Estimates

After a modest start to the year, Intuit’s shares gathered momentum mid-year and climbed to an all-time high by July-end. However, they pulled back from the peak in the following weeks, paring most of the earlier gains. The last closing price was below the stock’s 12-month average value of $664.51. The relatively low valuation and the management’s bullish outlook for the current fiscal year and beyond have enhanced INTU’s appeal as a reliable investment option.

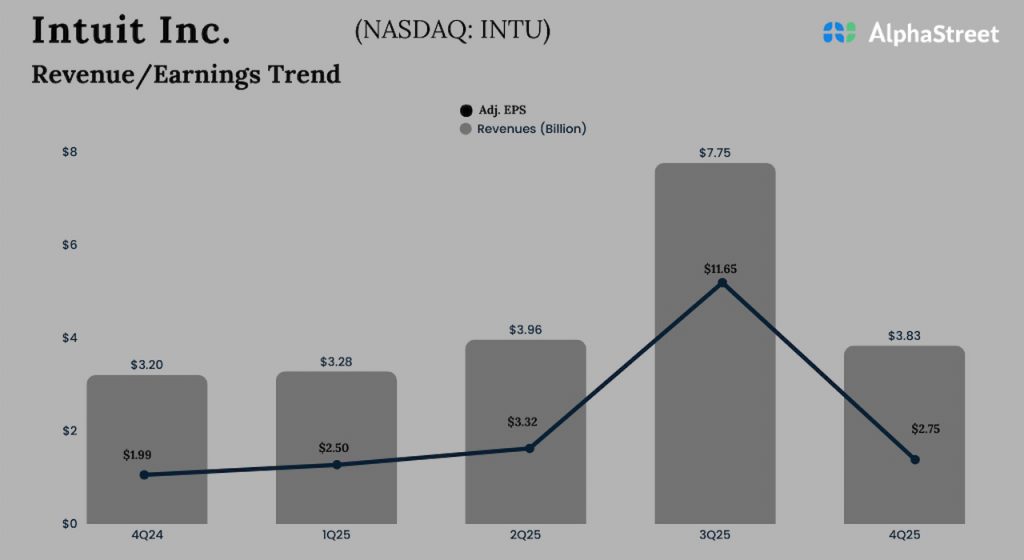

Intuit ended fiscal 2025 on a positive note, reporting higher revenue and profit for the fourth quarter. The numbers also beat analysts’ estimates. The company has a strong track record of outperformance, with quarterly earnings consistently exceeding expectations since Q3 FY22.

“The learnings we gained this year are fueling our investments and innovation to deliver durable double-digit growth across our consumer platform. We have significant momentum across the company, and I cannot be more excited about our opportunity ahead to accelerate growth. Our strategy and relentless focus on execution are working. We are leveraging data, data services, AI, and human intelligence to become the all-in-one platform for consumers, businesses, and accountants,” Intuit’s chief executive officer, Sasan Goodarzi, said in the Q4 earnings call.

Results Beat

Fourth-quarter revenue rose to $3.83 billion from $3.18 billion in the prior-year quarter and topped expectations, continuing the recent trend. On an adjusted basis, earnings were $2.75 per share in the July quarter, compared to $1.99 per share a year earlier. On an unadjusted basis, the company reported earnings of $1.35 per share for the fourth quarter, vs. a loss of $0.07 per share last year.

Intuit is betting big on its virtual team of AI agents and AI-enabled human experts to capitalize on the promise of artificial intelligence. Meanwhile, Mailchimp, the company’s email marketing platform, has experienced increased customer churn lately, particularly among small clients.

On Friday, Intuit’s stock opened lower but gained strength as trading progressed. In the afternoon, it was trading near the levels seen six months ago.