“

Micron Technology Inc. (NASDAQ: MU) reported strong earnings and revenue growth for the fourth quarter of 2020, benefitting from the pandemic-driven digital transformation spree. However, the company’s stock dropped during the extended trading session on Tuesday. Earlier, it had made strong gains immediately after the announcement. Earnings, adjusted for one-off items, climbed to $1.08 per […]

· September 29, 2020

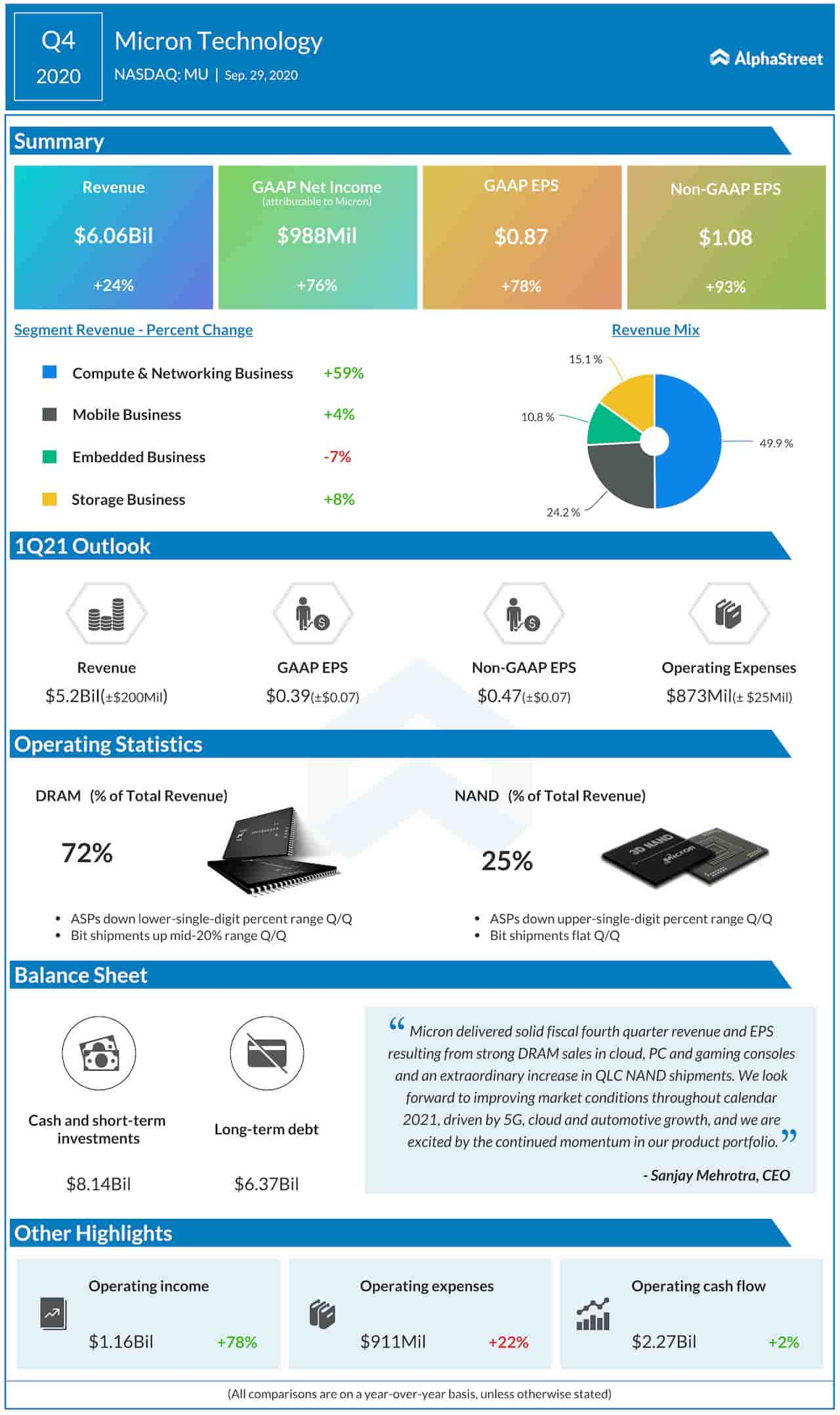

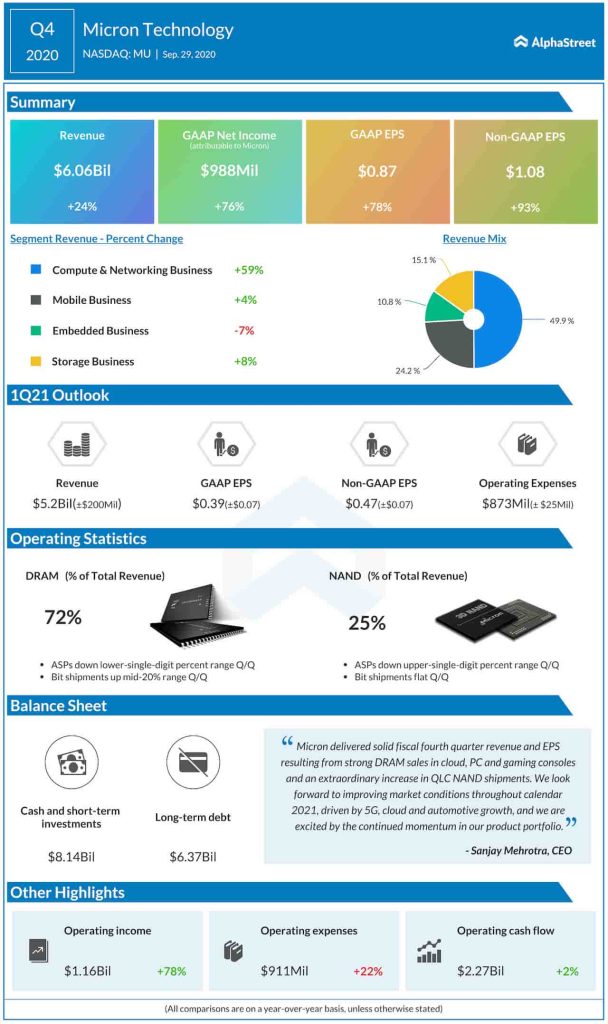

Micron Technology Inc. (NASDAQ: MU) reported strong earnings and revenue growth for the fourth quarter of 2020, benefitting from the pandemic-driven digital transformation spree. However, the company’s stock dropped during the extended trading session on Tuesday. Earlier, it had made strong gains immediately after the announcement.

Earnings, adjusted for one-off items, climbed to $1.08 per share in the final three months of fiscal 2020 from $0.56 per share last year. The bottom-line growth was driven by a 24% growth in revenues to $6.06 billion.