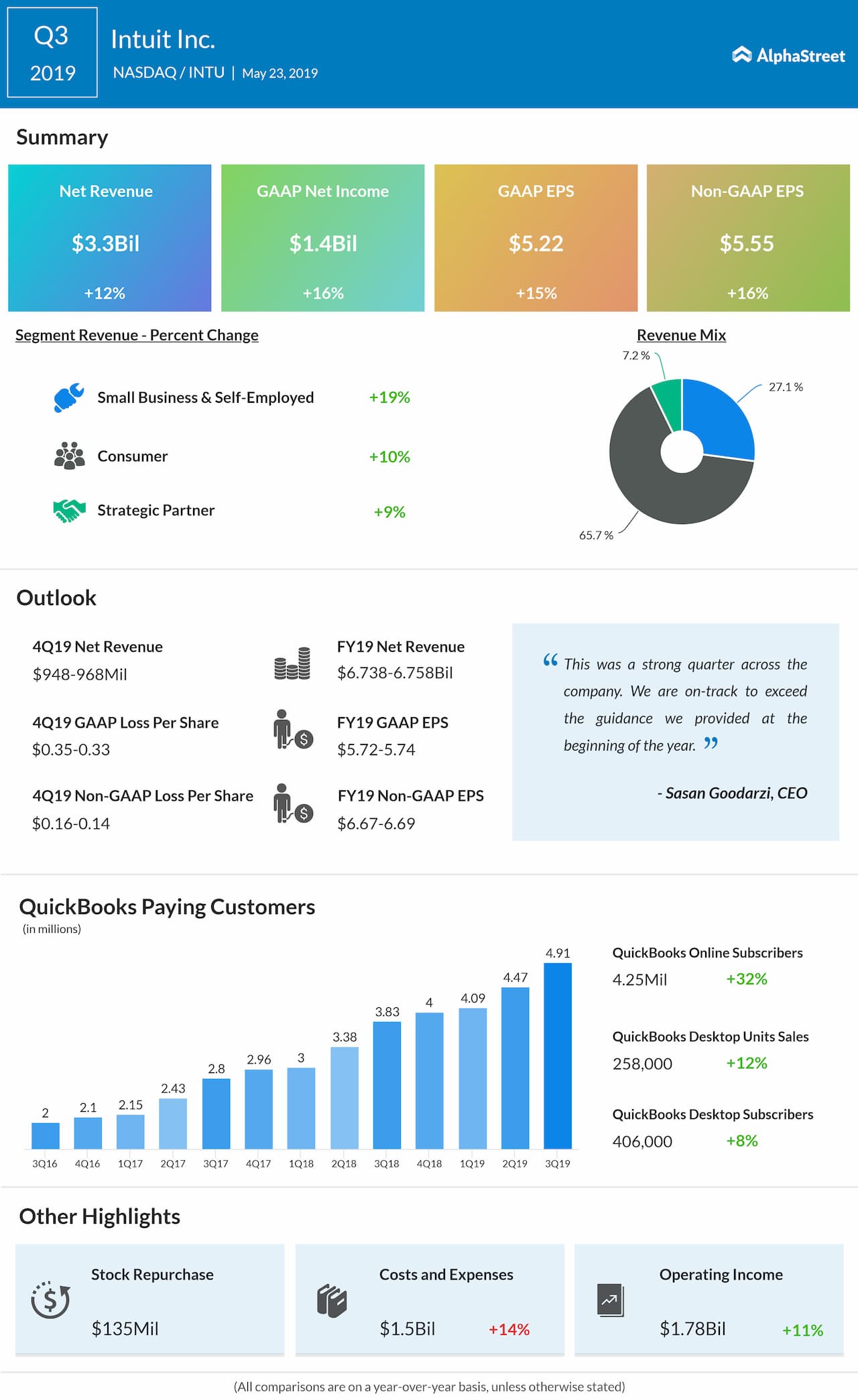

For the fourth quarter of fiscal year 2019, Intuit expects GAAP loss per share of $0.35 to $0.33, and non-GAAP loss per share of $0.16 to $0.14. Revenue is expected to be $948 million to $968 million, representing a growth of 10% to 12%.

The Mountain View, California-based company lifted its outlook for fiscal 2019. Intuit now expects GAAP EPS to be $5.72 to $5.74 versus the prior estimate of $5.25 to $5.35, non-GAAP EPS of $6.67 to $6.69 compared to the prior outlook of $6.40 between $6.50, and revenue in the range of $6.738 billion to $6.758 billion versus prior target of $6.53 billion to $6.63 billion.

“We had a great tax season, growing the Do-It-Yourself (DIY) category overall as well as our share within the category driven by our innovation and significantly improved customer experience. We continue to see momentum in our Small Business and Self-Employed Group driven by Online Ecosystem revenue growth.” said CEO Sasan Goodarzi.

Last month, Intuit’s peer H&R Block (HRB) reported that for its fiscal year 2019 through April 19, tax returns prepared by or through H&R Block increased 1.5% to 20.2 million. The Kansas City, Missouri-based company will be reporting its fourth quarter and fiscal year 2019 results on June 11.

Intuit stock, which surged to its all-time high ($272.14) early last month, had advanced 23% both in the year-to-date period and past 52 weeks period.