Outlook

Intuitive Surgical’s strong fundamentals and the rapid adoption of its devices justify the relatively high valuation. With each device sale, the company secures recurring revenues from the delivery of accessories and other services during the contract period. Since the company is working to integrate new features based on AI and machine learning technologies, its systems are expected to play a much bigger role in performing procedures with a high level of precision, thereby significantly improving patient outcomes.

Recently, the advanced fifth-generation da Vinci system received FDA clearance. Market watchers are bullish in their outlook on surgical robots and forecast continued strong demand growth, which bodes well for the company. After making a strong start to fiscal 2024, Intuitive Surgical looks poised to repeat the impressive performance it delivered in the first quarter.

The second-quarter report is expected to be released on Thursday, July 18, at 4:05 pm ET. The consensus earnings estimate for Q2 2024 is $1.54 per share, up 8.5% from the profit the company earned in the year-ago quarter. The positive outlook represents an estimated 13.4% revenue growth to $1.97 billion in the June quarter.

Key Metrics

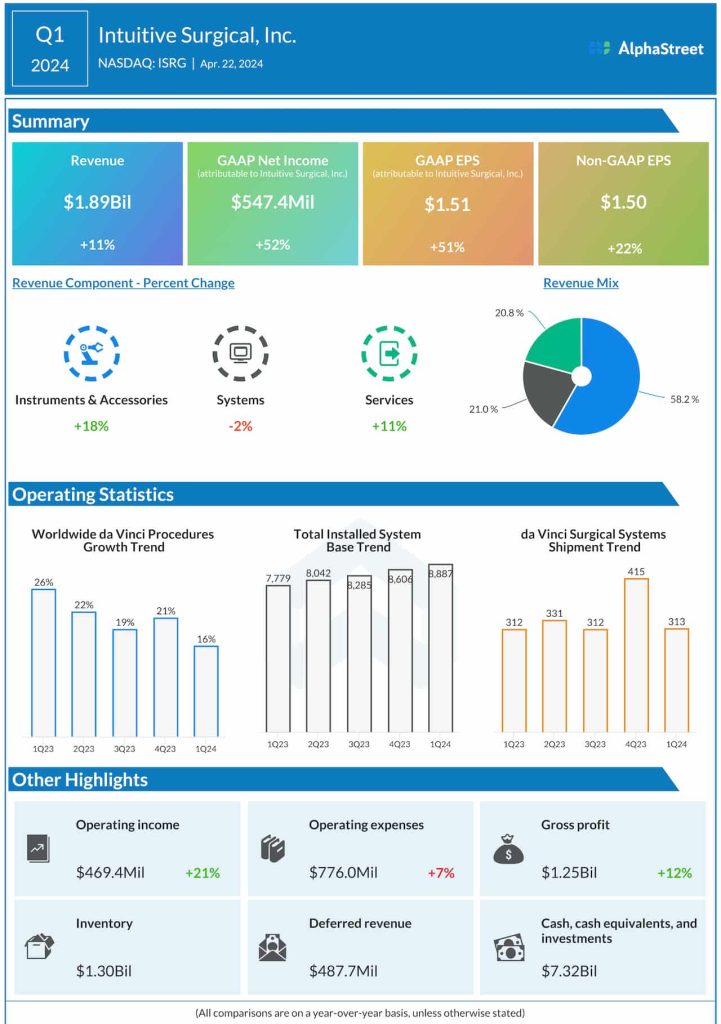

Last fiscal year, the company’s profit, on a per-share basis, beat estimates every quarter and the trend continued in early 2024. First-quarter adjusted profit climbed 22% year-over-year to $1.50 per share. At $1.89 billion, revenues were up 11% year-over-year and slightly above experts’ projections. Instruments & Accessories, which represent nearly 60% of revenues, grew an impressive 18%. Worldwide da Vinci procedures continued to grow in double digits, while the installed systems base climbed to a new high.

From Intuitive Surgical’s Q1 2024 earnings call:

“The first quarter of 2024 was a solid one for Intuitive, where core measures of our business remain healthy including solid procedure growth and capital placements. Furthermore, our teams delivered important milestones across several parts of our Intuitive ecosystem, including launching our next-generation multiport platform, da Vinci 5, launching our da Vinci SP platform in Europe, and improving our supply constraints for Ion catheters… Taken together, we remain enthusiastic about our opportunity and we’ll work through near-term pressures by focusing on what we can control.”

The stock price nearly doubled in the past two years and frequently outperformed the market during that period. ISRG traded at around $445 on Friday afternoon.