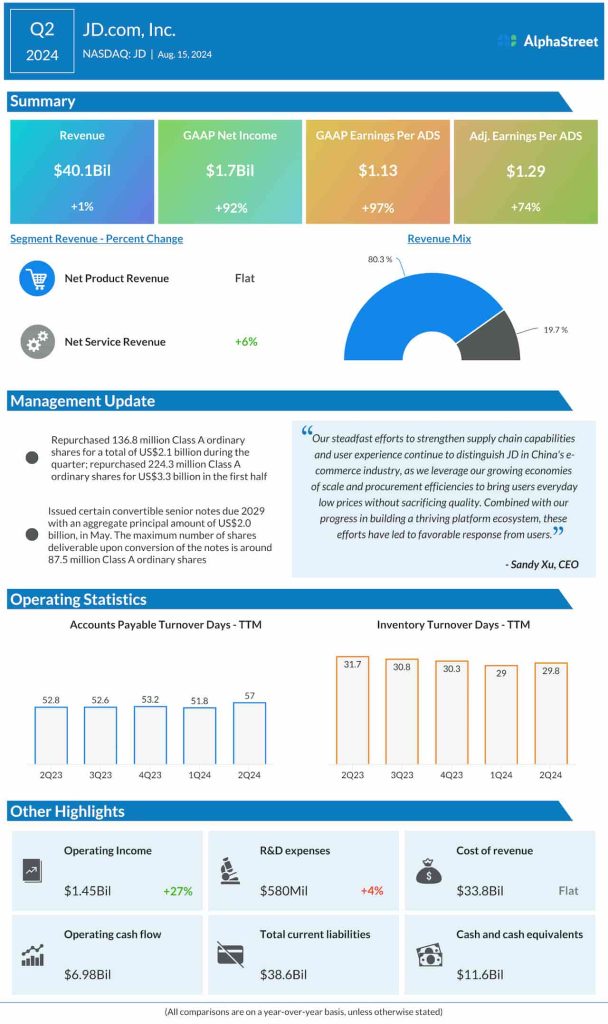

Adjusted profit jumped 74% year-over-year to $1.29 per ADS in the second quarter. On an unadjusted basis, the net profit was $1.7 billion or $1.13 per ADS in Q2, up 92% and 97% respectively from the prior-year period.

At $40.1 billion, second-quarter revenues were up 1% from the corresponding period of 2023. Net Product Revenue remained almost unchanged from last year, while Net Service Revenue increased 6%.

Ian Su Shan, CFO of JD.com, said, “We continued to enhance price competitiveness during the promotional season through our supply chain and disciplined approach, as opposed to reliance on subsidies. As such, our gross margin substantially increased by 137bps year-on-year to 15.8%, contributing to our record-high operating and net profit on a non-GAAP basis in the quarter.“