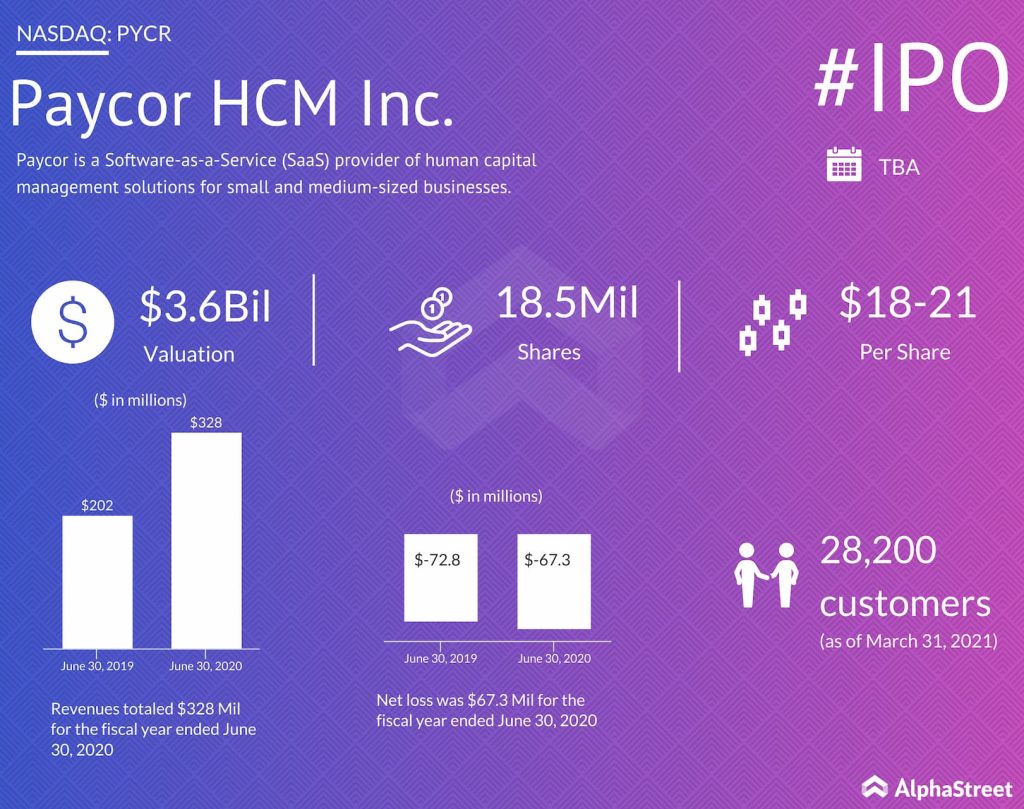

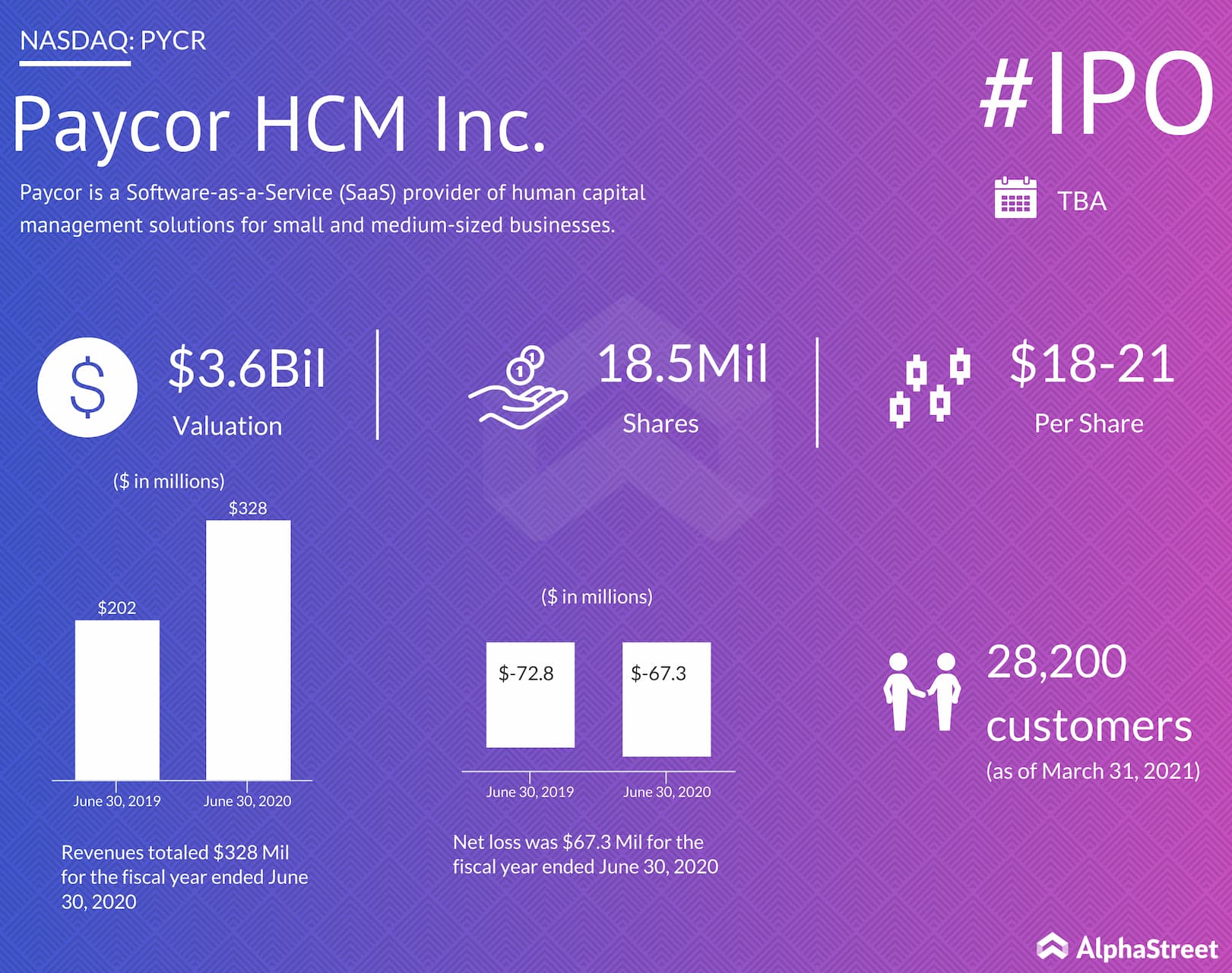

IPO details

Company intro

Paycor provides human capital management (HCM) solutions to small and medium-sized businesses that help them streamline HCM and payroll workflows and achieve regulatory compliance. It serves as the single secure system of record for all employee data. The company was founded in 1990 and has 1,945 employees.

Paycor provides services and solutions that help track human resources, payroll, time and attendance. In 2015, the company acquired Newton Software thereby adding applicant tracking software to its portfolio.

Paycor’s revenue mainly comes from the sale of Software-as-a-Service subscriptions to its cloud-native HCM software platform. Revenue is generated from customers on a per-employee-per-month basis, or in other words, from the number of employees of a given customer, and the amount, type and timing of products provided to a customer.

The company’s revenue is mostly recurring in nature and increases with the increase in customers and as customers add more employees and purchase more product modules. As of March 31, 2021, Paycor had approx. 28,200 customers and 44,400 client accounts.

Financials

For the fiscal year ended June 30, 2020, Paycor delivered revenues of $328 million, which was up 13% from the prior year. Net loss for the year amounted to $67.3 million. For the nine months ended March 31, 2021, revenues totaled $264.8 million, up 4% from the same period a year ago, while net loss was $46.2 million.

Risks

The COVID-19 pandemic impacted the businesses of several of Paycor’s existing and prospective customers and the resultant closures and restrictive orders led to reductions in headcount and delayed sales. The reductions in headcount took a toll on the company’s recurring revenue. Although Paycor has seen a recovery over the past few months, it remains vulnerable to risks such as headcount reductions, lower spending on HCM and payroll solutions and decreases in government and consumer spending.

Market opportunity

Paycor estimates its current annual recurring market opportunity is $26 billion in the US and it expects the opportunity to grow as the number of small and medium-sized businesses increases and the company expands its product portfolio. Paycor plans to drive new customer additions by expanding sales coverage in both new and existing markets over the next two years.

Click here to read more IPO-related stories