IPO details

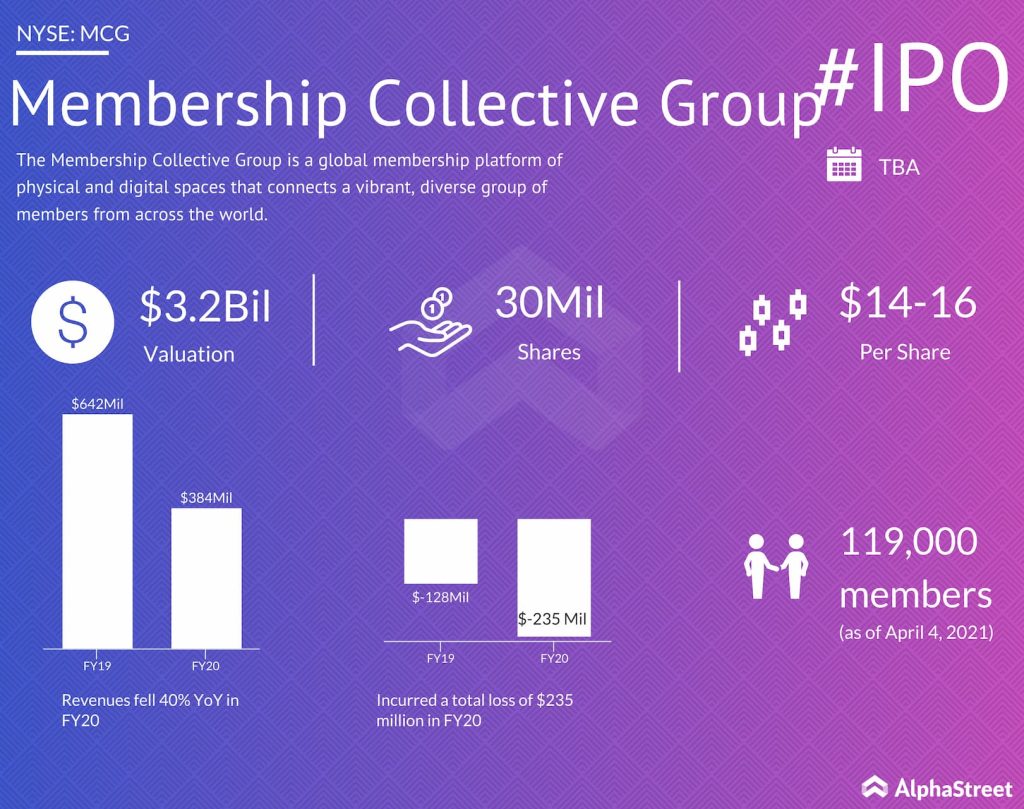

The Membership Collective Group is scheduled to go public on Thursday, July 15. The company is expected to start trading on the New York Stock Exchange under the ticker symbol MCG. MCG plans to offer 30 million shares at a price range of $14 to $16 per share to raise $450 million. The group of underwriters managing the IPO will be led by JP Morgan and Morgan Stanley.

Company intro

The Membership Collective Group provides memberships to a collection of clubs and restaurants around the world and focuses on creating spaces where creative people can come together to connect both professionally and socially. The company was founded in 1995 and has 4,815 employees.

The company’s portfolio comprises of Soho Houses, Soho Works, Soho Home, The Ned in London, Scorpios Beach Club in Mykonos and its digital channels. MCG has over 119,000 members as of April 4, 2021. The majority of the company’s membership and revenue come from Soho House, which had over 111,300 members as of April 4.

Financials

The Membership Collective Group had total revenues of $384 million in 2020, 46% of which came from membership revenues. The company reported a net loss of $235 million for the year. For the first quarter of 2021, total revenues were $72 million compared to $142 million in the same quarter a year ago. Net loss widened to $93 million in Q1 2021 from $45 million last year. In Q1, membership revenue accounted for 56% of total revenues.

The company’s sales and profits were impacted by closures and restricted hours as a result of the pandemic. It also saw a slight increase in member attrition as well as temporary freezing of memberships during this period.

Demand

Soho House, which is a core part of MCG, has a loyal membership base which remained relatively intact through the pandemic. The Soho House member retention rate stood at 92% for FY2020. MCG has strong demand for membership across its brands and its global wait list stood at 59,000 applicants as of May 30, 2021. The company managed to grow its membership at a 16% compound annual growth rate between 2016 and 2020.

MCG currently has a presence in 63 markets worldwide and the company believes it has significant opportunity for further expansion and growth by moving into new regions and launching new memberships that cater to different groups.

Click here to read more IPO-related stories