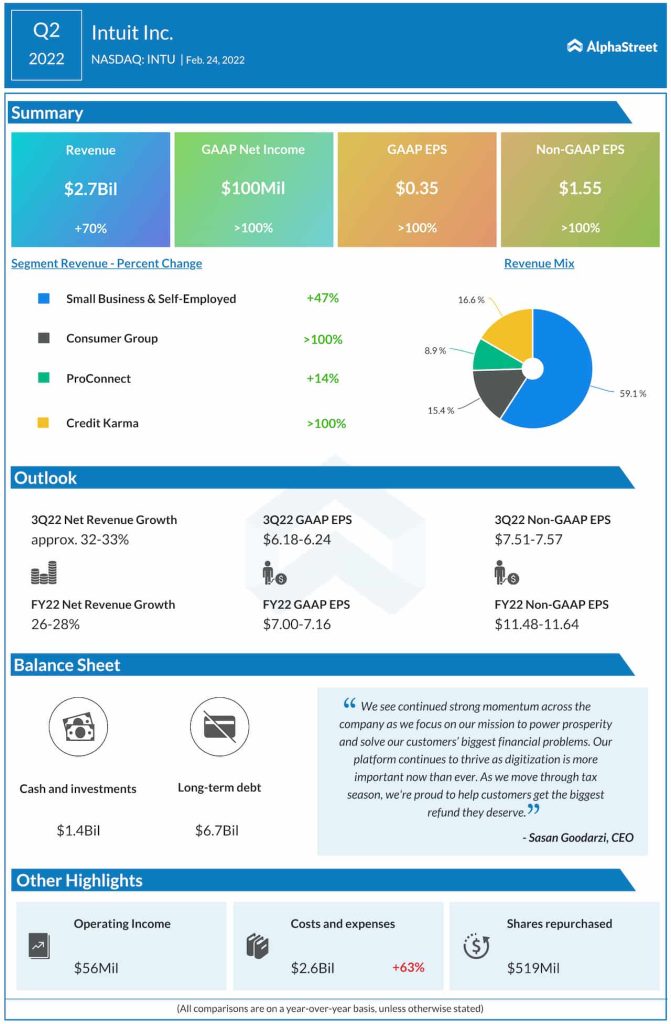

At $2.67 billion, second-quarter revenues were up 70% from the year-ago period but came in below experts’ projection. The topline benefitted from strong growth in the main operating segments.

Adjusted earnings increased to $1.55 per share in the latest quarter from $0.68 per share in the second quarter of 2021 but missed the consensus forecast. Net income, including one-off items, was $100 million or $0.35 per share, compared to $20 million or $0.07 per share last year.

Read management/analysts’ comments on Intuit’s Q2 results

Intuit’s shares traded higher on Thursday and closed the session up 6%. But they declined in the after-hours soon after the earnings announcement.