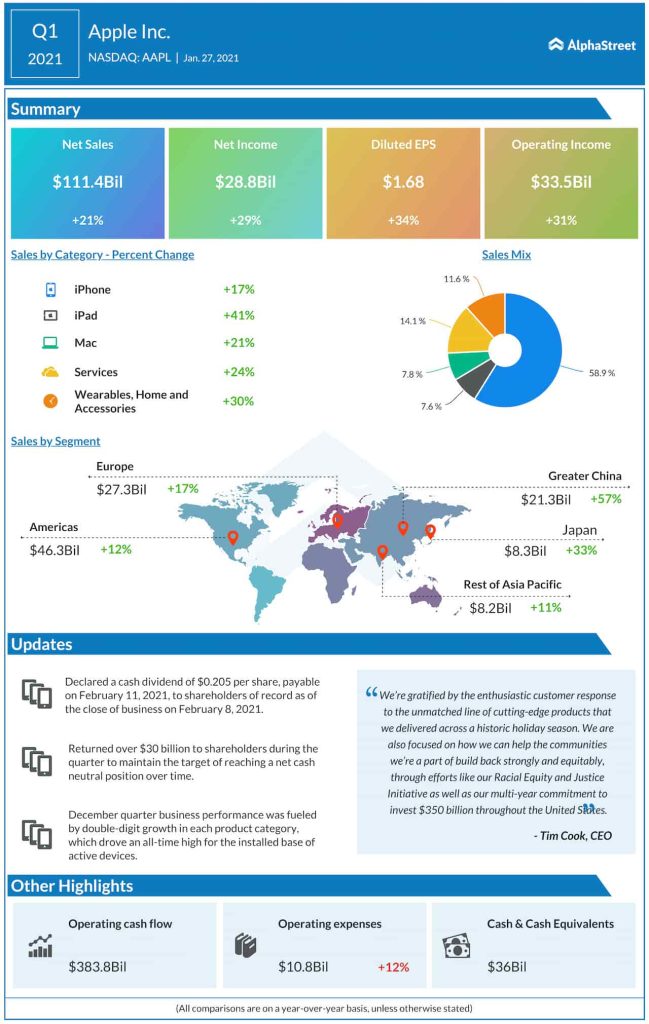

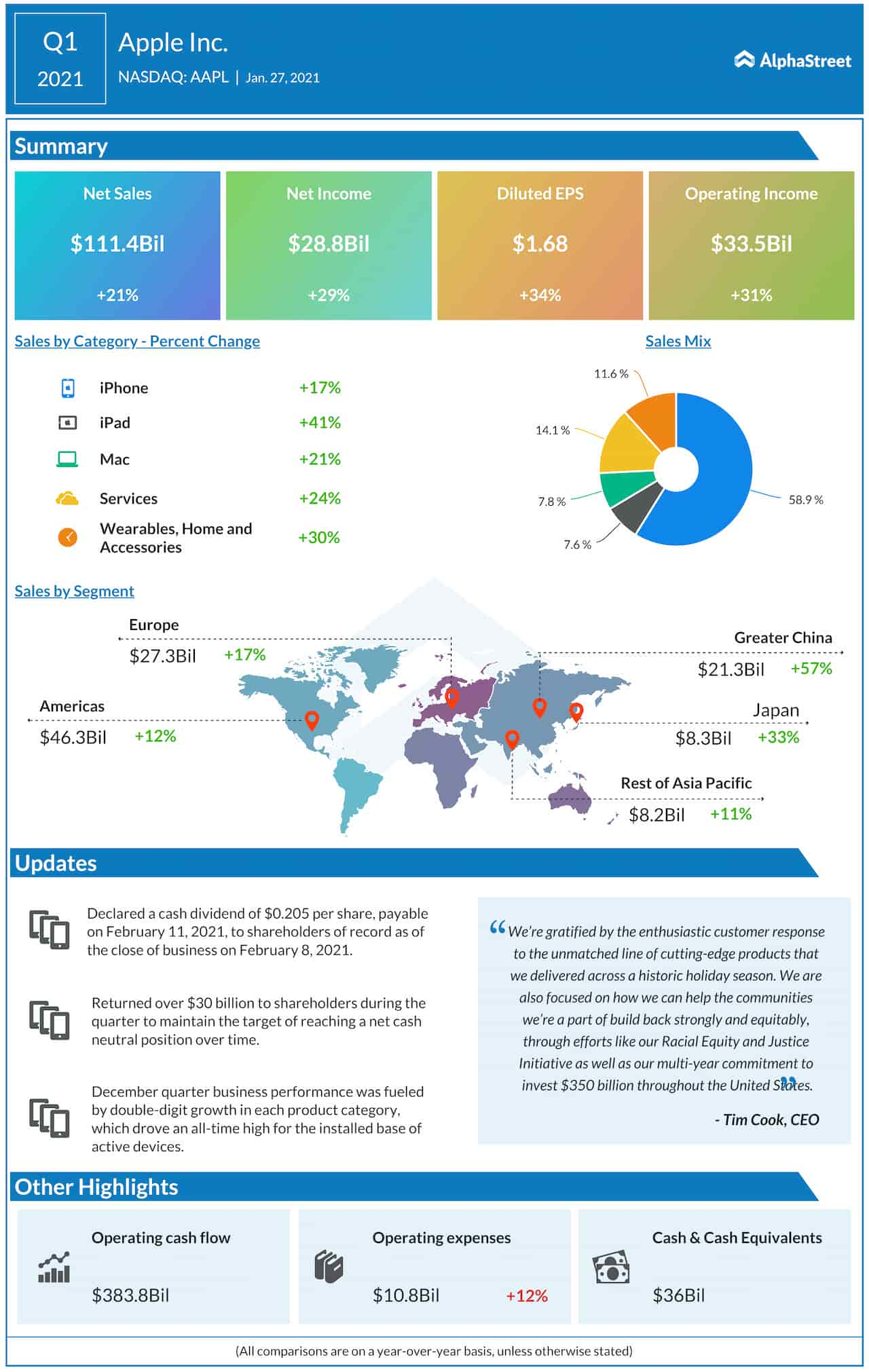

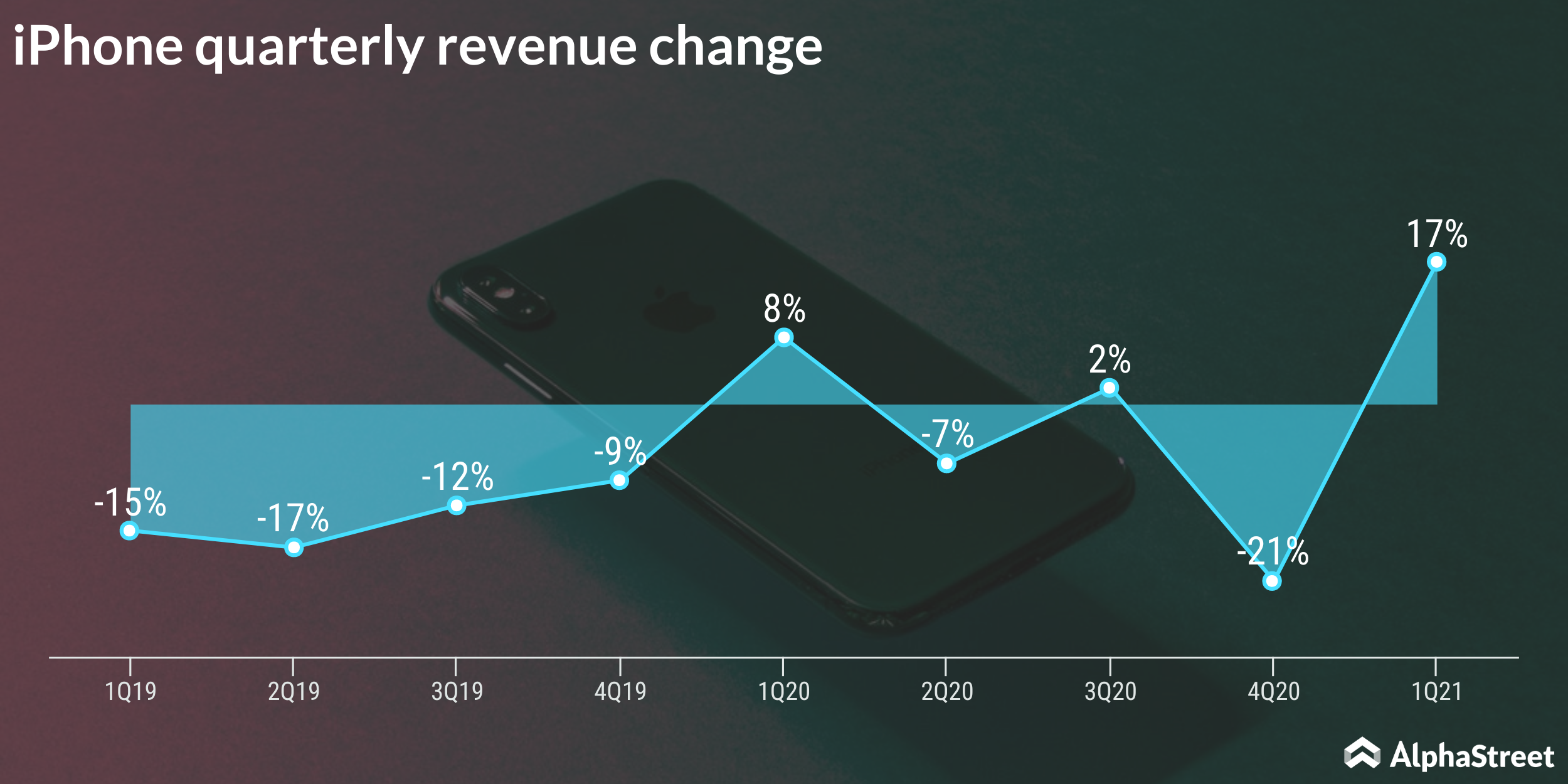

Sales of iPhone increased 17% from last year to $65.6 billion in the December-quarter. At $111.4 billion, total revenue was up 21%, which also came in above the estimates.

