Intuitive Surgical, Inc. (NASDAQ: ISRG), a leading provider of robotic-assisted surgical systems, reported higher earnings and revenues for the fourth quarter of 2019, aided by continued growth in the sales of da Vinci Surgical System, its flagship product.

The results also surpassed the market’s prediction. However, the company’s stock dropped during Thursday’s after-hours session, soon after the announcement.

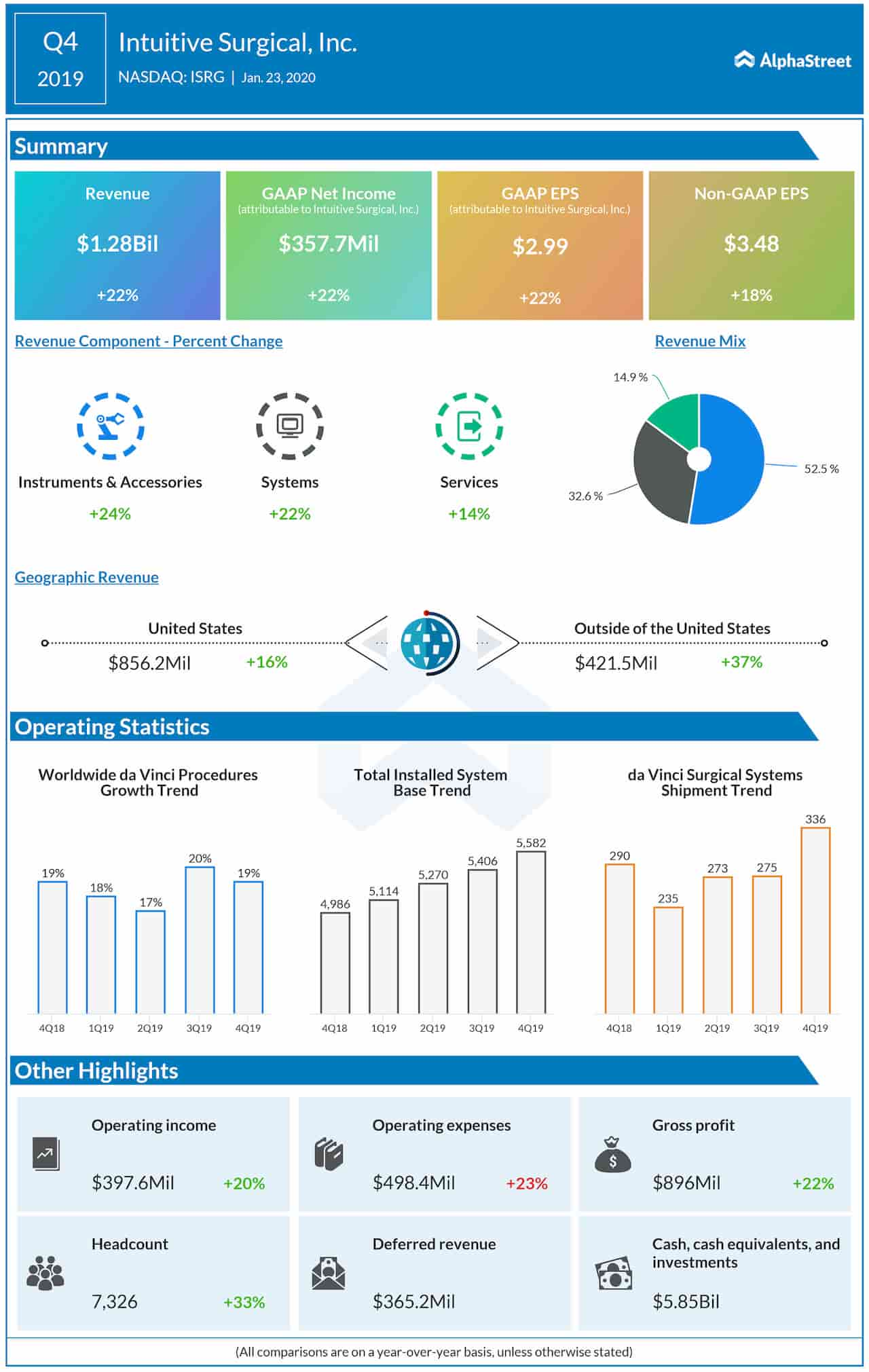

Total revenue moved up 22% year-over-year to $1.28 billion, beating the consensus estimate. The top-line growth was driven by an increase in procedures and system placements. Instruments and accessories revenue increased by 24% to $671 million, helped by double-digit growth in da Vinci procedure volume.

At $416 million, systems revenue was up 22%. System shipments included 126 units shipped under operating lease and usage-based arrangements, compared to 84 last year.

Net income for the quarter was $358 million or $2.99 per share, compared to $293 million or $2.45 per share in the prior-year quarter. Earnings, adjusted for special items, rose to $3.48 per share from $2.96 per share in the fourth quarter of 2018. Analysts had forecast slower growth.

Related: Intuitive Surgical Inc Q3 2019 Earnings Call Transcript

During the quarter, worldwide da Vinci procedures grew nearly 19% versus last year, driven mainly by growth in US general surgery procedures and worldwide urologic procedures. Intuitive shipped 336 da Vinci Surgical Systems, which was up 16% from the prior-year period, and grew its da Vinci Surgical System installed base to 5,582 systems, reflecting a year-over-year increase of 12% from last year.

Shares of Intuitive Surgical climbed to an all-time high this week, continuing the uptrend seen since the beginning of the year. The stock gained 19% in the past twelve months. It closed Thursday’s regular session higher.