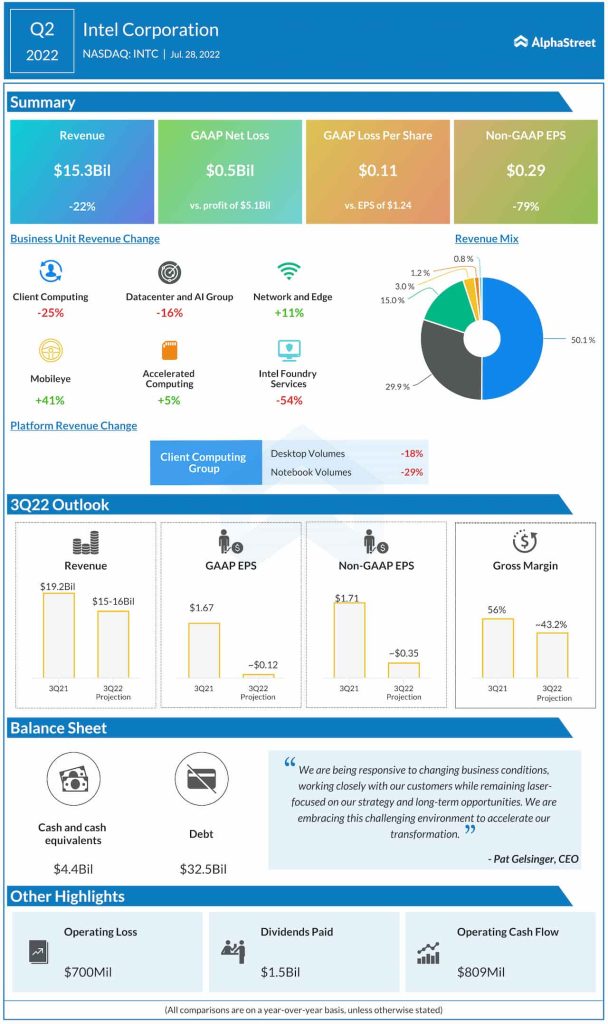

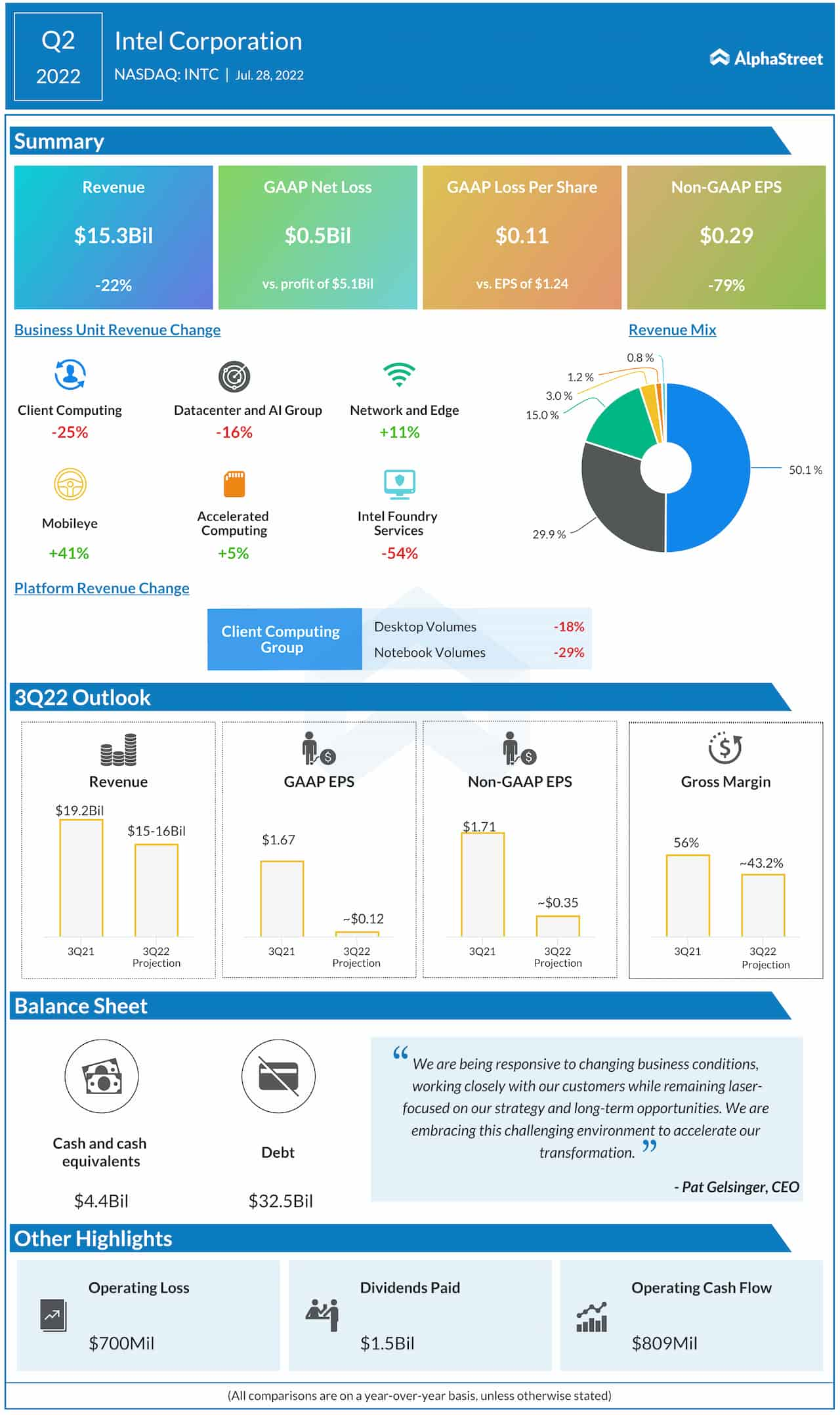

Second-quarter revenues decreased 22% annually to $15.3 billion. The top line also missed the consensus estimates.

Adjusted earnings declined to $0.29 per share in the latest quarter from $1.36 per share in the second quarter of 2021. The latest number also fell short of expectations. On a reported basis, the company posted a net loss of $0.5 billion or $0.11 per share, compared to a profit of $5.1 billion or $1.24 per share last year.

Check this space to read management/analysts’ comments on Intel’s Q2 results

“We are being responsive to changing business conditions, working closely with our customers while remaining laser-focused on our strategy and long-term opportunities. We are embracing this challenging environment to accelerate our transformation,” said Intel’s CEO Pat Gelsinger.