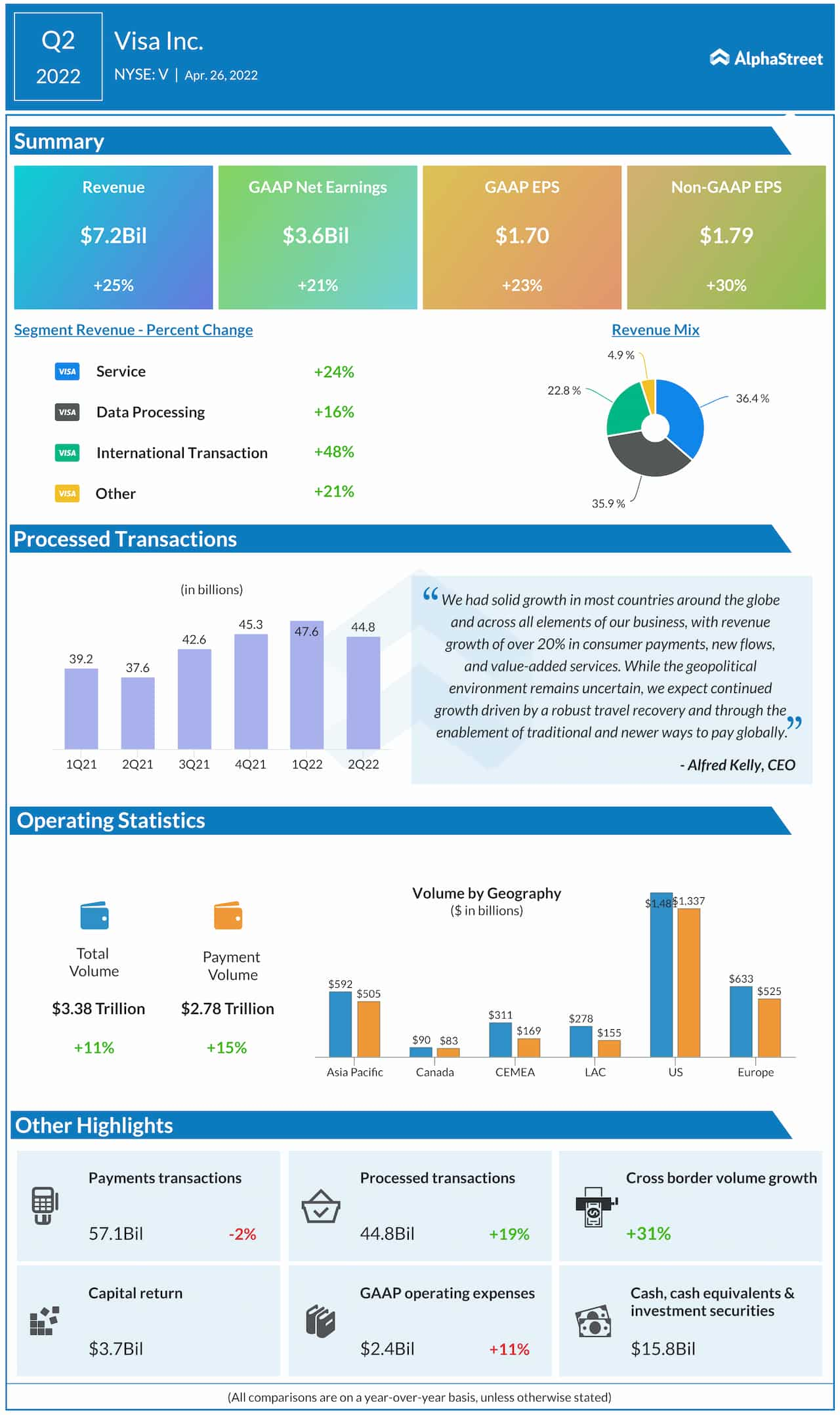

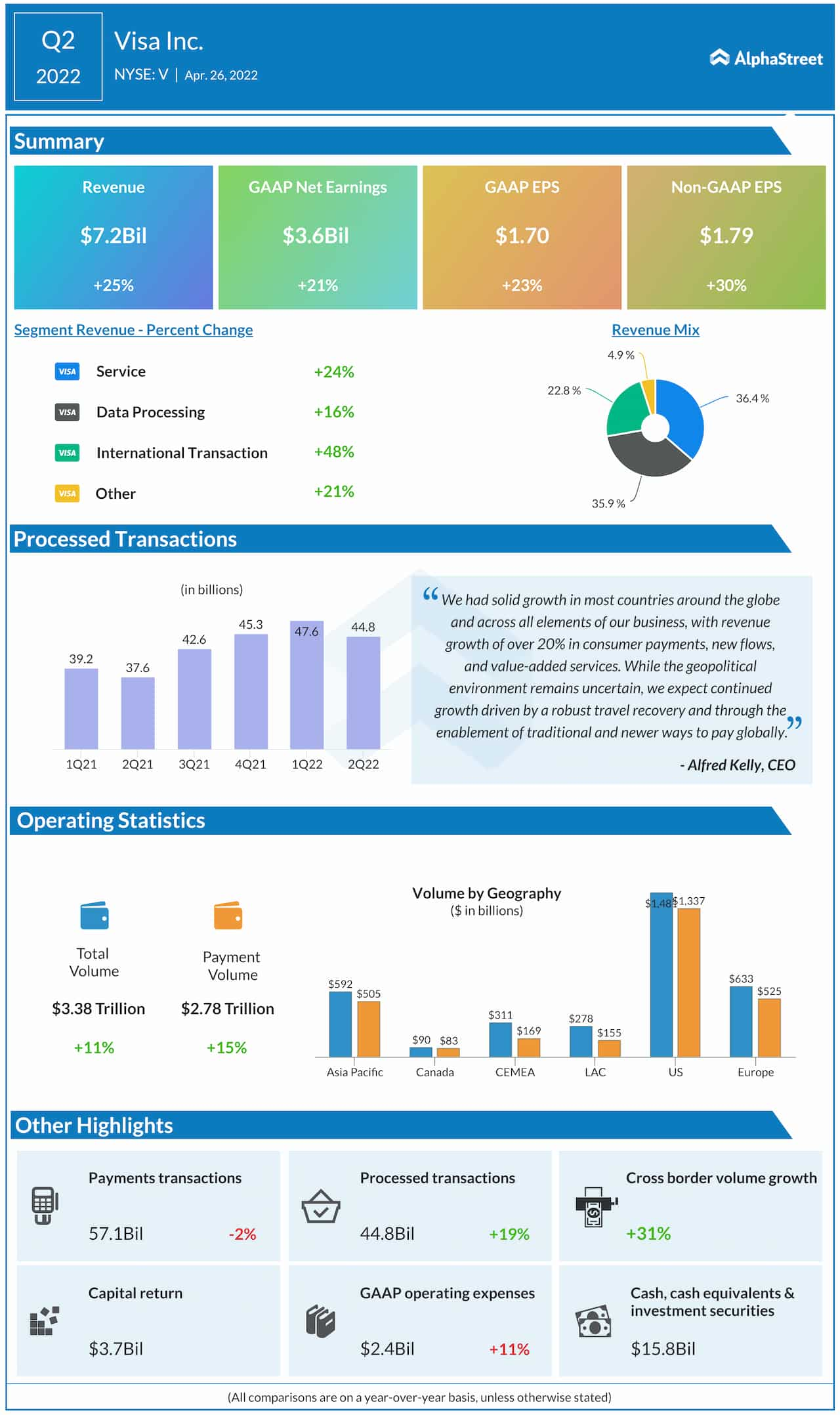

Credit card giant Visa Inc. (NYSE: V) has reported a double-digit increase in net profit and revenues for the second quarter of 2022. The results also exceeded Wall Street’s estimates, driving the company’s stock higher.

At $7.2 billion, second-quarter revenues were up 25% year-over-year and above analysts’ consensus forecast. Cross-border volume, excluding transactions within Europe, increased 47% on a constant-dollar basis for the three-month period.

Second-quarter earnings moved up to $3.65 billion or $1.70 per share from $3.03 billion or $1.38 per share in the same period of 2021. Adjusted earnings, excluding special items, rose to $1.79 per share from $1.38 per share in the prior-year quarter.

Check this space to read management/analysts’ comments on Visa’s Q2 2022 earnings

“We had a very strong quarter amidst the invasion of Ukraine and our decision to suspend operations in Russia, with GAAP EPS up 23% and non-GAAP EPS up 30%. The Omicron variant impacts were short-lived and the global economic recovery that began in the middle of last year continued,” said Alfred Kelly, Jr., CEO of Visa.