On the margins front, operating margins contracted 1.6 percentage points to 7.3% and pre-tax margins came in at 6.3%, down 1.3 percentage points. Margins were impacted primarily impacted by increased fuel costs and other operating expenses.

Fuel-related expenses shot up 29% due to rising fuel prices. It’s worth noting that aviation fuel prices rose 8% in the first quarter of this year. Labor costs rose 7% touching $499 million. Load factor for the airline rose modestly to 84.6%, compared to 83.9% reported last year.

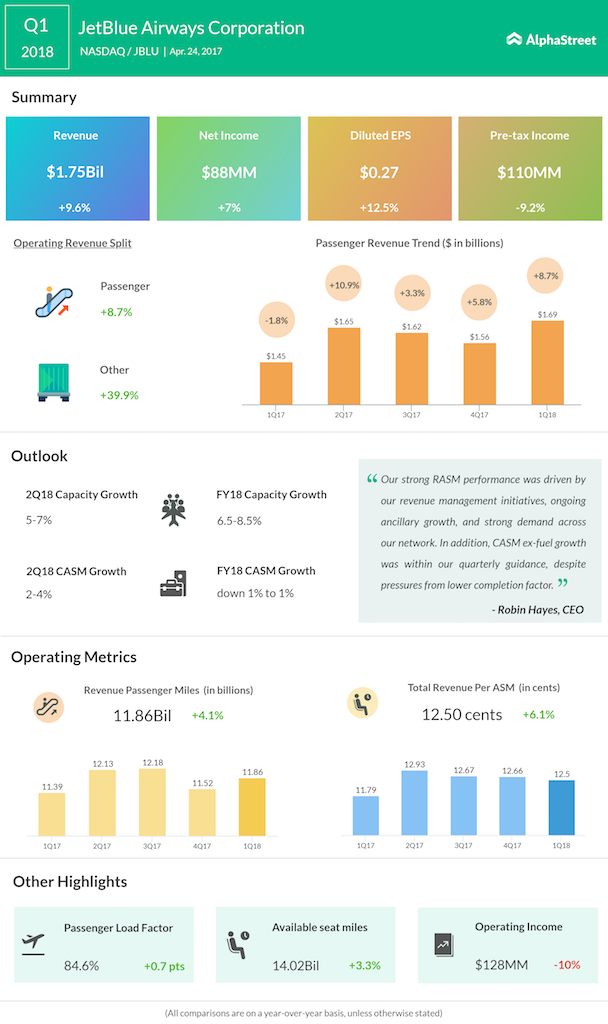

For the second quarter, unit revenues are expected to be in the negative 3% to 0% range due to a shift in the holiday calendar and lower completion factor. Capacity expansion is forecast between 5% and 7% while CASM, excluding fuel costs, are expected in the range of 2% to 4%. Fuel cost per gallon is projected to come in at $2.23.

For the full year 2018, capacity growth is projected to grow in the range of 6.5% to 8.5%. Non-fuel costs are expected to be in the negative 1% to 1% range.