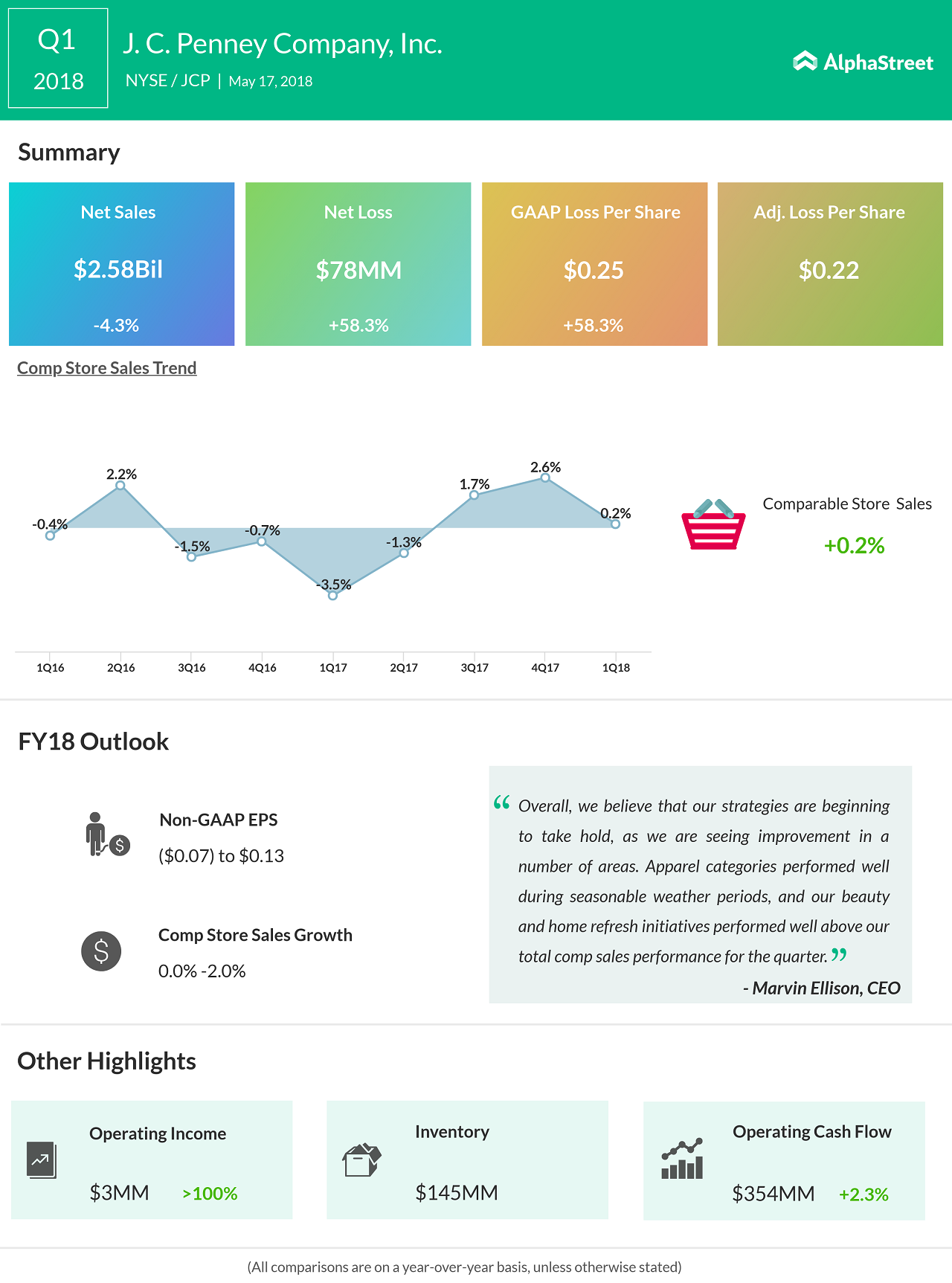

The department store chain J. C. Penney Company (JCP) reported a narrower loss in the first quarter helped by lower costs of goods sold and a decline in selling, general and administrative expenses. Despite this, shares of Penney fell 12.85% in the premarket after lowering 2018 guidance and wider-than-expected first-quarter adjusted loss.

The company’s net loss narrowed to $78 million or $0.25 per share from $187 million or $0.60 per share last year. Revenue declined 4.1% to $2.67 billion, due primarily to the closure of 141 stores in the second and third quarters of fiscal 2017. Comparable sales rose 0.2% for the first quarter, which was impacted in large part by a very late start to Spring with the customers experiencing cooler than normal temperatures in April.

Due to lower restructuring and management transition charges as well as other components of net periodic pension, Penney faced an adjusted net loss of $69 million or $0.22 per share compared to a profit of $2 million or $0.01 per share a year ago.

Cost of goods sold, which excludes depreciation and amortization, declined 0.8%, primarily driven by increased online clearance selling and continued growth in the mix of online business, markdown and pricing actions taken to clear slow-moving seasonal inventory and ongoing growth in major appliances.

Selling, general and administrative expenses fell by 12% primarily due to lower controllable costs and marketing spend and a reduction in lease expense associated with the balance amortization of a gain on the sale of a leasehold interest last year.

Looking ahead into fiscal 2018, the company lowered its adjusted per share guidance to a range of $0.07 loss and $0.13 earnings from previous adjusted EPS estimate of $0.05-$0.25. Comparable store sales are still expected to be between 0% and 2%. The revised forecast reflects only the impact of the adoption of new revenue recognition and pension accounting standards.

“Although our overall top line sales results came in below our expectations for the quarter, we were encouraged by the strong positive comp performance throughout February and March, as well as the last two weeks of April, when temperatures began to normalize,” executive chief Marvin R. Ellison said. Shares of Penney ended Wednesday’s regular trading session up 5.50% at $3.07 on the NYSE. The stock had been trading between $2.35 and $5.63 for the past 52 weeks.