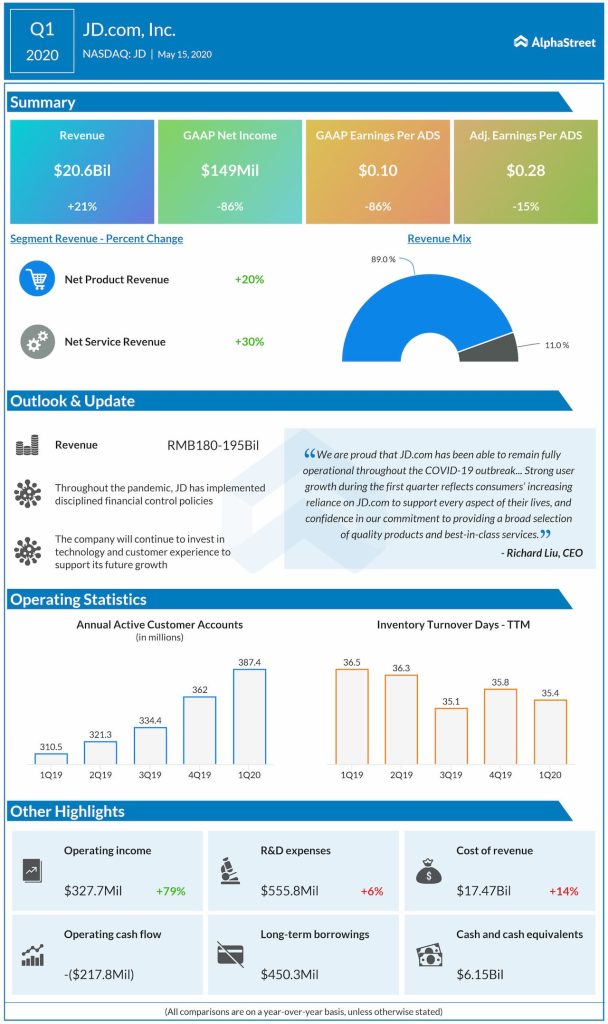

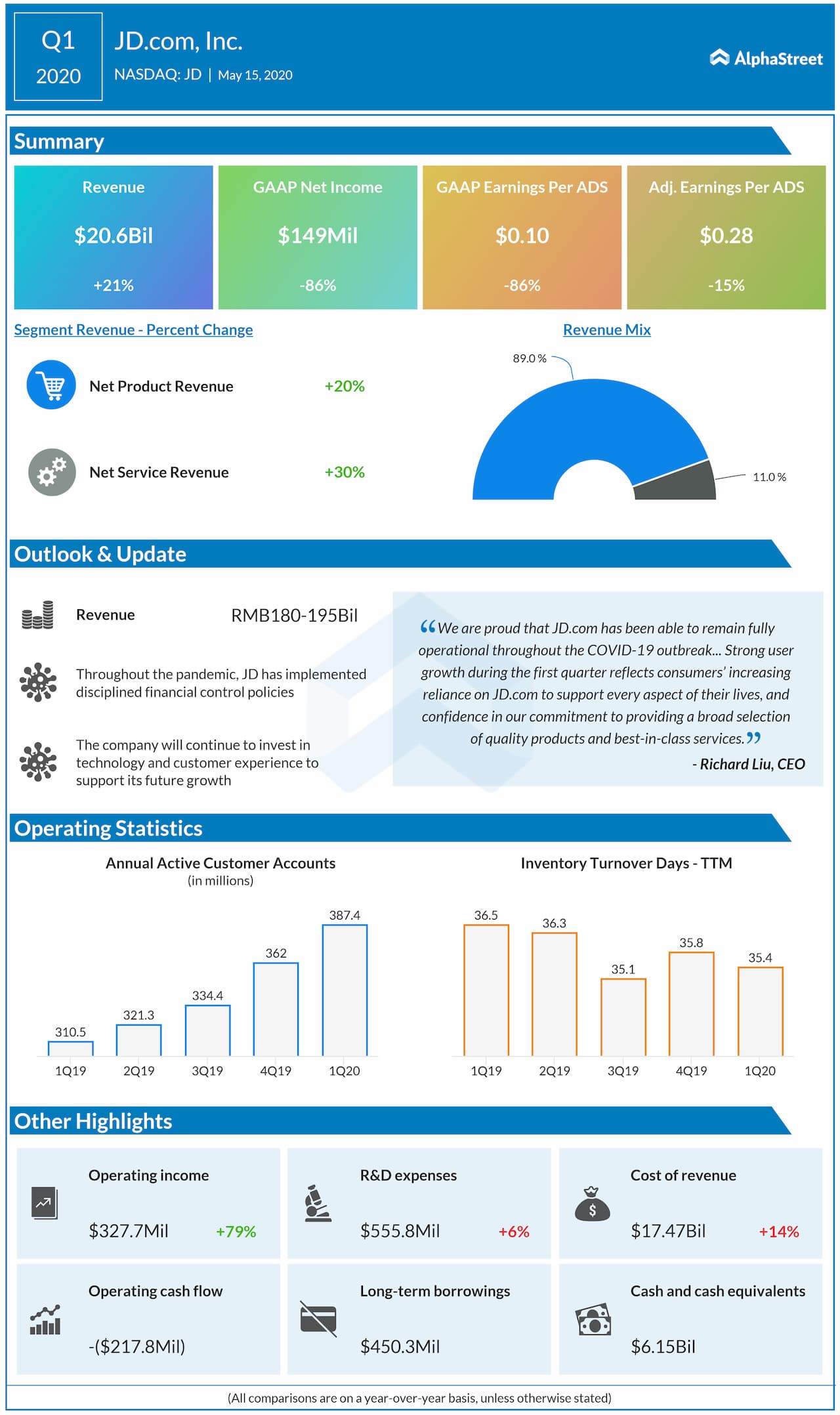

And all this came aside the top and bottom line smashing past analysts’ predictions, sending the stock to above $55, another record.

Going to the roots

Ironically, much of this growth happened in the lower-tier cities, where the e-commerce firm has been investing heavily. According to the company, over 70% of new customers were from these lower-tier cities, accounting for more-than-half of its fulfilled gross merchandise value (GMV). And the company plans to continue focusing on this area. During the Q1 earnings conference call, CEO Lei Xu said:

“And we will adopt a number of strategies to develop our user base in the future and first of all to target our lower-tier city markets and users, and we will call it, our dual-driver system.”

ADVERTISEMENT

JD.com’s newly launched discount platform Jingxi has been pivotal in achieving leeway into smaller cities where purchasing power is relatively less. The platform has also helped JD effectively lock horns against US-listed local rival Pinduoduo (NASDAQ: PDD), which is known for its value-for-money pricing.

[irp posts=”61856″]

Diversifying channels

Meanwhile, JD is apparently trying to diversify to insulate itself from potential disruptions in the lower-tier markets. For example, the company said it’s Jingxi platform was negatively affected by the epidemic in the early days of the outbreak. This was partly offset by boosting main sites, including JD Lite, through algorithms. JD is also looking at franchise physical stores to boost penetration into regional markets.

At the end of the day, Q1 results show that diversification has helped the firm well during the crisis. The CEO said during the call:

“Now the operation of Jingxi has come back to the normal level, the levels that we are feeling comfortable. And in the meantime, we also identified several opportunities with Jingxi to grow. First of all, due to the epidemic impacts, actually a lot of factories who originally produced commodities for exports, now is looking at domestic sales opportunities. And Jingxi can find a good way to collaborate with them to help these factories to transform their business.”

ADVERTISEMENT

Optimistic future

While JD continues to be optimistic about its future on the back of regional expansion, it needs to be seen in the coming quarters how this dependence would affect the margins. Currently, we are able to see that it is already denting the average revenue per customer despite higher purchases. Investors will need to keep a close eye on margins as the company reports results in Q2.

The Beijing-based firm has provided a rather confident outlook of 20-30% growth in net revenue in Q2. With COVID receding and the economy slowly getting back on track in China, this guidance offers a lot of confidence going forward.

[irp posts=”61527″]

Looking for more insights into JD.com? Read the latest earnings call transcript here.