Photo-sharing app Instagram, which last week announced that it has reached 1 billion monthly active users, is reportedly worth over $100 billion as a standalone company. The Bloomberg report also predicted that Instagram would exceed 2 billion monthly active users in the next five years as it keeps attracting new users at a faster pace than the parent company.

Instagram will account for 16% of Facebook’s (FB) revenue in 2018, compared to 10.6% in 2017, the report added.

Related: Instagram reaches 1 billion users; introduces long-form video

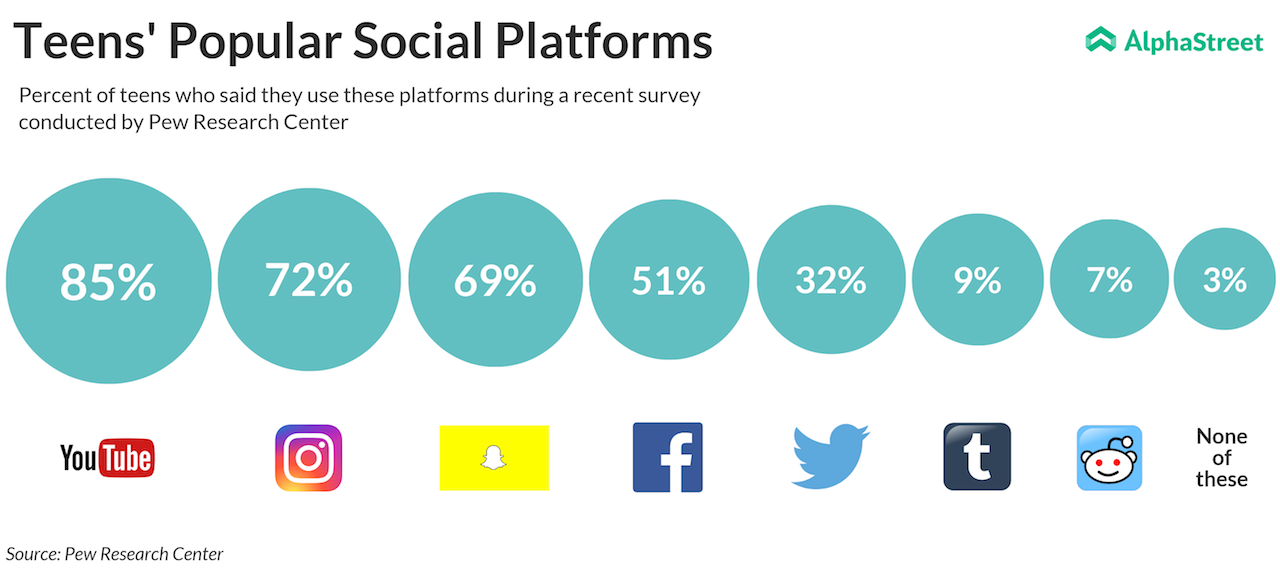

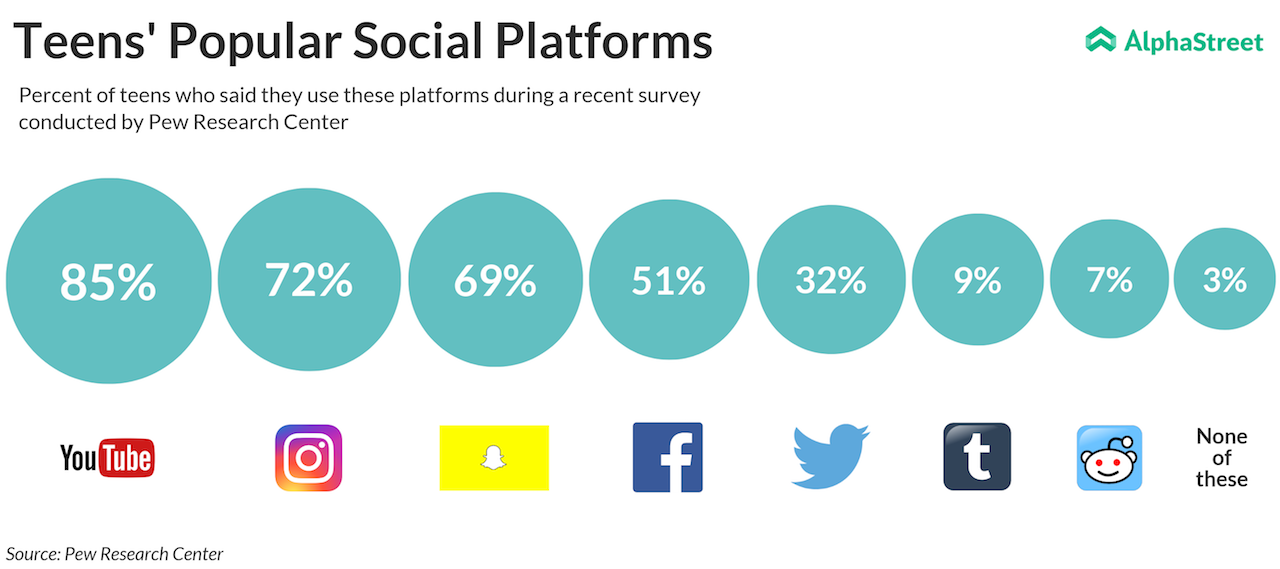

The growth rate of Instagram is backed by another study by Pew Research Center, which shows that younger users prefer Instagram and Snapchat over Facebook. As per the study, 85% of the teenagers use Google’s (GOOGL) YouTube, while 72% use Instagram, and 69% use Snapchat (SNAP). In contrast, only 51% of the teens use Facebook.

It is worth noting that Facebook is currently trying to attract more users through its live streaming and video-on-demand service.

Meanwhile, a new study from Similar Web shows that users spend about 53 minutes per day on Instagram. This is close to the average time spent on Facebook of 58 minutes per day. Snapchat users, meanwhile, spend 49.5 minutes per day on the app. Since last year, average engagement has improved in all three social network sites.

Instagram, which is maturing as a prospective social media platform, will likely turn out to be a gold-mine for Facebook as younger audiences are pouring into the site. With newer innovations such as the IGTV, we can expect to see sustained growth in this segment of Facebook.