The J.M. Smucker Company (SJM) missed analysts’ expectations on revenue and adjusted EPS numbers for the first quarter of 2019 and lowered its full-year sales outlook. Shares of J.M. Smucker dropped about 1% when the market opened today and continued to trade in the negative territory.

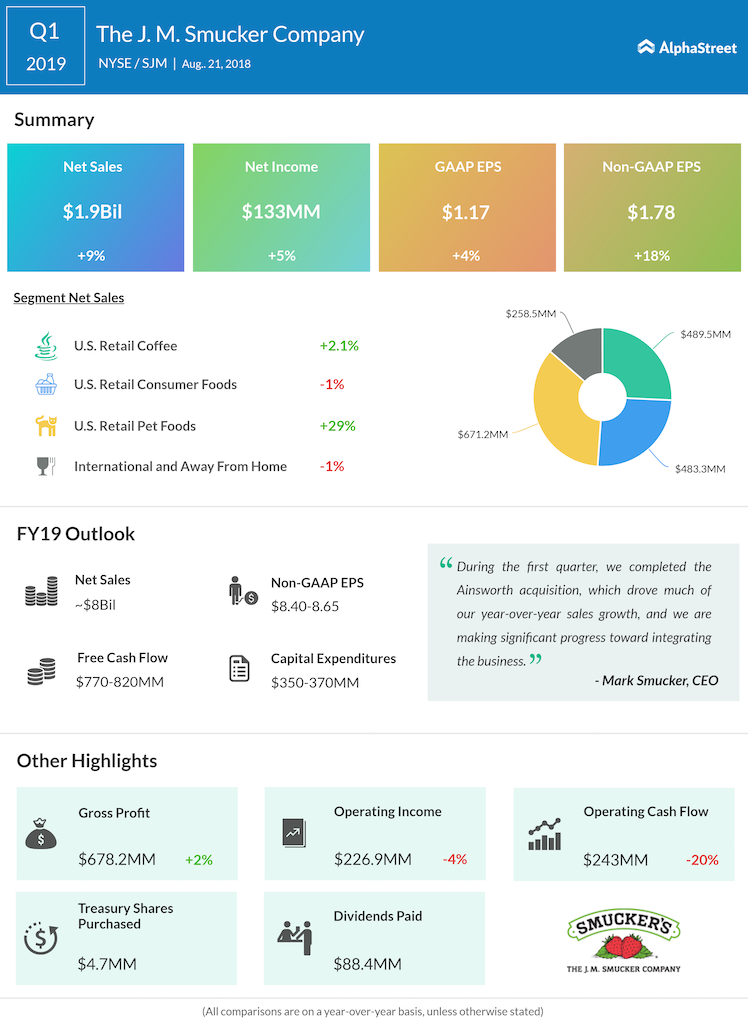

Net sales increased 9% to $1.9 billion versus the same period last year, reflecting the Ainsworth Pet Nutrition acquisition. Excluding Ainsworth, sales dropped 1%. Net income increased 5% to $133 million while diluted EPS grew 4% to $1.17 versus the prior-year period. Adjusted EPS grew 18% to $1.78.

The company is making progress in integrating the Ainsworth Pet Nutrition business and it expects the divestiture of its US baking business to close at the end of August.

J.M. Smucker cut down its guidance for the full year of 2019 to reflect the impact of the US baking business divestiture. The company now expects net sales to total $8 billion from the previous range of $8.3 billion. Free cash flow is expected to come in the range of $770 million to $820 million versus the prior guidance of $800 million to $850 million. Adjusted EPS guidance remains unchanged at $8.40 to $8.65.

During the quarter, net sales for the US Retail Coffee segment increased 2%, helped by the Dunkin’ Donuts and Café Bustelo brands. US Retail Pet Foods saw an increase of 29% in net sales, benefiting from the Ainsworth acquisition. International and Away From Home segment net sales fell 1% due to lower net price realization.

Shares of the Orrville, Ohio-based company have dropped about 9% so far this year and 7% in the past 12 months.

Related: JM Smucker expands pet food portfolio by swallowing Ainsworth Pet Nutrition

Related: JM Smucker sheds baking brands to focus on pet foods, snacking

Related: Q4 2018 Earnings Infographic