Thanks to the strong tax season, Intuit sold 4% more TurboTax units in the quarter, which also includes the contribution of TurboTax Online which saw a 6% growth. The company launched TurboTax Live, a video-based tax preparation tool, at the end of last year to provide online help to tax filers. The assisted tax preparation market is expected to be worth $20 billion and result in consistent revenue growth in the future.

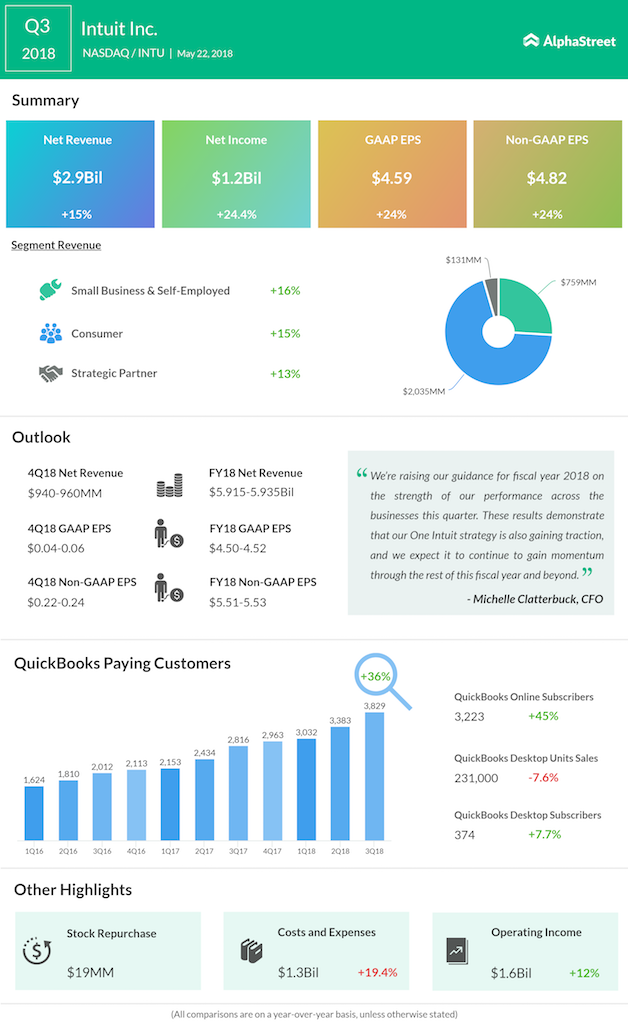

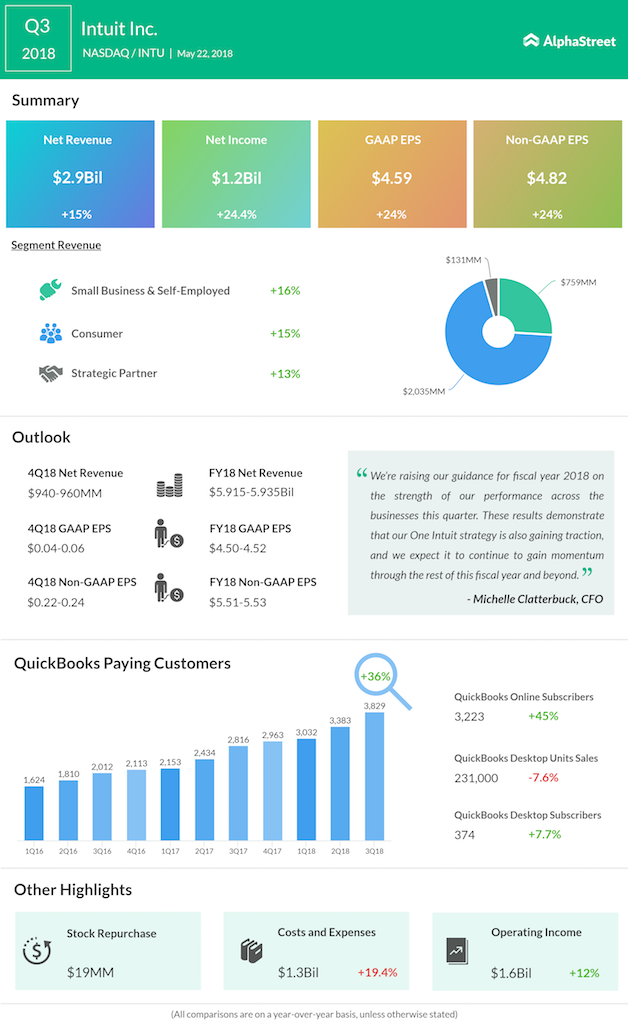

Accounting software QuickBooks Online ended the quarter with 3.2 million users, which is a 45% jump in user subscription over last year. Self-Employed user base nearly doubled to 683,000 users compared to 360,000 in the prior year period.

Backed by the strong third quarter results, Intuit lifted its full-year guidance. The company now expects its revenue to come between $5.915 billion and $5.935 billion, and earnings, on an adjusted basis, is projected in the range of $5.51 to $5.53 per share.

For the current quarter, the financial software firm forecasts revenue of $940 million to $960 million and adjusted earnings of $0.22 to $0.24 per share. Shares of Intuit shot up nearly 21% in 2018 and soared nearly 50% over the last 12 months.