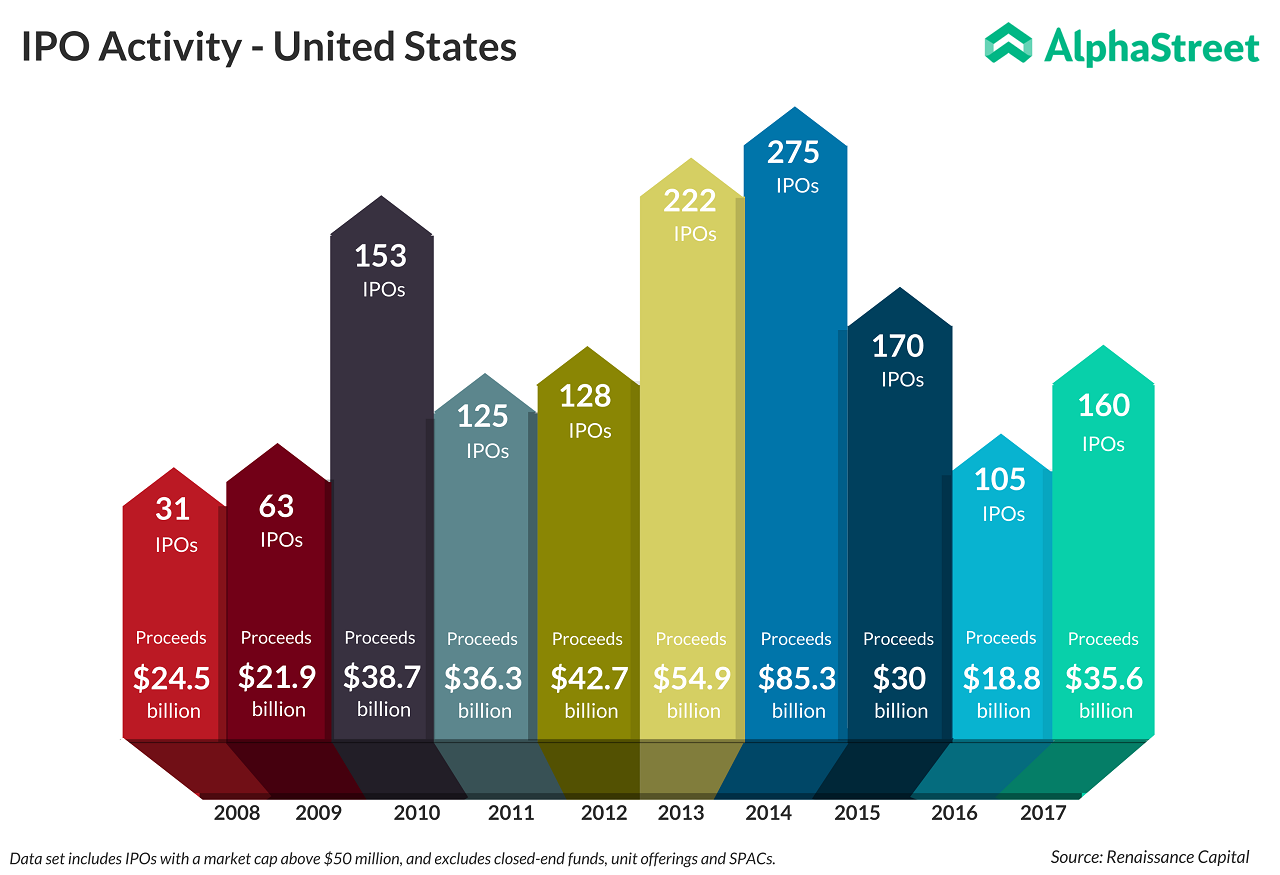

Infographic: US IPO Trends Since Financial Crisis

Global IPO market made a big comeback in 2017 since the financial crisis. After a grim IPO activity in 2016, the US stock market flourishes on a bull-run in 2017. There were 160 IPOs in the US in 2017 raising $35.6 billion, a rise of 89% in terms of proceeds and 52% by volume compared […]

“Global IPO market made a big comeback in 2017 since the financial crisis. After a grim IPO activity in 2016, the US stock market flourishes on a bull-run in 2017. There were 160 IPOs in the US in 2017 raising $35.6 billion, a rise of 89% in terms of proceeds and 52% by volume compared […]

· February 12, 2018

Global IPO market made a big comeback in 2017 since the financial crisis. After a grim IPO activity in 2016, the US stock market flourishes on a bull-run in 2017. There were 160 IPOs in the US in 2017 raising $35.6 billion, a rise of 89% in terms of proceeds and 52% by volume compared with 2016, according to Renaissance Capital.

Raising $3.9 billion in proceeds, Snap Inc. was the largest listing on US exchanges for 2017, becoming the first largest tech listing in the US since Alibaba in 2014 and also the largest US-based tech listing since Facebook in 2012. A perfect stage has been set for a strong IPO market in 2018 as several multi-billion dollar companies are expected to make their debut.