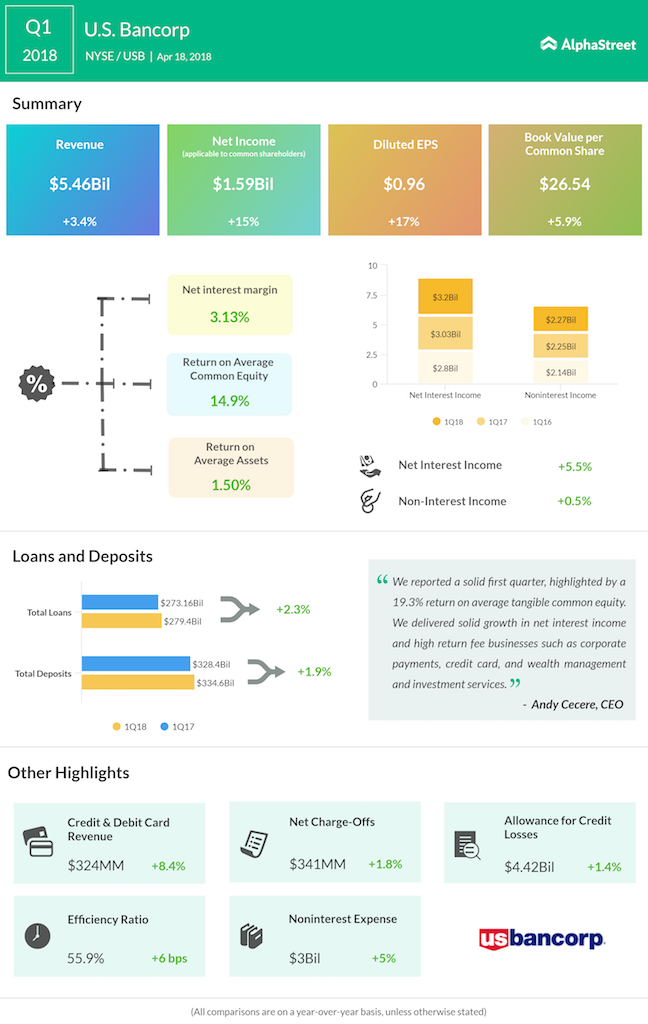

Average loans rose 2.3% due to across the board growth in loans disbursed offset by 6.5% drop in commercial real estate loans. The bank’s average deposits saw 1.9% increase, primarily driven by time deposits.

Asset quality improved in the quarter where bank’s non-performing assets (NPA) decreased 19.5% to $1.2 billion, driven by improved performance in commercial and mortgage related loans. All the segments of the bank recorded double-digit growth compared to last year except Treasury and Corporate Support line’s profits declined 33%. The decrease was primarily due to increased labor costs and reduced profit contribution from investments from stocks.