Bullish Outlook

Broadcom looks poised to deliver strong growth going forward, supported by tailwinds like its aggressive AI push, the exceptionally healthy balance sheet – operating cash flow stood above $4 billion in the most recent quarter – and benefits from the recent Apple deal. Once completed, the planned acquisition of cloud technology company VMWare, which is currently stuck in regulatory hurdles, would allow Broadcom to expand its market share while providing enterprise customers with an expanded platform of infrastructure solutions.

From Broadcom’s Q1 2023 earnings call:

“Keep in mind that as hyper scalers, a growing portion of our switches are being deployed within their AI networks which aren’t separate from the traditional x86 CPU scale-out running existing workloads. Now, this is today. Tomorrow, with generative AI using large-scale language such as AI models with billions of parameters, we have to run thousands of AI engines in parallel, enabling large and synchronized burst of data at speeds of 400 and 800 gig. Demand works to support this massive processor density is critical, and as important as the AI engines.”

Q2 Estimates

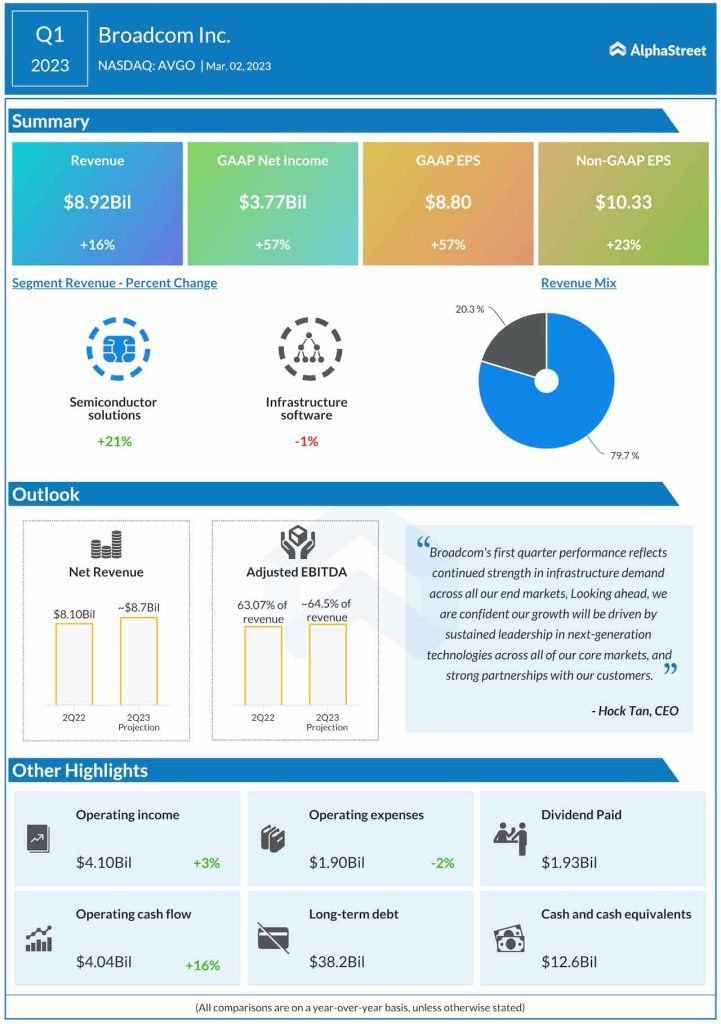

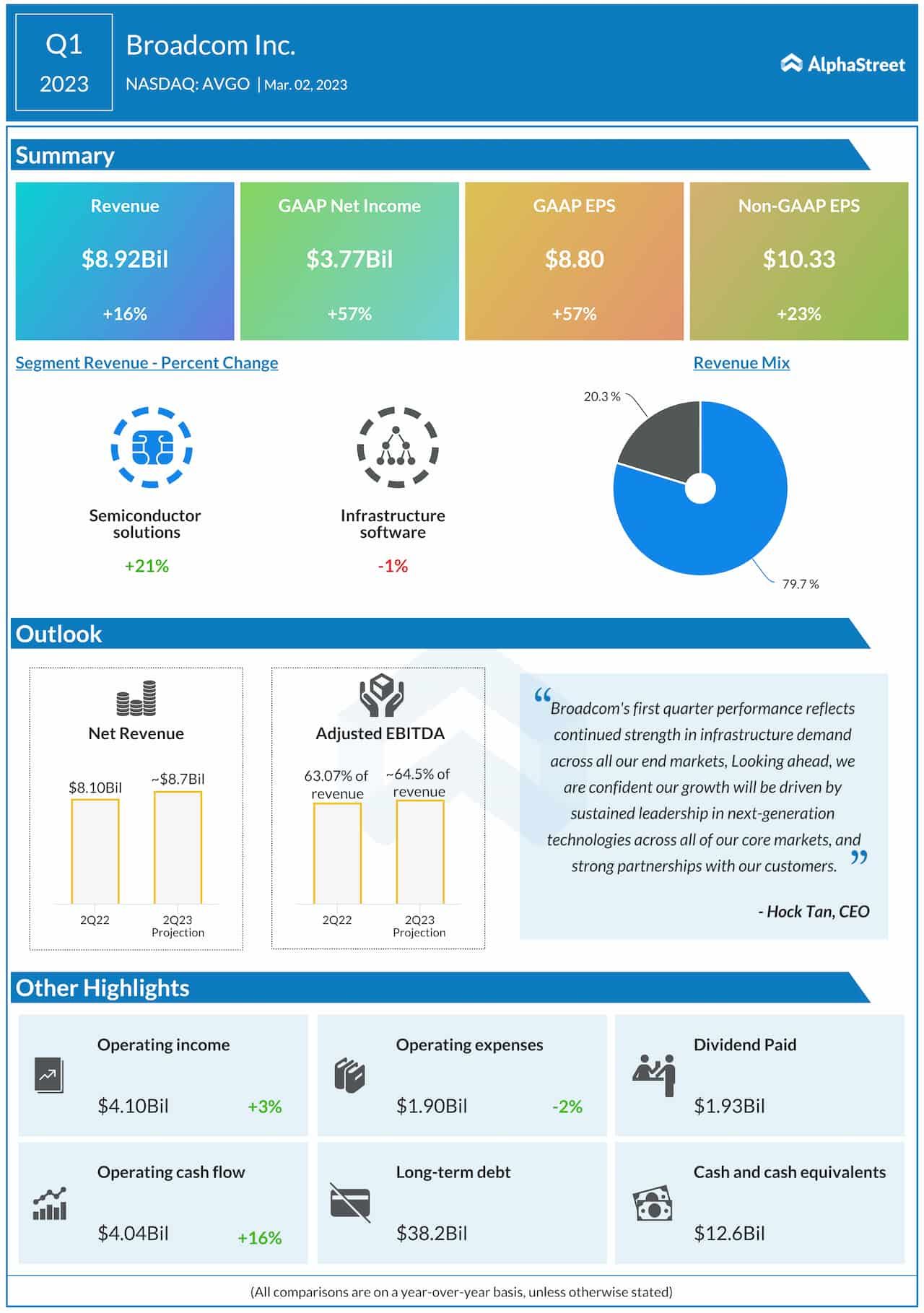

The company has been doing quite well in terms of delivering above-consensus results, with the key numbers beating estimates in every quarter in the past three years. In the first three months of the fiscal year, strong growth in Semiconductor Solutions revenue more than offset weakness in the Infrastructure Software division, resulting in a 16% growth in total revenues to $8.92 billion. At $10.33 per share, adjusted earnings were up 23% year-over-year.

Analysts are of the view that earnings and revenue growth continued in the April quarter. They are looking for an 11% increase in second-quarter earnings to $10.08 per share on estimated revenues of $8.7 billion, which is up 7% from last year and in line with the guidance issued by the management. The report is scheduled for publication on June 1, at 4:15 PM ET.

Apple Deal

Apple has been Broadcom’s most important customer for quite some time, with about 20% of the company’s revenues coming from supplies to the latter in recent years. The multi-billion dollar deal signed by the companies last week is part of Apple’s commitment to invest about $430 billion in the US economy.

This year alone Broadcom’s shares grew an impressive 47%, and the uptrend continued this week. It started Tuesday’s trading sharply higher and gained further in the early hours of the session.