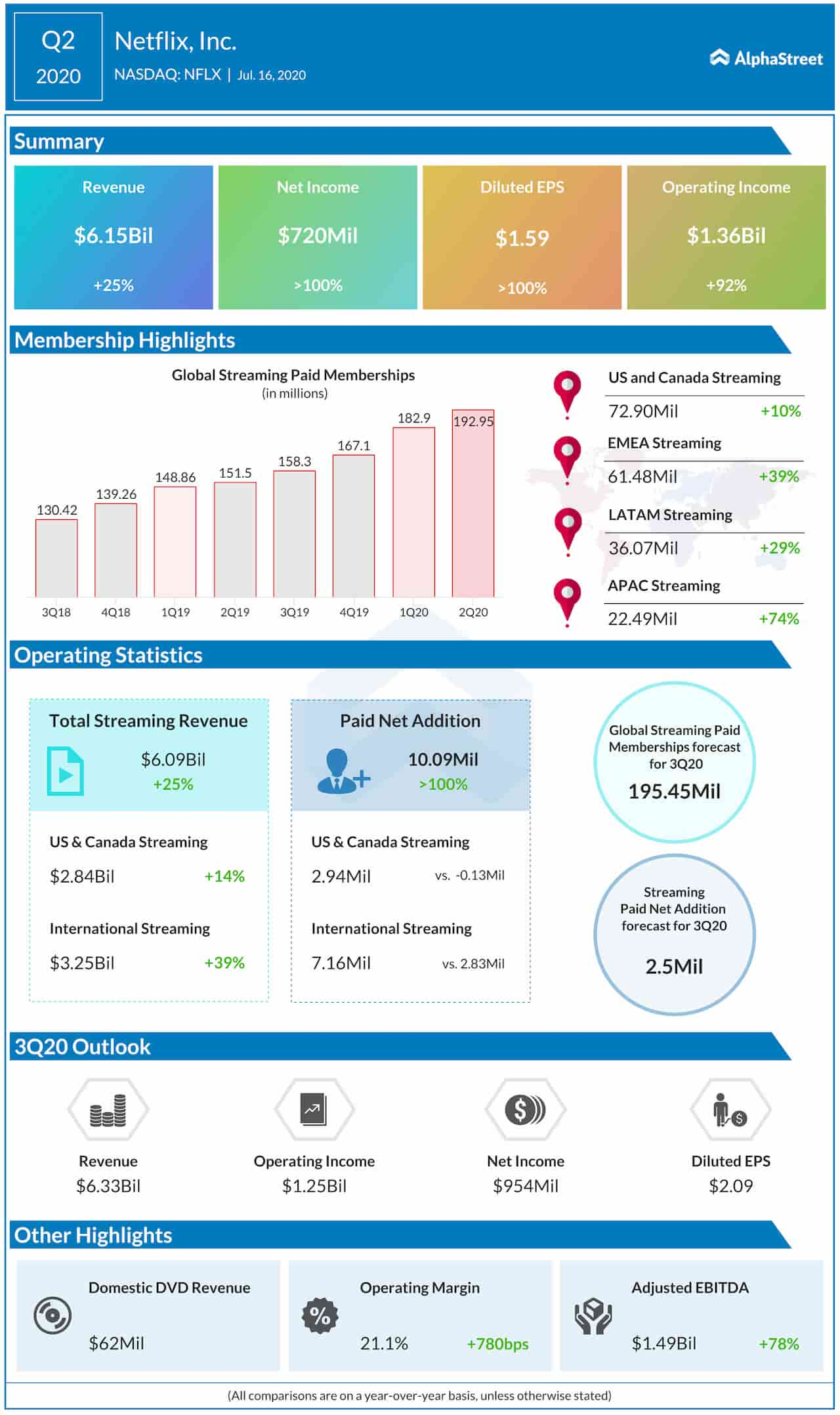

Currently, it is the COVID-19 pandemic and global lockdowns that have compelled viewers to turn to binge streaming, thus providing a fillip to the stock price. The net subscriber addition in the first and second quarters are the biggest testimony to this. In the first six months of 2020, the streaming giant has already added 26 million subscribers as compared to a mere 12 million in the same period in 2019.

Increased subscriber addition amid lockdown

The company has struggled with various factors like US market saturation, negative cash flows, and slow subscriber growth in the past few quarters. However, the pandemic has altered the scenario to a great extent. In the last quarter, Netflix’s subscriber base has climbed to nearly 193 million even after a consistent increase in pricing since 2014.

However, the stock has got a slight jolt after the company forecasted weak subscriber guidance and missed earnings expectations. This could be a temporary phenomenon that indicates consumers’ interest in streaming has plateaued. It is only a matter of time that Netflix will see viewers returning to it as other avenues of entertainment are limited at this juncture.

Leading the streaming war with superior technology

Last year, the Netflix stock was subdued due to apprehensions over the ensuing streaming war. However, the current numbers show that so far Netflix is leading the race. The company has 190 million subscribers, with Amazon Prime at slightly over 150 million subscribers. Third in line is Disney+ with over 50 million subscribers.

Analysts believe that the streaming giant will see sustained growth in the next 5-10 years, even after the pandemic. In terms of technology, Netflix has an edge over the other players in the market. It has been in the business for long and invested loads of money into making the platform a cut above the rest in terms of content and streaming quality.

Also read: 3 key takeaways from Netflix’s Q2 earnings

Strong fundamentals make it a clear winner in the long-run

Netflix has access to even the minutest change in viewing habits with access to over 200 million households globally. What empowers Netflix is the AI at its core, which gathers humongous data and recommends the ideal content for viewers. Personalization is clearly the distinguishing factor here. Wall Street expects that the streaming giant could potentially reach over 500 million subscribers in the future.

It can be safely said that Netflix is here to stay and grow. In the long-run, the company will be able to add more subscribers and the price increases will boost its cash flow position too. The company’s operating margin has already shown improvement since 2016 and it also posted a positive cash flow in the second quarter. The company looks financially stable and the stock is also likely to reflect its future growth potential, albeit a few minor hiccups in the near-term.

____

Disclaimer: The views and opinions presented here are of the author alone and does not represent the views of AlphaStreet