“Our December quarter business performance was fueled by double-digit growth in each product category, which drove all-time revenue records in each of our geographic segments and an all-time high for our installed base of active devices,” said Apple’s CFO Luca Maestri.

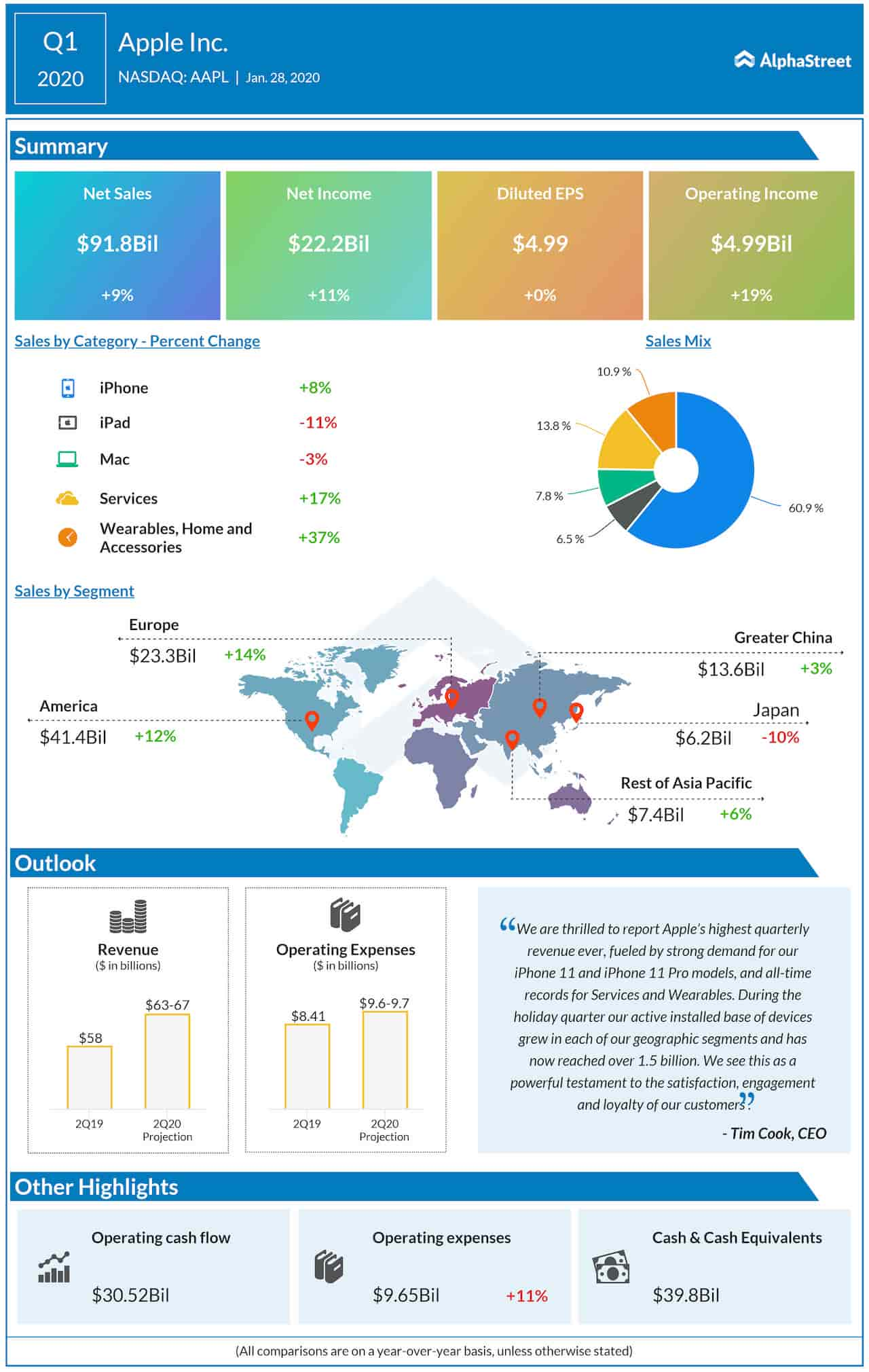

The gadget giant recorded a net income of $28.8 billion or $1.68 per share, compared to $22.2 billion or $1.25 per share in the first quarter of 2020. It was better than the outcome analysts’ had predicted.

Read management/analysts’ comments on Apple’s Q4 results

Shares of Apple climbed to a new record last week, ahead of the earnings release. The stock, which gained 8% so far this year, closed Wednesday’s regular session lower.